VPBank started the first quarter of 2024 with flying colors, achieving a 64% year-over-year increase in consolidated pre-tax profit. The parent bank and its subsidiaries are adhering to their 2024 business plans, optimizing market opportunities, while maintaining strict risk control and strengthening support platforms, paving the way for growth in subsequent quarters.

Scalable Growth, Ensuring Liquidity

Amidst global and domestic economic headwinds, VPBank sustained its strategy of scalable growth, safeguarding liquidity and meeting its quarterly profit targets set at the beginning of the year.

The recently released financial report indicates that the bank’s consolidated credit expanded by 2.1% compared to the beginning of the year – surpassing the industry average (1.3%) – and grew by nearly 22% year-over-year, reaching almost 613 trillion VND. Within this, the SME segment grew by almost 14%, driven by the bank’s strategy to attract new customers and digitize lending processes to enhance customer experience. The Retail Banking segment continued its traditional strength, with a loan balance exceeding 240 trillion VND, including business loans and credit cards, growing by 3.4% and 4%, respectively, compared to the beginning of the year. Notably, home loans witnessed a 5% increase, accounting for 51% of total home loans, signaling a gradual recovery in the real estate market.

In parallel with the credit growth, customer deposits and negotiable instruments of the consolidated bank increased by 2.4% compared to the end of 2023 and by more than 21% year-over-year, contributing to a more efficient balance sheet. The solid capital foundation built in 2023, combined with ample liquidity, has contributed to optimizing VPBank’s cost of funds (CoF) in each quarter. As of March 31, the consolidated bank’s CoF decreased to below 5%, compared to an average of over 6% in the fourth quarter and the whole of 2023, indicating a gradual decline in the coming quarters.

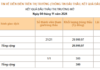

In the first quarter of 2024, VPBank recorded a consolidated pre-tax profit of approximately 4.2 trillion VND, a surge of nearly 66% compared to the previous quarter and 64% year-over-year. For the parent bank alone, Q1 pre-tax profit exceeded 4.9 trillion VND, almost double that of Q4 2023, with total operating income increasing by 15% and net interest income rising by 25% compared to the same period last year.

Combining the parent bank’s profit with VPBankS and OPES, VPBank earned nearly 5,200 billion VND, approximately twice as much as in the final quarter of 2023.

At FE Credit, continuing the restructuring efforts initiated in 2023, the consumer finance arm capitalized on the advantages of the group model strategy, focusing on portfolio management and automation to reduce operating costs and increase productivity. Consequently, the company’s disbursement volume has steadily improved, with the first quarter showing a 29% increase compared to the average of 2023. Backed by strategic partner SMBC and the support of its parent bank, FE Credit is expected to regain its growth trajectory, aiming for positive growth in 2024 and sustainable growth in the medium to long term.

Laying the Foundation for Sustainable Growth

In an effort to digitize the ecosystem and pave the way for sustainable growth in the next phase, the parent bank and its subsidiaries are continuously investing and enhancing digital transformation, refining their digital infrastructure to optimize operating costs, diversify products, and expand the customer base.

One notable effort is the parent bank’s ongoing development of its digital banking platform. In the first quarter, the parent bank pioneered a new authentication method for international cardholder online transactions – Out of Band (OOB) – on the VPBank NEO digital banking platform. This method enhances security and improves the experience of international card transactions. Additionally, the Card Zone feature, which consolidates card-related utilities on the VPBank NEO app, has provided users with seamless and quick experiences, attracting a new customer segment for the bank.

In the first three months of 2024, the number of registered accounts on VPBank NEO reached nearly 9.4 million, with over 124 million transactions processed.

Earlier in 2023, VPBank NEO launched over 120 new products and services, bringing the total number of features and products to 250. Prominent features and products include Loan On Card, ShopQR, Tap & Pay, Apple Pay, eKYC, etc., enabling customers to conveniently manage and fulfill their financial transaction requirements within a single app.

Developing and upgrading banking solutions and services on digital channels has helped VPBank improve operational efficiency by optimizing operating costs. The parent bank’s cost-to-income ratio (CIR) declined to 24.6% in the first quarter of 2024 (a significant reduction from 26.1% in 2023).

Meanwhile, at VPBankS, the securities company has been actively building a specialized product and service platform, tailored to the risk appetite of investors, with the aim of becoming a one-stop shop for all investors by 2026. The recently launched NEO Invest website provides professional and active investors with a simple and convenient trading platform, offering value-added services throughout their investment journey.

On the other hand, OPES is gradually building its digital insurance platform and brand, moving towards digitizing the entire customer experience, formally entering the insurance industry’s digital transformation race to optimize revenue and profit while keeping pace with the VPBank ecosystem.