UPDATE

DIG previously announced to its shareholders about the attendance gift program for the shareholders attending the general meeting. However, as of 3:15 pm, the number of shareholders attending the meeting had not yet reached the quorum required to hold the meeting. According to the schedule, the DIG general meeting was scheduled to start at 1:30 pm.

At 4:32 pm, the organizing committee announced that the general meeting had reached the required quorum with the participation of both in-person and online attendees, representing 50.24% of the total voting shares.

**DIG’s** 2024 Annual General Meeting of Shareholders was held on the afternoon of April 26 in Vung Tau. Photo: Thu Minh

|

Goal of developing Thanh Hoa and Vung Tau into two high-level medical centers

DIG Chairman Nguyen Thien Tuan shared that DIG has identified two key focus areas for the future: developing two cities in Nam Thanh Hoa and Vung Tau, both of which have long coastlines.

These two cities will be high-level medical centers, primarily serving foreigners, who currently have a demand due to the large number of Japanese and Korean individuals living in Vietnam without their families and who plan to stay in the country for 10-20 years.

The Vietnamese government has implemented new policies, and interest rates are trending down, facilitating the development of resorts for Japanese and Korean visitors. The company is currently working on a proposal that includes: working with foreign partners to establish two joint hospitals with Japan, collaborating with the Japanese Medical Association on funding, and aiming to invest in two systems of cancer screening and radiotherapy equipment.

Regarding the outlook for industrial parks (IPs), Mr. Tuan mentioned the trend towards eco-industrial parks, information technology, and investment in electronics equipment, and highly valued Japanese and Dubai investors.

For **DIG**, all IP products must be exported with the three key attributes of “green, smart.” Green refers to using electricity that is not derived from fossil fuels.

Mr. Tuan added that **DIG** is planning to acquire a golf course, which includes 6 hectares of land to be used for a five-star hotel. Recently, **DIG** established a company to manage the golf course in the future, which could be operated by foreigners (Korean or Japanese).

According to calculations, **DIG** has approximately 20 locations across the country that could be used for golf courses, with the land in Dong Hoi, Quang Binh province, already largely compensated. One area that the management board is highly interested in is industrial parks. “It was a big mistake of mine to only focus on urban areas and not industrial parks, resulting in the loss of a significant revenue stream. Now, an opportunity has presented itself to us that may not come again for a thousand years. Industrial parks must now be eco-industrial parks. If we do not adapt, we will fall behind, and revenue will decline. All urban areas are now being planned with this development orientation.”

According to Mr. Tuan, **DIG** is currently interested in four land areas for industrial park development: Chau Duc II with an area of 1,000 hectares (including 400 hectares of urban land) that has been agreed upon with Ba Ria – Vung Tau province; Pham Van Hai with an area of 270 hectares where a request has been submitted to become the main investor; Hang Gon IP at the end of the Long Thanh – Dau Giay expressway with 400 hectares of rubber plantation land; and Long Son IP, a joint venture with other partners, in which **DIG** could own 30%.

Mr. Tuan emphasized the focus on developing eco-industrial parks to potentially increase rental rates by one and a half to two times.

General Director **Nguyen Quang Tin** stated that the company will increase its use of technology and digitization in advertising to compete with other entities and promote **DIG’s** products.

Plan for pre-tax profit of over a trillion dong

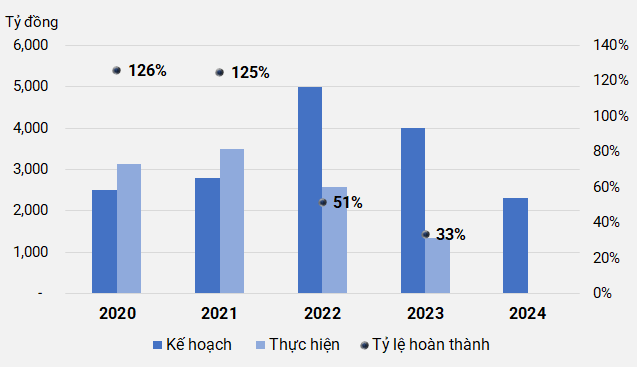

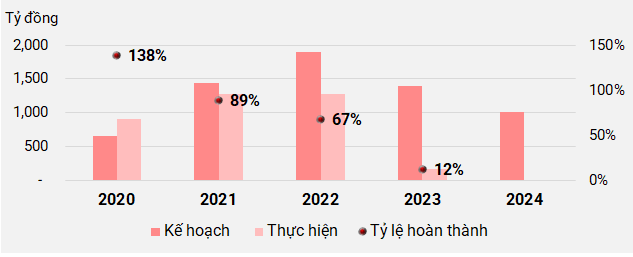

Since the COVID-19 pandemic, **DIG** has set very high business targets, but actual results have been very low. In 2024, the company has once again set a revenue and profit target that is more modest than the plans of previous years, but still significantly higher than the results achieved in 2023.

Specifically, **DIG** has set a revenue and other income target of VND 2,300 billion, an increase of 72% compared to the previous year; a consolidated pre-tax profit of VND 1,010 billion, six times the result achieved in 2023. Dividends are expected to range from 8% to 15%, and the charter capital is set at VND 10,000 billion.

|

**DIG’s** revenue plan fulfillment results in recent years

Synthesized by the writer

|

|

**DIG’s** pre-tax profit plan fulfillment results in recent years

Synthesized by the writer

|

In 2024, **DIG** will focus on completing the necessary procedures to prepare for investment in the Long Tan – Dong Nai tourism urban area project; obtaining approval for the adjustment of the master investment plan for the Chi Linh central area; completing the progress adjustment for the Bac Vung Tau new urban area and the Dai Phuoc eco-tourism urban area; adjusting the master investment plan for the Hiep Phuoc residential area; completing the detailed planning adjustment at a scale of 1/500 for the Nam Vinh Yen new urban area project; and completing the legal procedures for the Lam Ha Center Point housing project… The total investment plan for 2024 is over VND 7.2 trillion, including VND 6.4 trillion for project investment and VND 811 billion for financial investment.

General Director **Nguyen Quang Tin** said that the Joint Stock Commercial Bank for Investment and Development of Vietnam (**BIDV**, **HOSE**: **BID**) has committed to supporting **DIG** in the development of all projects during the 2024-2028 period.

The Bac Vung Tau new urban area and the Long Tan tourism urban area have encountered obstacles in land acquisition and clearance. Mr. Tin informed that the Long Tan project has already secured funding for the implementation process, including funds from bond issuances and share offerings in the near future. Additionally, a bank from the Big 4 group has committed to supporting this project.

General Director Nguyen Quang Tin stated that the pre-tax profit target for 2025 of over a trillion dong will come from the Dai Phuoc urban area (VND 881 billion), the Lam Ha Center Point project (VND 129 billion), the Nam Vinh Yen new urban area (VND 87 billion), Vi Thanh (VND 46 billion), and two other projects in Hiep Phuoc and Vung Tau Gateway (approximately VND 20 billion).

Issuance of 410 million shares

At the general meeting, **DIG** presented a plan to issue 410 million shares to increase capital to over VND 10.2 trillion, including an offering of 200 million shares to existing shareholders, a private placement of 150 million shares, 30 million ESOP shares, over 15.2 million shares to pay dividends for 2023, and over 15.2 million shares to increase share capital from retained earnings.

Of these, 200 million shares will be offered to existing shareholders at a price of VND 15,000 per share (representing 32.794% of outstanding shares) in 2024, and the shares will be subject to a one-year transfer restriction. The proceeds are expected to reach a maximum of VND 3,000 billion and will be used to pay off VND 900 billion in bonds, provide additional capital for the Cap Saint Jacques project (VND 1,135 billion), and invest in the Vi Thanh residential area (VND 965 billion).

The private placement of 150 million shares is expected to be priced at not less than VND 20,000 per share and will also be subject to a one-year transfer restriction. The proceeds are expected to reach VND 3,000 billion; of which VND 1,000 billion will be used to provide additional capital for the Lam Ha Centre Point housing project in Ha Nam province, and VND 2,000 billion will be used for the Nam Vinh Yen new urban area in Vinh Phuc province. The expected implementation period for the issuance is 2024-2