After shedding more than 100 points last week, the stock market entered the new week with positive support information from the KRX system. Buying power quickly dominated across the board, helping green cover most stock groups, especially the two groups of securities and banks.

At the end of the session on April 22, the VN-Index increased by 15.37 points (+1.31%) to 1,190 points. However, liquidity was quite low, with the matched order value on the HoSE only reaching about 14,000 billion VND. Foreigners traded less actively when they net sold 172 billion VND across the market.

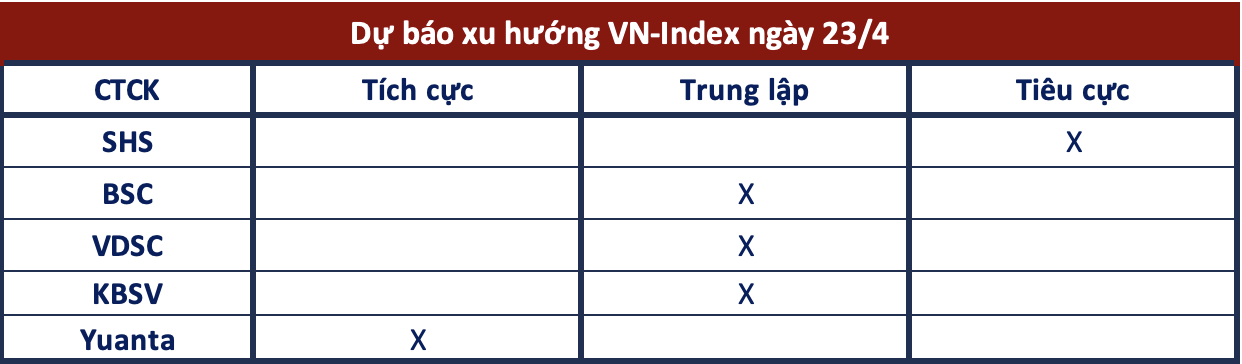

Commenting on the market in upcoming trading sessions, most of the brokerage firms made contrasting comments:

Risks decline after recovery is still high

SHS Securities: In the short term, the VN-Index has broken through the firm support level of 1,250 points, leading the market into a downtrend and returning to the 1,150-1,250 points accumulation channel. The recovery rally on April 22 may only be of a technical nature and the risk of the VN-Index continuing to decline after the recovery is still high. In that scenario, the reliable support level will be the 1,150-point zone. The immediate resistance level of the index is the psychological level of 1,200 points.

Begin the process of bottoming out

BSC Securities: The VN-Index is starting to bottom out when approaching support levels. However, the decline in liquidity in the April 22 session shows that market sentiment is still weak, and investors should trade cautiously in the upcoming sessions.

There is not much room for recovery

VDSC Securities: The market had a recovery after a session of strong dispute around the MA(200) line. The recovery is currently stalling in the gap-down zone from April 19, at 1,190-1,193 points. Liquidity has fallen sharply compared to the previous session, indicating that the supporting cash flow is still cautious, especially when the market recovers to the gap-down area.

The current recovery momentum is largely due to the cooling down of supply after many sessions of causing great pressure, with expectations regarding support information from KRX. The recovery may continue in the next trading sessions; however, the recovery may not be significant since the 1,200-1,210 point area is a relatively strong resistance point in the short term. At the same time, the risk of pulling back again after the recovery is still remaining, as the supporting cash flow is generally not positive.

Fluctuating development

KBSV Securities: After the opening gap-up in the first session, the VN-Index fluctuated in the late morning before gradually regaining momentum toward the afternoon. The index closed, forming a “Spinning” candlestick pattern after a gap-up, accompanied by a decrease in liquidity, indicating that the recovery has stalled and is not very convincing. The uptrend has relieved some of the selling pressure and weakened the negative market sentiment, but the market is likely to continue fluctuating in the upcoming sessions.

Can continue to recover

Yuanta Securities: The market will likely continue its recovery in the next session, and the VN-Index may retest the resistance zone of 1,200-1,225 points. However, the risk of a decrease remains high, so the market cannot avoid strong fluctuations, especially since liquidity is still low, indicating that cash flow is not yet ready to return to the market.