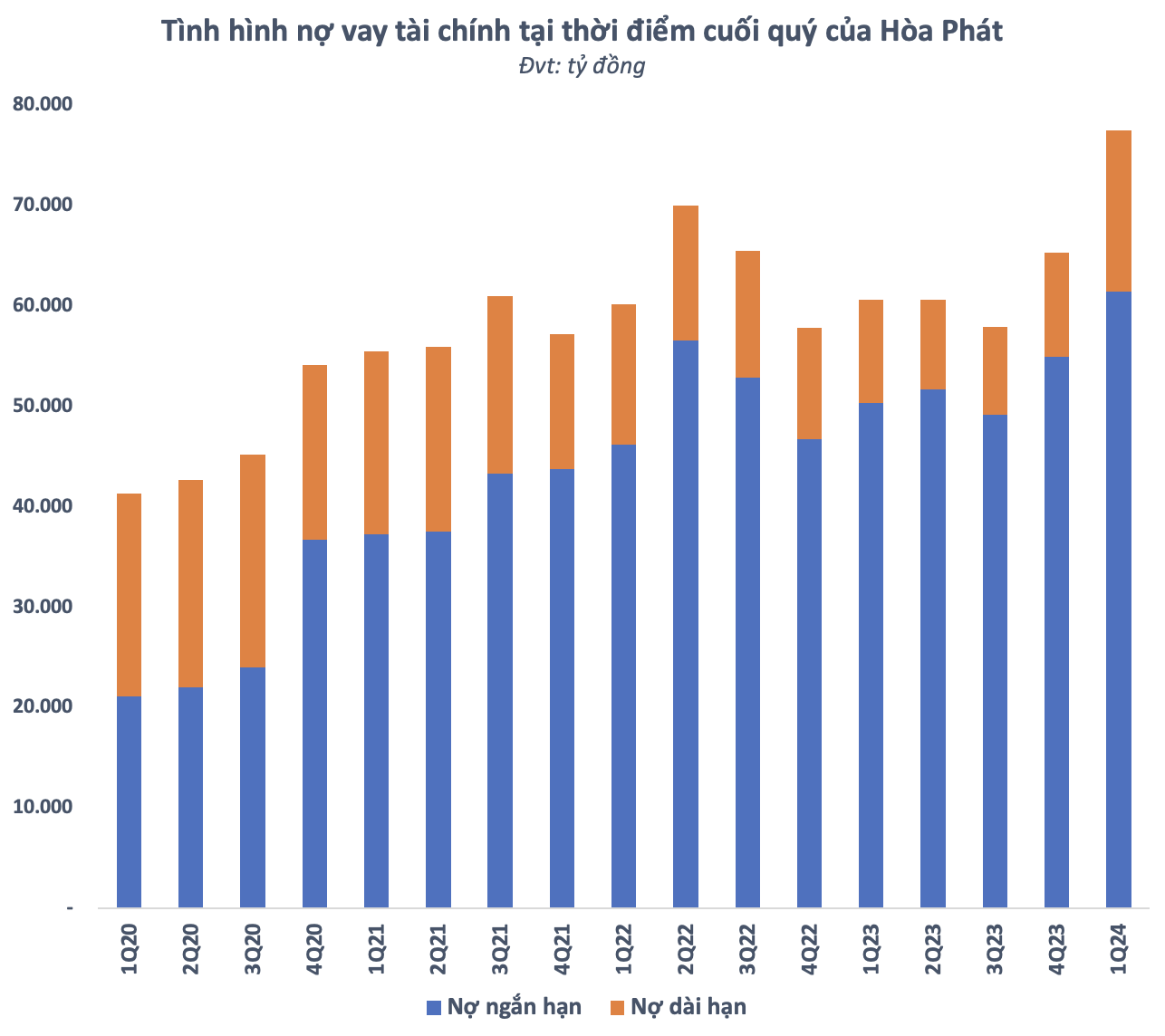

With interest rates at record lows, many businesses have become more aggressive in borrowing from banks to finance their operating and investment activities. According to its consolidated financial statements for the first quarter of 2024, Hoa Phat (code HPG) recorded total financial debt of over VND 77,500 billion as of the end of the quarter, an increase of more than VND 12,000 billion compared to the beginning of the year and the highest level in its operating history.

Both short-term and long-term debts of Hoa Phat increased sharply in the first quarter of 2024. Of which, short-term debt increased by nearly VND 6,500 billion compared to the beginning of the year to over VND 61,400 billion, the highest ever. Long-term debt also increased by nearly VND 5,700 billion compared to the beginning of the year to nearly VND 16,100 billion, the highest level since the end of the third quarter of 2021.

Hoa Phat said that the outstanding loan balance increased sharply compared to the end of the year due to the procurement of materials and disbursement for the Dung Quat 2 Iron and Steel Complex project. In the first quarter of 2024, Hoa Phat poured an additional VND 4,250 billion into this “steel punch”, bringing the total cumulative investment capital disbursed to the end of the first quarter of 2024 to VND 26,800 billion (over USD 1 billion).

The total designed capacity of the Dung Quat 2 Iron and Steel Complex is 5.6 million tons/year, including 4.6 million tons of HRC hot-rolled steel coils and 1 million tons of special steel. Hoa Phat expects it will take about 3 years for Dung Quat 2’s capacity to operate at its maximum level, thereby increasing its crude steel capacity to over 14 million tons/year.

At the recent 2024 Annual General Meeting of Shareholders, Chairman of the Board of Directors Tran Dinh Long once again affirmed that Hoa Phat is focusing on the key project of the Dung Quat 2 Iron and Steel Complex. Answering shareholders’ questions about whether enough capital had been prepared, Mr. Long said that in the market, Hoa Phat is confident that it is a business that coordinates capital very well so shareholders can rest assured. “The Dung Quat 2 project can ensure that all project items will be completed by September 2026”, emphasized the Chairman of Hoa Phat.

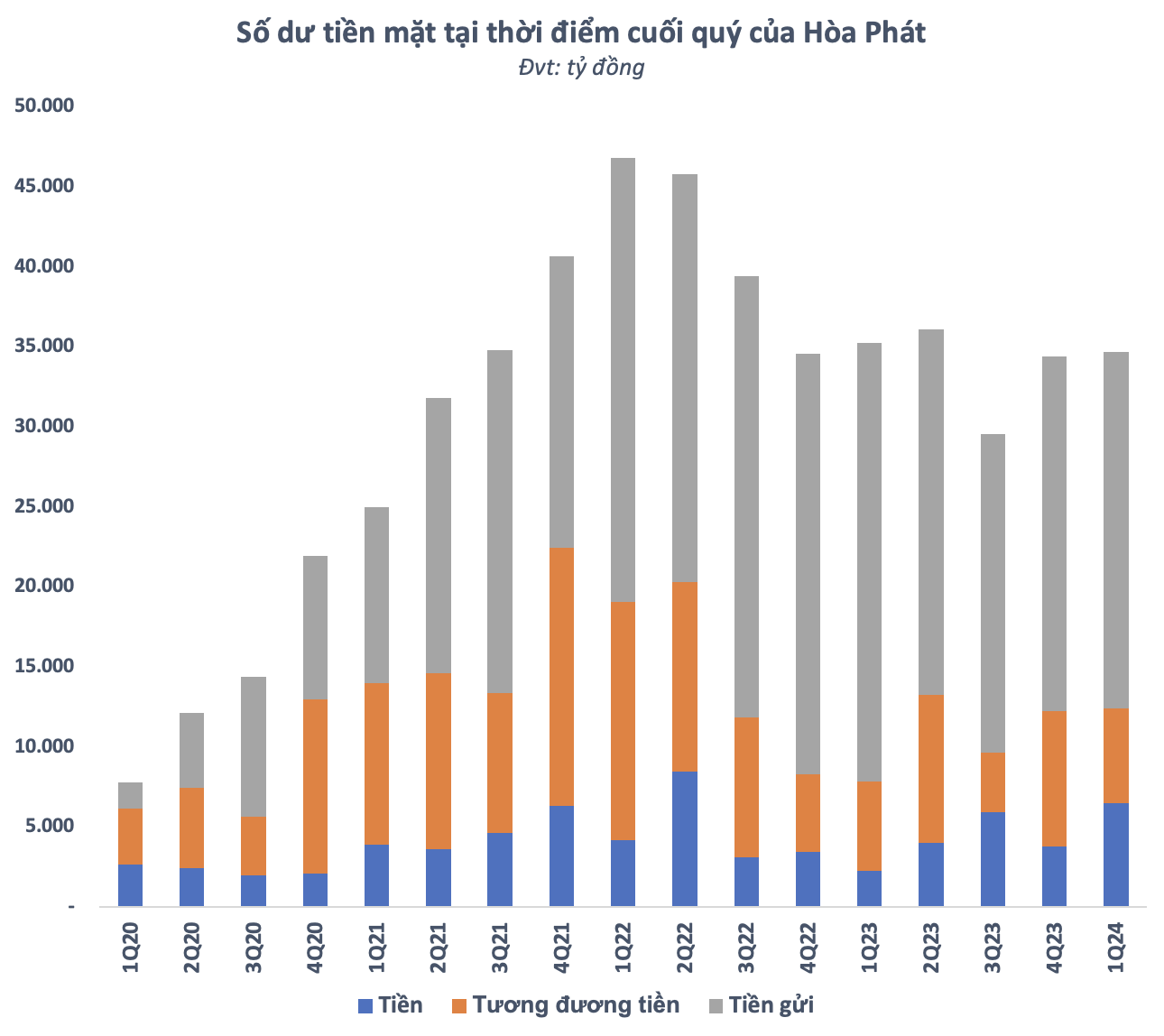

Mr. Long’s confidence is well-founded when looking at Hoa Phat’s ability to raise capital from borrowing in the first quarter. In addition, this group is also “holding” a large amount of cash (cash, cash equivalents and deposits) of up to VND 34,700 billion at the end of the first quarter, a slight increase compared to the beginning of the year.

The “mountain” of cash helps Hoa Phat can proactively balance the use of capital sources to serve its investment and business operations. In the context of low interest rates as present, Hoa Phat has no tendency to accumulate additional deposits (short-term), while also aggressively borrowing to optimize the efficiency of capital use.

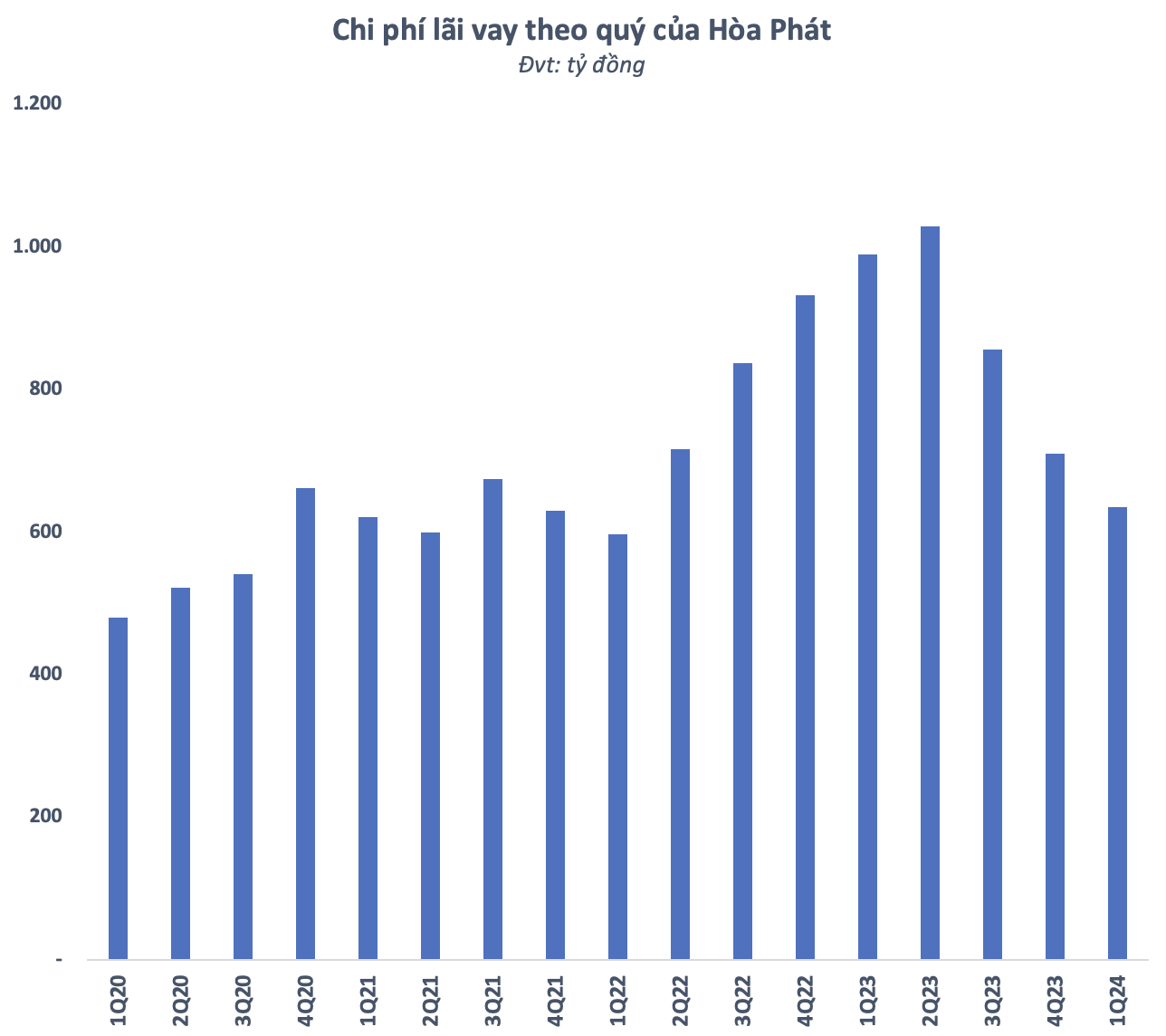

Although the debt increased sharply in the first quarter of the year, but in fact, Hoa Phat’s interest expense decreased by nearly 36% compared to the same period in 2023, down to VND 636 billion. Compared to the previous quarter, this expense also decreased by about 11%. This is the lowest quarterly interest expense that Hoa Phat has to bear since the second quarter of 2022.

According to Hoa Phat’s explanation, good management of the credit limit structure allows the group to be flexible in adjusting the foreign currency borrowing structure and reducing the dependence on foreign capital at a time when the cost of USD capital is high and the foreign exchange risk is significant, taking advantage of domestic capital at more competitive prices.

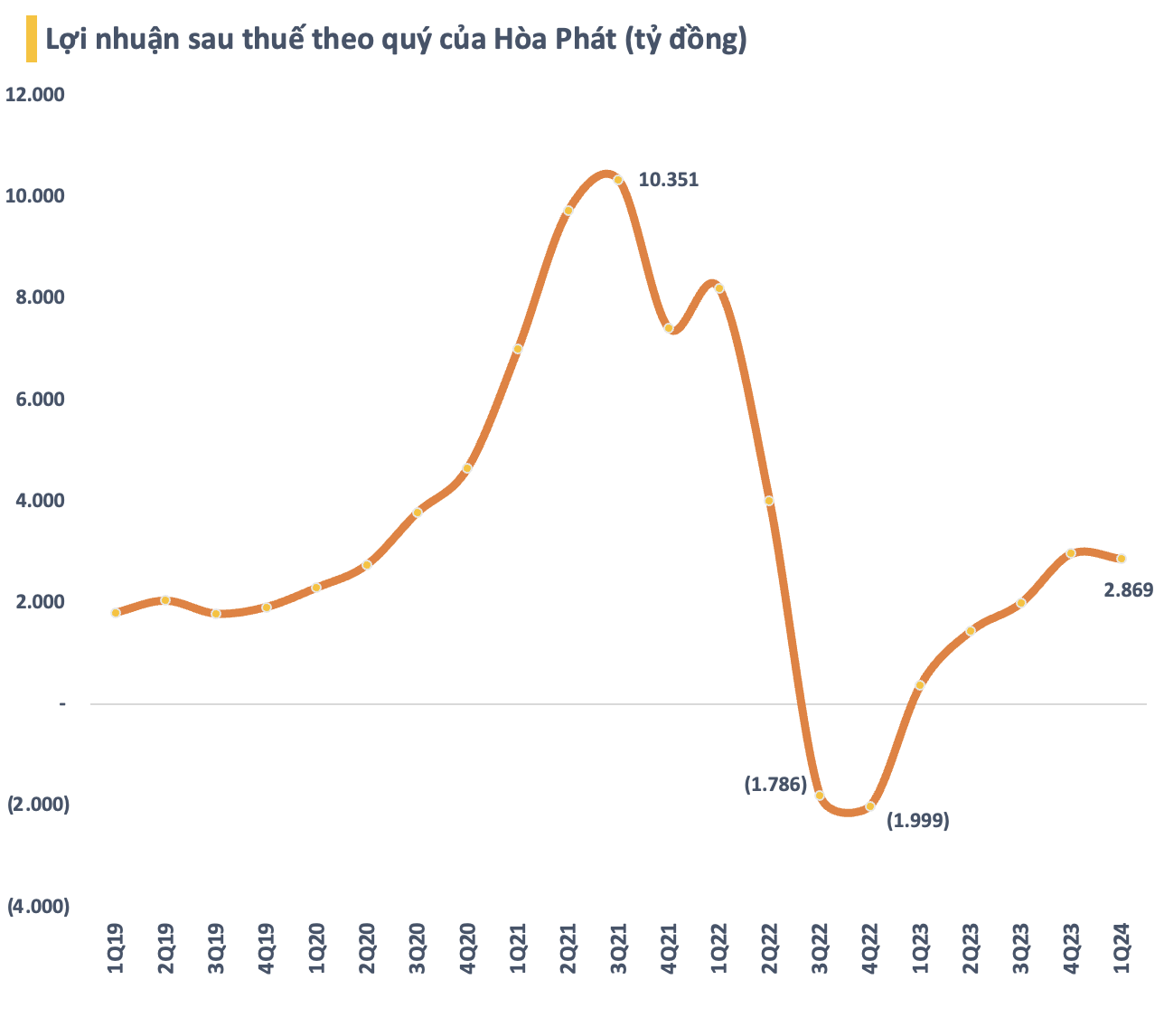

The sharp decrease in interest expense contributed to preserving Hoa Phat’s profit. In the first quarter of 2024, the group had a post-tax profit of VND 2,869 billion, 7.5 times higher than the same period in 2023, but still slightly lower than the previous quarter. This result ended the streak of 4 consecutive quarters of growth over the previous quarter for the leading enterprise in the steel industry.

In the structure, steel accounts for the largest proportion, contributing 93% of revenue and 85% of Hoa Phat’s consolidated post-tax profit respectively. Agriculture ranks second in terms of revenue with a占比 of 5%. In terms of profit, this position belongs to the real estate segment with a 9% contribution to the group’s consolidated post-tax profit.