The stock market has had a stellar day of trading. The market was characterized by green and the core groups of stocks all experienced growth, which helped the main index to widen its gains towards the end of the session. The VN-Index closed up by over 23 points, finishing at 1,205.61 with liquidity on HoSE not being overly explosive, at approximately 17,000 billion VND.

The 2.4% breakout session in the Vietnamese market was in line with the trend of other indices in the region on April 24th, and was among the most active groups.

It is not hard to imagine the joy of investors as the market once again crossed the 1,200 point mark, as just over a week ago, concerns following a drop of over 100 points over the course of just a few days nearly wiped out the market’s gains since the beginning of the year. The mood among investors has clearly been lifted somewhat following the recent session.

However, looking at the larger picture, historically, counting the first time that the 1,200-point mark was officially surpassed in early April 2018 up to the present, the Vietnamese market’s main index has crossed the 1,200 mark a total of 9 times. In previous instances, the VN-Index crossing this psychological threshold brought with it expectations of a major wave but ultimately led to disappointment.

VN-Index has exceeded the 1200-point mark 9 times

It must be noted that despite being the same VN-Index milestone, the market capitalization of HoSE has grown significantly, currently standing at over 4.9 million billion VND. Simultaneously, it is difficult to state with certainty any trend as the stock market always carries unpredictable variables, especially with a frontier market like Vietnam.

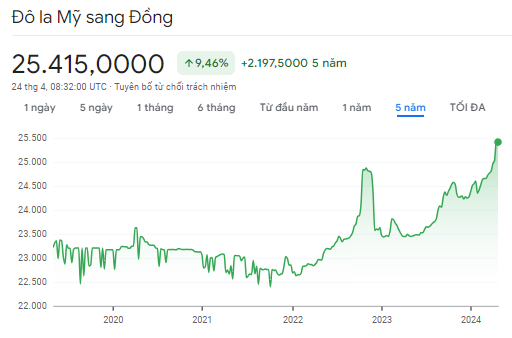

The current context is still considered risky, as the market is being heavily impacted by international information such as the CPI in the US and geopolitical conflicts. Domestically, there are also many negative factors such as inflation and the gradual increase in interest rates, particularly the soaring exchange rate due to the pressure of interest rate differentials and recent global events. Foreign capital has also recorded net selling in the trillions over the past several months, which has somewhat impacted investor sentiment.

However, there are some positive signals that could bolster confidence in the near future. Domestic pillars such as the low interest rate environment and monetary easing, the domestic economic recovery, and expectations for market and KRX upgrades will create favorable conditions for capital flows into the stock market.

According to Mr. Bui Van Huy, Director of DSC Securities Branch, banks still have the “game” of capital increase and separation, bank stocks still have a chance to recover and the market will find it difficult to decline significantly. The global market outlook is not overly “bright”, but there is a possibility of at least one interest rate cut in September before the US election. In summary, the expert believes that the risks for the global market will be greater in the later part of the year and not currently, and the possibility of the VN-Index falling by 15-20% is highly unlikely.

Mr. Petri Deryng, head of the PYN Elite Fund from Finland, also maintains a positive view. He said that the market had just experienced a relatively negative decline and the value of PYN Elite Fund’s stock portfolio had also decreased by about 9.5% in the past 3 weeks. The fund is trying to rotate part of its weight from stocks that have increased in value to stocks that overreacted in the recent sell-off. However, Mr. Petri Deryng still believes that the Vietnamese stock market is on a relatively clear upward trend. On the growth path, there may be some strong pullbacks, but investors need to accept adjustments if they want to participate in the market.

In the second half of this year and in 2025, PYN Elite Fund expects the international interest rate environment to be favorable, helping to maintain and even reduce interest rates in Vietnam without putting negative pressure on the exchange rate. The narrowing of the interest rate differential with the USD could strengthen the Vietnamese dong by the end of the year, allowing the SBV to easily adjust interest rates and exchange rates, which would create positive momentum for stock market sentiment.