The principle of accumulating bank stocks during a period of market undervaluation has existed for centuries worldwide. Consequently, in 2023, when the VnIndex temporarily adjusted down by more than 16% in less than two months and many bank stocks “halved” or “thirds” from their peak, many Vietnamese investors opted for: Accumulating bank stocks at a low valuation.

The wise choice of investors

Discovering and considering stocks that are being undervalued is one of the key skills that legendary investor Warren Buffett always applies when making investment decisions. Accordingly, a good stock is one that is undervalued compared to its intrinsic value, which will create a “margin of safety” for investors and of course has the potential for high returns in the future with businesses that generate profits and pay sustainable dividends to shareholders.

The Bank group – known as the “king of stocks” due to its extensive growth potential and its role as a pillar in the context of Vietnam’s economy being assessed by international organizations as having a positive outlook. In fact, the market shows that the stock prices of the banking group are still in an attractive area compared to the general market, and the valuations of some bank stocks are at an average level of the past 2 years. In addition, the “downpour” of cash dividends from this group is gradually attracting the attention of investors, thereby creating momentum for stock price increases.

The fluctuations of the stock market are like waves filled with dangers that can strike. Therefore, stocks with a history of regular dividends, sustainable development are always a priority for “safe and steady” investors. In times when the interest rate for 12-month and 18-month savings deposits fluctuates at only 4.2 – 4.9%/year, the stock market in general and dividend-paying stocks in particular have caught the “green eye” of investors.

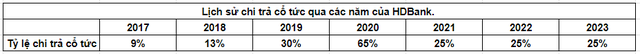

For example, at HDBank – the bank that is currently the focus of the stock market, maintaining an attractive dividend payout for shareholders for many consecutive years. This year’s AGM season, the bank plans to pay a dividend at a rate of 25%, including 10% in cash and 15% in shares.

Notably, HDBank expects to pay a dividend of up to 30% in 2024, including cash and shares. Thus, after more than a decade of consistent and high growth, HDBank has always maintained the tradition of paying regular annual dividends at a high rate.

Or at Techcombank, after 7 years of “endless” waiting, shareholders were “overjoyed” with the plan to distribute up to 115%. In which, with the retained earnings of 2023, after setting aside funds, Techcombank plans to distribute cash dividends at a rate of 15%, corresponding to nearly VND 5,284 billion.

Regular dividend payments are a testament to the effective business performance and “health” of the business itself. Along with stable business operations, building a unique story combined with a regular dividend payment mechanism will be a factor driving the stock price in a positive direction.

Sweet rewards from accumulating bank stocks in the “old year”

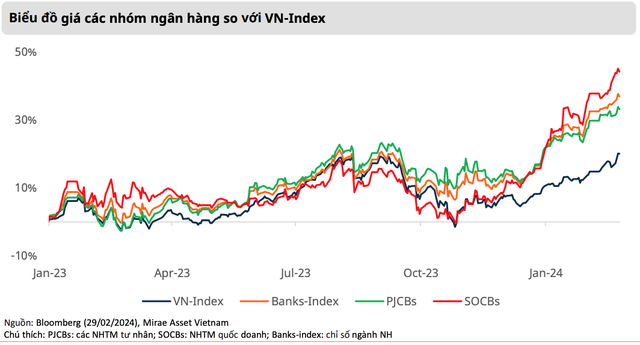

The Vietnamese stock market in 2022 – 2023 has witnessed many ups and downs. Similar to other sectors, bank stocks also suffered correction pressure when the market fluctuated. However, along with the signal of economic recovery, this group has recorded a breakthrough, surpassing some important thresholds, such as VCB, BID, MBB, ACB, HDB breaking historical peaks.

After a period of difficulty, the cash flow poured into the banking group shows the positive expectations placed on this market-leading group. Statistics show that if an individual “goes all in” into the basket of typical bank stocks such as VCB, BID, MBB, HDB since April/2023, it is estimated that VCB (+23%), BID (20%), MBB (56.8%), HDB (54%) compared to the current market price.

Since the fourth quarter of last year, when the health signals of banks have improved and recorded positive business results in combination with dividend plans, the wave of continuous price increases of banks has brought profitable value to investors.

As an important pillar and accounting for up to 30% of the total market capitalization, the group of bank stocks has made a significant contribution to the growth of the general index. Supporting information such as credit growth and asset quality has pushed the stock prices of this sector to perform positively. Despite the adjustments, bank stock prices are still higher than the general market.

VCB and BID are currently priced at VND 90,500/share and VND 48,350/share, respectively. As of the end of February/2024, this major pair continuously “led each other” to establish new peaks, holding the top position since the end of 2023. Notably, the TOP with the strongest price increase included HDB stock, this stock achieved a profit margin of nearly 20% in just the past 3 months.

Is the golden opportunity to accumulate banking stocks in the “new year” coming?

In the first quarter of 2024, Vietnam’s GDP growth reached its highest level in the first quarter of the past four years. The recovery trend has been expanding across many sectors, credit growth is recovering and tends to increase in a low-interest-rate environment.

Banks are entering the peak of the AGM season, the common point shows a confident plan for the 2024 outlook, especially in terms of profit growth targets, improving asset quality, strengthening the capital buffer and tightly controlling credit quality.

However, the stock market has just had negative reactions and a sharp correction after the adverse developments in the foreign exchange market and geopolitical instability in the world. The VnIndex fell sharply, making the valuations of bank stocks even more attractive. Notably, indicators such as forward P/E, P/B in this group also tend to be “cheaper” due to the positive profit growth outlook.

These new developments recall the impressive results of the choice of accumulating banking stocks last year. And on the floor, the cash flow accumulating bank stocks seems to be reactivated, a new opportunity is opening up for investors who are looking for potential growth stocks.