HDBank Plans to Increase Pre-Tax Profit by 22% in 2024, Sets Higher Dividend Target

UPDATE

HDBank shareholders gather for the Annual General Meeting

HDBank shareholders check in before the Annual General Meeting

|

HDBank forecasts a pre-tax profit of nearly VND 16,000 billion in 2024, an increase of 22% compared to the 2023 performance.

HDBank sees ample growth opportunities amidst challenging circumstances, aiming to extend its streak of 12 consecutive years of business growth in 2024.

|

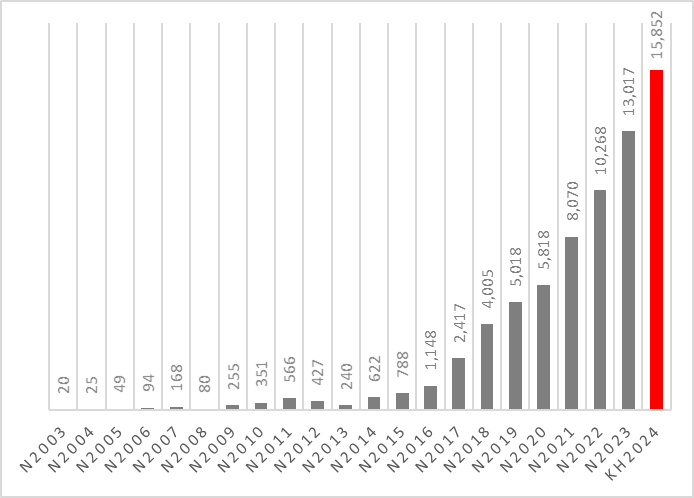

HDBank’s planned pre-tax profit in 2024. Unit: Billion VND

Source: VietstockFinance

|

Specifically, HDBank aims to achieve a pre-tax profit of VND 15,852 billion in 2024, a 22% increase compared to the 2023 performance. The ROE is targeted at 24.6%, a 2% improvement compared to the 2023 performance. Non-performing loans remain low, among the best in the industry.

By the end of 2024, total assets are expected to increase by 16% to VND 700,958 billion. Total mobilization is expected to reach VND 624,474 billion, an increase of 16%. Total outstanding loans are projected to be VND 438,420 billion, an increase of 31%, aligned with the credit growth target set by the State Bank of Vietnam (SBV).

Based on the growth-oriented business plan for 2024, HDBank plans to pay dividends in 2024 at a maximum rate of 30% (of which, it is expected to pay dividends in cash at a maximum rate of 15%).

Capital increase to over VND 35,000 billion

As of the end of 2023, HDBank achieved a pre-tax profit of over VND 13,017 billion, an increase of 27% compared to 2022, and fulfilled its target profit. In 2023, HDBank’s total assets grew continuously for several years, reaching VND 602,315 billion, an increase of 45% compared to the beginning of the year and exceeding the plan by 16%.

Total outstanding credit reached VND 353,441 billion at the end of 2023, an increase of 32% compared to the beginning of the year, ranking among the banks with high credit growth rates and within the limit set by the SBV.

Besides boosting credit growth, HDBank has always focused on controlling credit quality, with a consolidated non-performing loan ratio of 1.79%, while HDBank’s own ratio is 1.51%, both of which are low compared to the industry.

HDBank’s mobilized capital as of the end of 2023 reached VND 536,641 billion, an increase of 47% compared to 2022, helping HDBank ensure a sufficient capital need and high liquidity. Of which, HDBank’s customer deposits reached VND 370,778 billion, an increase of 72%.

With the positive results in the past year, HDBank has decided to distribute dividends in 2023 to shareholders at a rate of 30%, consisting of 10% in cash and 20% in shares.

|

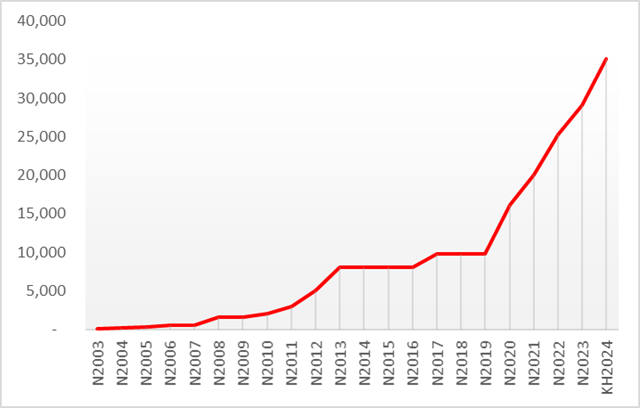

HDBank’s capital increase process. Unit: Billion VND

Source: VietstockFinance

|

Accordingly, in 2024, the bank plans to increase its charter capital by more than VND 6,025 billion, from VND 29,076 billion to VND 35,101 billion, through the issuance of dividends for 2023 (at a rate of 20%) and 20 million ESOP shares (which have been approved by the 2023 Annual General Meeting of Shareholders; currently, the procedures for completing the capital increase are underway).

The capital increase will help HDBank further improve its financial health indicators, which are already high in the industry, serving as a strategic foundation for sustainable development in the coming years. Specifically, the additional capital of VND 6,025 billion will be used by HDBank for medium- and long-term lending and to supplement working capital in the bank’s operations.

Basel III implementation completed, CIR improved

HDBank is among the banks with high capital adequacy ratios, with a capital adequacy ratio under Basel II of 12.6%. As one of the pioneering banks to apply and complete Basel III at a very early stage (July 2023), HDBank has officially completed the comprehensive implementation of the Basel III standard and expects to officially apply it in the second quarter of 2024.

Since last year, HDBank has invested heavily in numerous technology projects, leading to relatively high CIR. Along with this, the bank has focused on investing in the project to fully apply Basel III. Now that the implementation delay has shortened, the projects have become operational, and Basel III is being fully implemented, the values are gradually being transformed into operational efficiency, helping to improve CIR. In recent years, HDBank has maintained good control over operating costs, resulting in a significant decrease in the CIR from over 40% to 34% in 2023, with a further sharp decline in the first quarter of 2024.

Prepared to support the restructuring of other banks

HDBank is one of four banks that have been assessed as having sound operations and good financial capacity and have been selected by the Government and the State Bank of Vietnam (SBV) to participate in the restructuring of the commercial banking system.

HDBank is ready to assume the duties of supporting the SBV in restructuring the industry. By participating in this program, HDBank has the opportunity to make a breakthrough and achieve higher growth. Notably, the support mechanism of providing additional annual credit growth limits will enable HDBank to grow rapidly, dominate the market, and become one of the top banks in the next five years. HDBank’s dividend policy, profit distribution, and funds are not dependent on or affected by this mandatory transfer and are independent of the business results of the mandated transfer in the period of implementing the mandatory transfer plan.

By participating in this program, HDBank has the opportunity to make a breakthrough and achieve higher growth. Notably, the support mechanism of providing additional annual credit growth limits will enable HDBank to grow rapidly, dominate the market, and become one of the top banks in the next five years.

ESG strategy focus, readiness to participate actively in the carbon credit market

HDBank is committed to promoting the provision of products and services in industries and sectors that drive the economy, such as rural agriculture, green lending, manufacturing, renewable energy, rural agriculture, and lending activities that reduce energy consumption, CO2 emissions, and waste treatment/recycling, in addition to leveraging its leading position in supply chain financing. In particular, HDBank is ready to participate actively in the carbon credit market as soon as the legal framework is complete.

In 2023, the bank took the lead in upgrading to the international governance standard Basel III while implementing its sustainable development strategy (ESG). HDBank is the first bank to publish a (ESG) sustainability report in 2024, as part of Vietnam’s commitment to Net Zero Carbon with the international community.

Recently, it has been reported that HDBank is participating in the restructuring program for weak credit institutions? What are HDBank’s plans for the near future, what is the current progress, and what are the benefits to the bank