Vinh Hoan Corporation (stock code: VHC – HoSE) requested an extension to submit its Q1 2024 financial statements on April 23. The company explained that, according to regulations, the deadline for Q1 2024 financial statements submission is April 30, 2024.

However, due to VHC and its subsidiaries currently providing documents to the United States Department of Commerce for the 20th administrative review of frozen tra fish fillets exported from Vietnam to the United States, the company could not prepare its Q1 2024 financial report on time.

Therefore, Vinh Hoan requested an extension for submission and publication of its Q1 2024 financial report (separate and consolidated) no later than May 15, 2024.

Vinh Hoan had previously proposed to submit its Q3 2023 financial report no later than November 15, 2023, instead of the stipulated October 30, 2023 deadline, citing the reason that the company and its subsidiaries had to receive an inspection delegation from the United States Department of Commerce from October 19, 2023, to October 27, 2023, for the 19th administrative review of frozen tra fish fillets exported from Vietnam to the United States.

However, the State Securities Commission indicated that the reason given did not fall under the circumstances for postponing information disclosure due to force majeure and requested Vinh Hoan to disclose information in accordance with regulations.

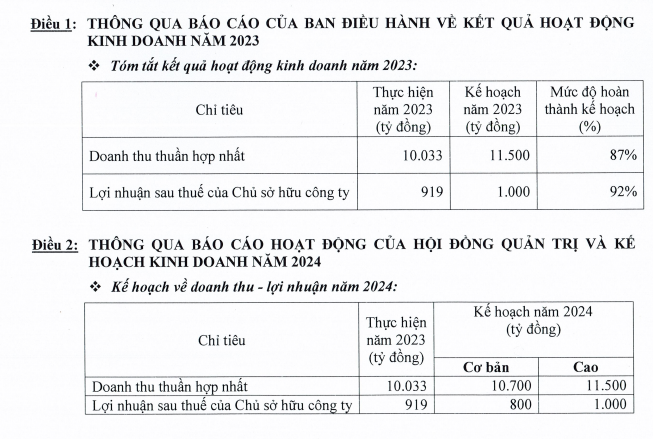

Vinh Hoan recently held its 2024 Annual General Meeting of Shareholders (AGM) on April 17. The meeting approved the business plan for 2024 with two scenarios: a high scenario and a base scenario.

For the base scenario, Vinh Hoan planned revenue of VND 10,700 billion, a 6.6% increase year-on-year, and the parent company’s after-tax profit is expected to be VND 800 billion, a 12.9% decrease compared to 2023.

Source: VHC

For the high scenario, revenue is projected at VND 11,500 billion, a 14.6% increase year-on-year, and the parent company’s after-tax profit is expected to be VND 1,000 billion, an 8.8% increase compared to 2023.

Regarding investment plans, Vinh Hoan expects to invest VND 930 billion in 2024. The company will invest in capacity expansion and upgrading collagen production and renovating the Vinh Hoan Collagen factory; invest in a farming project, warehouses, and additional machinery and equipment for phase 1 of the Thanh Ngoc fruit processing plant; invest in warehouse expansion and capacity upgrades at the Feedone aquatic feed factory; invest in warehouse expansion and capacity upgrades at the Sa Giang factory; investments to expand farming areas; and new investments and renovations of Vinh Phuoc, Thanh Binh, and Vinh Hoan factories.

VHC shareholders also approved the profit distribution plan for 2024, with a 20% dividend payout ratio, meaning that shareholders will receive VND 2,000 for each share owned, and a 20% bonus fund allocation for the Board of Management, not exceeding VND 20 billion.

Previously, on February 29, 2024, the company had paid an interim dividend for 2023 at a rate of 20% in cash.