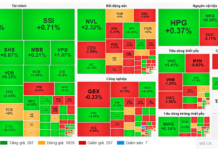

The stock market is experiencing a challenging phase with relentless declines. The VN-Index has “lost” over 100 points (~9%) since its peak in late March, reaching 1,177 points. This rapid decline has nearly wiped out all the market’s gains since the beginning of the year.

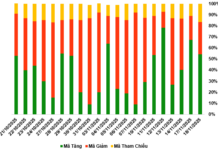

What’s concerning is that the downtrend is showing little to no signs of slowing down. Market liquidity has nearly “disappeared” with the absence of billion-dollar trading sessions. The average trading value on the Ho Chi Minh Stock Exchange (HOSE) has remained around 15,000 billion VND in recent sessions. The decline in liquidity even during sessions of heavy market declines suggests that money is still firmly staying on the sidelines, waiting for clear signs of a bottoming out.

In fact, many believe that the VN-Index is unlikely to drop by 15-20%, and the MA200 threshold at the 1,170-1,180 point range could serve as a balance point for the index. However, there are still no indications that the market has found its bottom. After these shocking declines, will the VN-Index ever stop falling?

The Decline May Not Be Over

Mr. Ngo Minh Duc, Director of LCTV Financial Investment Joint Stock Company, believes that the market is still in a correction phase. After four strong declines last week, the market experienced a bull trap on April 22nd before falling again, temporarily breaking through MA200 on the afternoon of April 23rd. Typically, the market rarely “falls” continuously for 8-10 sessions as it did during the COVID period; instead, it usually declines for 4-5 sessions, recovers, and then declines again. This is a crucial development that investors should monitor to avoid buying too early.

Mr. Duc believes that high margin levels will be a major concern going forward. While margin pressure may not reach widespread liquidation thresholds, many investors will actively sell to reduce their margins, which could lead to a deeper correction.

Regarding the current low liquidity, Mr. Duc believes that many investors are hoping for further market discounts as a 9% decline from the peak after a nearly 300-point surge is not enticing enough.

Additionally, the lack of technical signals indicating a bottoming out makes trading investors more cautious about entering the market. On the other hand, the tardy release of Q1 financial results is causing investors to slow down their trading to seek out companies with growth potential in the near future.

According to the expert, for the market to stabilize and find its bottom, prices need to be discounted significantly, and it will take more than just one or two sessions. If inflation increases in April or the Federal Reserve delays an early interest rate cut, selling pressure could intensify, pushing the index below the MA200 support level of 1,175 points. If this scenario plays out, the VN-Index could potentially revisit the 1,120-1,135 point range.

Investors Should Stay on the Sidelines Rather Than Trying to Time the Bottom

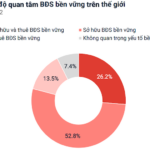

For money to return and drive the index higher, the market needs stable macro support, such as low inflation, a cooling exchange rate, and no further interest rate increases. Therefore, in addition to watching technical signals, investors should pay attention to macro indicators to allocate their portfolios and investment proportions appropriately.

In the short term, investors should remain on the sidelines to avoid risks. “A bottom is formed over a period of time, not just a few sessions, and within a downtrend, there are always interspersed up sessions that do not change the overall trend.

“Instead of trying to time the bottom, investors should wait for the market to stabilize and establish a balance before re-entering to mitigate risks. At the same time, investors should adhere to the discipline of taking profits/cutting losses when their positions become profitable/unprofitable,” Mr. Duc advised.