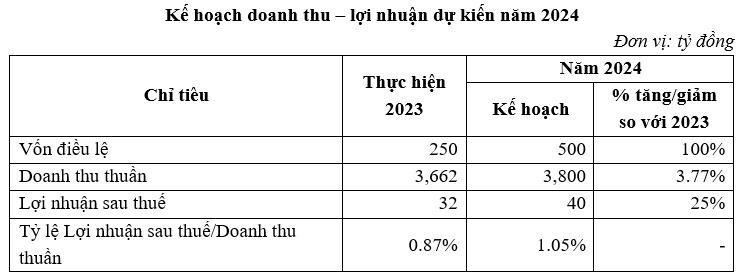

Siba Group plans to increase its revenue by nearly 4% to VND 3,800 billion, aiming for a 25% growth in profit after tax to VND 40 billion. The net profit margin is expected to increase from 0.87% to 1.05%. The company will not declare dividends for 2023.

The plan for charter capital is VND 500 billion, double that of last year, through the issuance of stock dividends and bonus shares. These plans were approved at the 2023 Annual General Meeting of Shareholders on May 11, 2023, and were subsequently amended at the Extraordinary General Meeting of Shareholders on February 5, 2024.

Source: SBG

|

In terms of implementation plans, Siba Group said that the provision of mechanical products and the construction and installation of factory buildings are currently the most profitable activities for the mechanical division. However, prior to 2024, SBG had only focused on investment in mechanics and manufacturing. Therefore, the company’s orientation this year will be to develop a business strategy for products that meet market demand in order to increase revenue and profit, while also reducing costs and using investment capital effectively from the additional sources.

It is worth noting that in 2023, the revenue from mechanical and construction engineering increased significantly, indicating that SBG is investing in and developing this division effectively.

Of particular note is the development and construction of product lines according to the “5S” orientation – including Sibacons (Construction), Sibagri (Agricultural Equipment), SibaF&R (Furniture & Home Appliances), SibaEco (Energy and Environment), and Service (Services). 5S will provide equipment for “5F” – including Field (Cultivation), Fish (Aquaculture), Farm (Livestock), Food (Food), and Fertilizer (Fertilizers).

However, the company also presented a restructuring plan for certain subsidiaries, including the divestment of Sibacons. SBG stated that due to a change in business direction at the subsidiary, the company will divest its shares and allow the parent company, Siba Holdings, to take over this division. The plan was approved by the General Meeting of Shareholders.

Siba Group’s 2024 Annual General Meeting of Shareholders. Photo: Chau An

|

Divestment of an energy company to expand

For the energy division, Siba Group plans to continue developing rooftop solar power at VMECO Bac Lieu Clean Energy Company Limited. In addition, it will restructure (divest/dissolve) VMECO Dong Thap Clean Energy Company Limited.

At the meeting, General Director and Member of the Board of Directors Nguyen Van Duc said that the divestment is actually a matter of restructuring.

“Previously, according to government regulations, the construction of rooftop solar power plants with a capacity of less than 1MW required separate legal entities for investment and grid connection to sell electricity to EVN. But this policy has now changed, and it is no longer necessary to establish a separate legal entity for each MW. Therefore, SBG will divest from the energy company in Dong Thap and focus on the company in Bac Lieu with the orientation of building 100MW of rooftop solar power at farms to sell electricity directly to the farms. SBG will use this company to continue investing in subsequent projects, optimizing operations, and reducing costs,” said Mr. Duc.

“SBG sees energy as a sector with good opportunities at present and in the future. The government has a policy that allows companies to build renewable energy systems to sell to consumers, factories, and businesses… without going through the state. This is one of the key reasons for SBG to focus on developing renewable energy.”

It is noteworthy that Mr. Duc said that SBG has recently signed a memorandum of understanding with Nissin Electric of Japan to invest in a 100MW rooftop solar power system over 3 years.

“In order to sell electricity to consumers, it is necessary to focus on power transmission. Nissin Japan specializes in power transmission, with 100 years of experience. By partnering with Nissin, SBG has two objectives: to use their products to invest in the future transmission system; and to cooperate in joint ventures for power transmission for energy companies and state-owned corporations in the future.”

Regarding the agricultural products division, the company shared that this activity accounts for up to 80% of revenue, so it needs to be continued. SBG currently has agricultural business operations in the domestic market, but due to unpredictable price fluctuations and low profit margins (usually only ≤1%), the company will consider gradually reducing its revenue in the 2022-2030 period in order to focus maximum resources on the mechanical and renewable energy divisions.

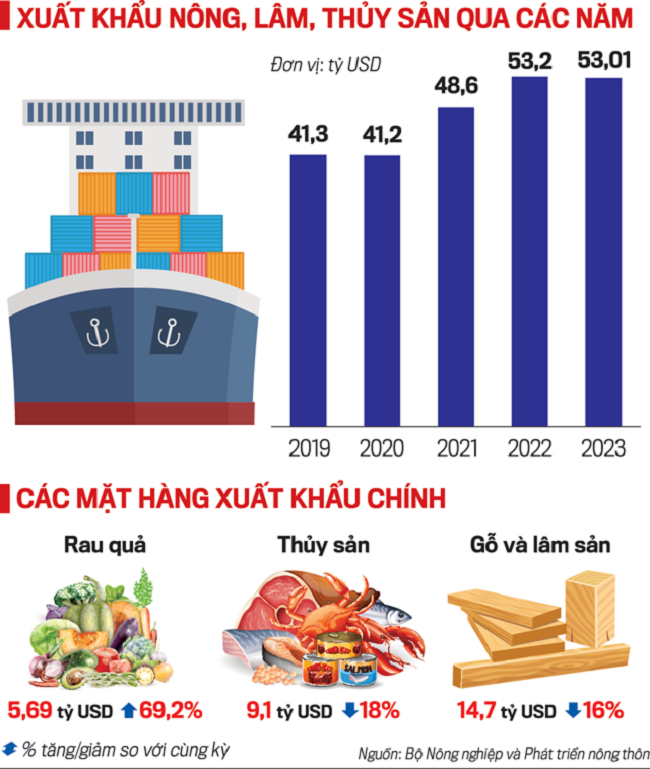

| SBG‘s business results from 2019 to present |

Mr. Truong Sy Ba joins the management team

The General Meeting of Shareholders also approved the dismissal of Mrs. Phan Hong Van from her position as a member of the Board of Directors due to the expiration of her term (2019-2024) and in order to meet the condition that members of the Board of Directors cannot serve for more than 5 years. At the same time, Mr. Truong Sy Ba was elected as a new member of the Board of Directors.

Mr. Sy Ba is not a stranger to Siba Group, as he is the Chairman of Siba Holdings – the parent company of SBG, part of the Tan Long Group ecosystem where Mr. Ba is also Chairman of the Board of Directors. In addition, he is also the Chairman of the “vegetarian pig” company BAF – another member of Tan Long.

Mr. Truong Sy Ba – Chairman of the Board of Directors of BAF and Tan Long Group joins the management team of SBG. Photo: T.M

|

Speaking at the meeting, Mr. Ba said that Siba Group was established to seize the potential and ride the wave of Vietnam’s integration and the shift in the supply chain in Asia.

“SBG has the advantage of being part of the Tan Long ecosystem, which has operations in livestock, rice, etc., all with a long-term vision. Therefore, initially, SBG‘s role was to research and develop the Group’s ecosystem, and R&D products to reach out to the market outside. SBG has researched many technologies related to livestock housing. Things that had to be imported before are now being supplied by SBG for 80%. The same is true for the rice sector, such as high-tech drying technology, production of transportation equipment…” – quoted from Mr. Sy Ba.

Sharing more about the orientation, Mr. Ba said that the cooperation with Nissin also aims to invest in battery storage, with the goal of using 100% renewable energy. In addition, the company plans to continue developing a wastewater treatment system and implement biomass power from waste…

The meeting also approved the resignation of Mrs. Le Thi Xuan Duc from her