Vietbank’s 2023 business picture is marked by several bright colors reflecting positive indicators: Vietbank’s total assets reached 138,258 billion VND, achieving 111% of the plan. The asset portfolio structure continues to be adjusted in the direction of increasing the proportion of income-generating assets and always maintaining it at over 95%. The total outstanding credit balance accounts for 58% of total assets and reaches 80,754 billion VND, an increase of 19.6% compared to 2022, completing the assigned target and exceeding the average credit growth of the entire system.

Risk warning and assessment activities have been enhanced. Tightly managing and supervising the purpose of loan use and controlling asset quality are also among Vietbank’s top priorities. Thanks to that, Vietbank’s credit quality has always been maintained at a good level, with Vietbank’s bad debt ratio as of December 31, 2023, in accordance with Circular 11 of the SBV, being kept at 1.79%, lower than the average of the entire banking system as of Q4.2023. Capital mobilization reached 101,547 billion VND, an increase of 25.2% compared to 2022, successfully exceeding the plan.

Along with that, Vietbank also diversified its sources of capital mobilization, ensuring stability and liquidity safety, contributing to improving capital costs at a reasonable level. Vietbank’s pre-tax profit in 2023 after audit reached 812 billion VND, fulfilling 84.6% of the plan, achieving a growth of 23.8% compared to 2022. Vietbank’s leaders shared that the bank has proactively adjusted its profits to go along with the difficulties of businesses. Vietbank is also ready to have a response scenario to adjust interest rates to share the difficulties with the market in general and customers in particular.

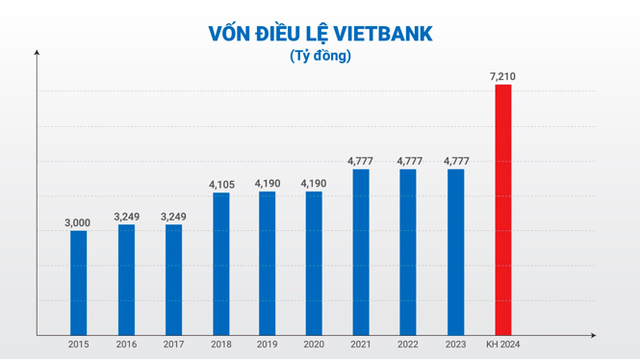

The increase in charter capital for the second consecutive year of Vietbank is part of the restructuring plan approved by the State Bank. Accordingly, Vietbank is one of the first banks to be approved by the SBV for a restructuring plan. This is an important step creating a stable foundation for the bank’s future operations. 2024, with the foundations built in 2023, is expected to be a pivotal year for safe and sustainable development.

Sharing about the plan to increase the charter capital this year, a representative of Vietbank said that the dividend payment in 2024 is one of the bank’s important goals in bringing value to shareholders as well as enhancing financial capacity and competitiveness in the market. The dividend payout ratio of 25% is one of the highest in the banking system in a context where the economy and business operations face many difficulties.

Previously, at the 2023 General Meeting of Shareholders, Vietbank’s General Meeting of Shareholders approved the implementation of a plan to increase charter capital to 1,003 billion VND, corresponding to 17%, bringing the bank’s total charter capital to 5,780 billion VND.

Through 3 capital increases from 2019 to date, the bank’s charter capital has doubled compared to the previous decade. In 2024, Vietbank will continue to submit to the General Meeting of Shareholders a plan to increase its charter capital by nearly 25% by paying dividends in shares to existing shareholders. Thus, Vietbank’s charter capital will reach about 7,210 billion VND after completing the 2023 and 2024 plans. The continuous increase in charter capital is a positive sign, creating an important driving force for Vietbank’s comprehensive and strong development, towards the bank’s strategic goals.

In 2023, Vietbank also achieved important achievements and awards. With the spirit of solidarity, determination, and relentless efforts, Vietbank was honored by prestigious organizations to be an Outstanding Asian Enterprise, a Strong Brand – Sustainable Development, Top 50 Largest Enterprises in Vietnam, Top 100 Leading Employers in Vietnam & Top 10 Best Places to Work in Vietnam, Top 50 Fastest Growing Enterprises in Vietnam, a Typical Bank for the Community, Top 10 Golden Quality Services for Consumer Rights, Top 10 Competitive Brands in Vietnam. Notably, Mastercard presented the Excellence in Innovation award to Vietbank – the first bank to complete the Mastercard payment and issuance project in the shortest time ever in the Vietnamese market