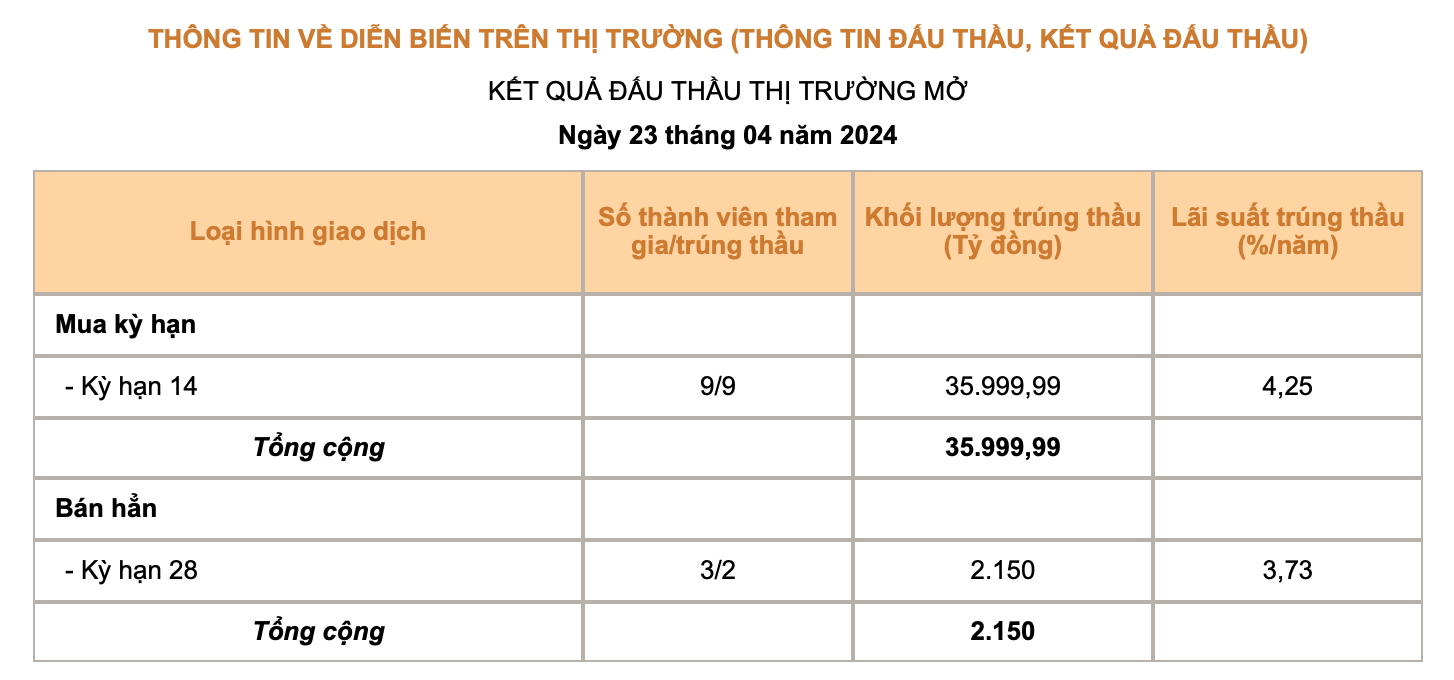

On April 23, the State Bank of Vietnam (SBV) lent nearly VND 36,000 billion to nine members through the OMO channel with a term of 14 days. Notably, the winning interest rate has increased to 4.25%/year, up from 4%/year recently. This is also the highest interest rate on the OMO channel since mid-2023.

In addition, the OMO loan on April 16 (with a term of 7 days) also matured with a total value of nearly VND 12,000 billion, thereby withdrawing the corresponding amount.

Also in today’s session, the SBV issued VND 2,150 billion of Treasury bills with a term of 28 days and an interest rate of 3.73%/year. Three members participated, and two members won the bid. At the same time, the Treasury bill issue on March 26 matured, and the SBV reinjected VND 3,700 billion into the market.

Thus, on this day, the SBV net injected over VND 25,500 billion.

Faced with the overheating exchange rate, the State Bank of Vietnam is implementing synchronous measures to stabilize the market. Along with issuing Treasury bills, the SBV also uses the OMO channel to regulate liquidity and interbank market interest rates.

The OMO interest rate hike is expected to affect VND interest rates in the interbank market, thereby narrowing the USD-VND interest rate differential without significantly affecting the general interest rate level in the economy. Through this move, the central bank aims to limit USD speculation and reduce pressure on the exchange rate.

In the structure of policy interest rates, the OMO interest rate is a type of interest rate that has a strong impact on the market because it is directly and continuously linked to the cost of supporting funds for the system, especially with stability in cases where system liquidity needs support.

Earlier, on April 19, the SBV publicly intervened to sell foreign currencies to banks with negative foreign exchange status to bring their foreign exchange status to 0. The intervention exchange rate was VND 25,450. However, in fact, by April 23, the USD exchange rate at banks continued to increase sharply and was listed at the ceiling of VND 25,488.

At a recent press conference of the State Bank of Vietnam, Deputy Governor Dao Minh Tu said that all the causes of the exchange rate increase have been assessed by the SBV, and adjustment measures have been taken using its tools, including the central exchange rate tool and market management, to ensure an appropriate supply and demand of foreign currencies. And if necessary, the SBV will use foreign exchange reserves to intervene in the exchange rate to ensure the set target. “Vietnam’s exchange rate management approach is very flexible. Although we continue to stabilize the exchange rate for the economy, it is not fixed. Instead, it fluctuates to adapt to the situation and avoid strong global impacts. We are also ready to intervene if the exchange rate continues to have adverse effects,” said Mr. Tu.