Following the notice sent to securities companies on April 21, 2024 by the HOSE, the companies have been actively preparing to make the transition to the new KRX system. On April 24 and 25, 2024, several securities companies issued announcements regarding their plans to implement the trading system.

Vietcap Securities announced a temporary suspension of logins for all trading platforms from April 27 to 30, 2024, to ensure a smooth upgrade process and to coordinate data verification and testing with the exchanges and VSDC. The company plans to complete the upgrade and allow investors to download and use the trading applications from May 1, 2024.

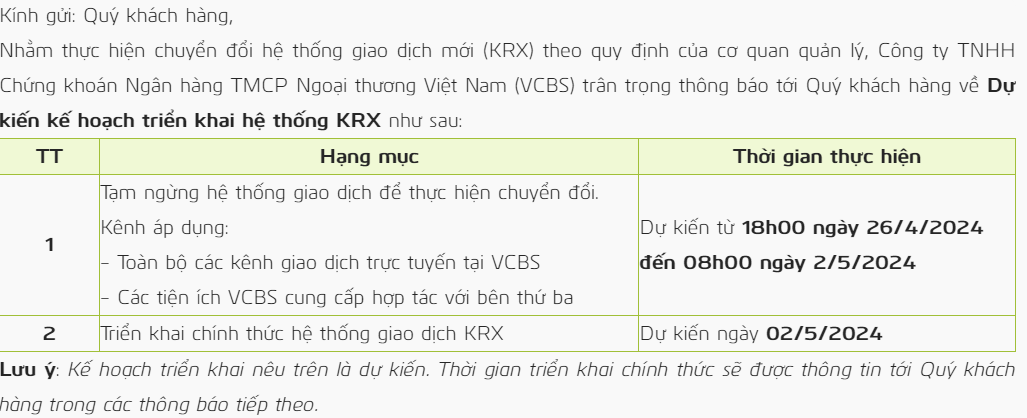

Vietcombank Securities (VCBS) announced a temporary suspension of its trading system to implement the system migration. The suspension will affect online trading channels at VCBS and VCBS’s third-party partner utilities from 6:00 PM on April 26, 2024 to 8:00 AM on May 2, 2024.

Announcement by VCBS Securities

|

ACBS Securities also issued a statement announcing that ACBS will conduct maintenance and upgrades on their system to implement the KRX system, from 5:00 PM on Friday, April 26, 2024 to 8:00 AM on Thursday, May 2, 2024.

During this period, ACBS will suspend processing of orders for the following services: securities depository, securities transfer, blocking, etc., starting from 5:00 PM on Thursday, April 25, 2024. The company will stop accepting money transfer requests from 4:00 PM on Friday, April 26, 2024.

Furthermore, investors will not be able to log into their securities accounts on online trading channels. After the specified period, the system will resume normal operation to serve customers.

DNSE Securities announced that it will be implementing the system migration in preparation for the official launch of KRX, as planned by the Stock Exchange, from 5:00 PM on Friday, April 26, 2024 to 8:00 PM on Wednesday, May 1, 2024. During the system migration, the following online trading services will be temporarily unavailable: Placing orders for buying/selling underlying and derivative securities, making deposits/withdrawals for derivatives, transferring money, borrowing against sales, connecting with trading companions, and using features, utilities, and settings that involve changes to information/data in the Entrade X account.

For VNDIRECT Securities, from 5:00 PM on Friday, April 26, 2024 to 12:00 AM on Thursday, May 2, 2024, the company will implement the plan to transition to the new KRX trading system, as directed by the Stock Exchanges. Therefore, some features will be temporarily suspended, including logging into and checking information on the following platforms: Price board, My DGO (Myaccount), Mobile App; opening account, registering for products/services, changing information; making deposits/withdrawals 24/7; trading securities.

According to a statement by the management of SSI Securities, their employees are working day and night to complete the system migration testing by April 30, 2024.

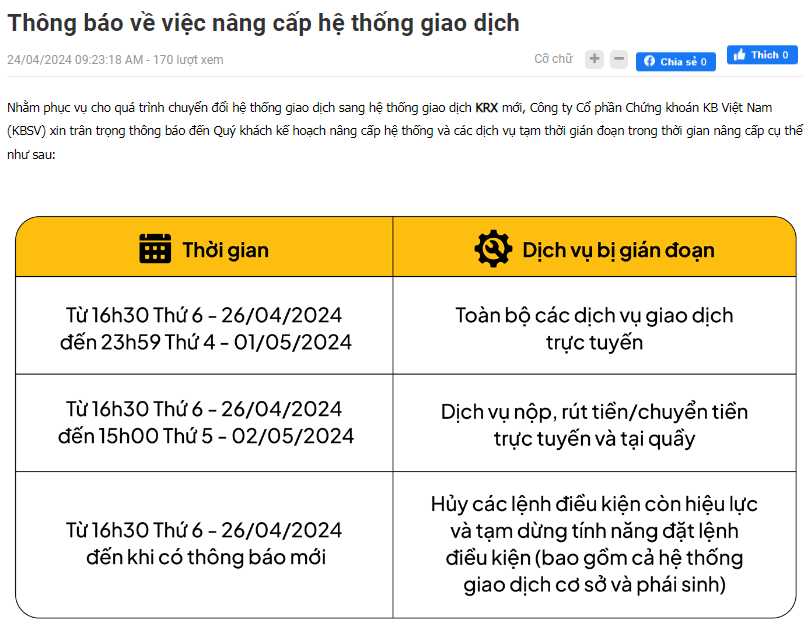

Other securities companies, such as Bao Viet Securities, KB Vietnam Securities, and Ho Chi Minh City Securities (HSC), have also announced their plans for the new KRX system migration and the schedule for providing services during the data migration and system testing period.

Announcement by KBSV Securities

|

KRX is an information technology system for managing and operating trading on the Vietnamese stock market, with HOSE as the investor and the Korea Exchange (KRX) as the implementing unit. The project has been under development since 2012.

In addition to HOSE, the beneficiaries of the KRX System include the Hanoi Stock Exchange (HNX) and the Vietnam Securities Depository and Clearing Corporation (VSDC).

KRX aims to upgrade the technology and infrastructure of the stock exchanges in Vietnam. Due to various objective reasons, such as the prolonged pandemic and the complexity of the large-scale project, the implementation of the KRX System has not progressed as planned.

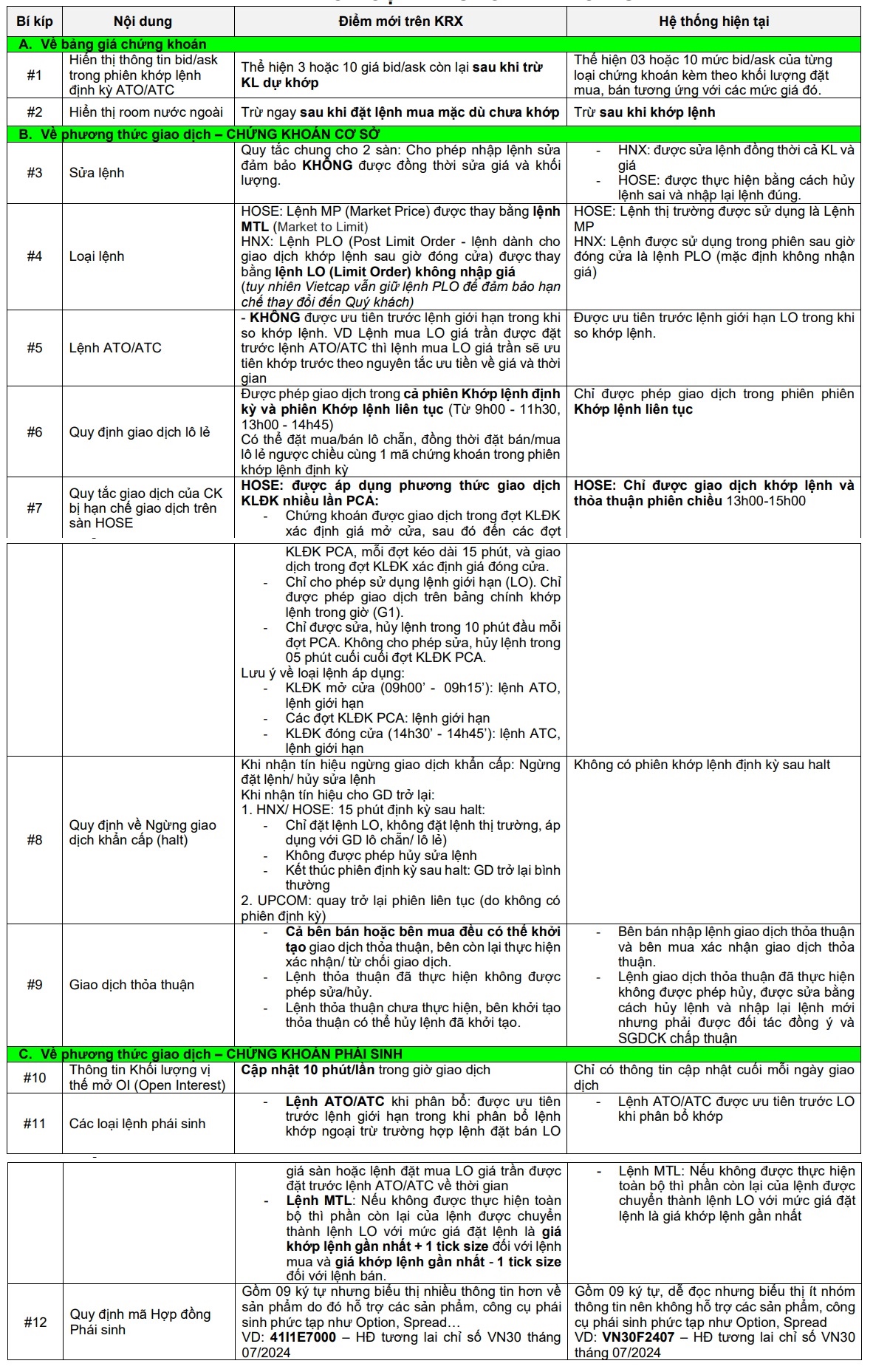

The system is expected to transform the Vietnamese stock market with its advanced platform. In a notice to investors, Vietcap Securities outlined the expected changes when the KRX system goes live.

|

New features in KRX system trading

Source: Vietcap Securities

|

However, the plan to launch KRX on May 2, 2024 is at risk of being delayed. On April 25, 2024, the State Securities Commission issued an urgent dispatch to the Stock Exchanges and the Vietnam Securities Depository and Clearing Corporation (VSDC) in response to the proposal from the Ho Chi Minh City Stock Exchange (HOSE) to approve the official operation of the KRX Information Technology System (KRX system). According to the State Securities Commission, there are currently insufficient grounds to approve HOSE’s request to put the KRX information technology system into official operation on May 2, 2024.

The State Securities Commission stated that HOSE’s proposal to the authority to approve the official operation of the KRX system without a report from the Ministry of Finance, the Vietnam Securities Exchange (VNX), and without the opinions of the beneficiaries (Hanoi Stock Exchange (HNX) and VSDC) is not in compliance with legal regulations.

Furthermore, according to the content of HOSE’s Proposal No. 4, the KRX information technology system has not yet received a general acceptance report between the investor, the contractor, and the beneficiaries (HNX, VSDC), which is not in compliance with Decree 73/2019 on the management of technology investment using state budget funds.

HOSE’s proposal has not yet demonstrated that the KRX information technology system has been approved by the competent authority for information security level (level 4) in accordance with Circular 12/2022 of the Ministry of Information and Communications.

Regarding member readiness, the State Securities Commission stated that there are currently no official documents from the members regarding their readiness to connect to the KRX information technology system or their ability to provide securities services to investors after the connection.

Regarding the plan for reverting to the old system, as stated in HOSE’s Proposal No. 4, the State Securities Commission requested the stock exchanges and VSDC to ensure that the current trading, registration, depository, and clearing and settlement systems operate safely, stably, and seamlessly in all situations.