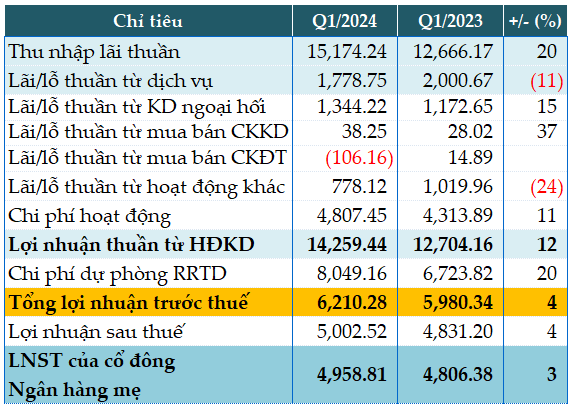

In the first quarter, the bank earned VND15,174 billion in net interest income, a 20% increase year-over-year.

Non-interest income was inconsistent. Service revenue fell 11% (to VND 1,779 billion) and investment securities trading lost over VND106 billion; however, foreign exchange trading revenue rose 15% (VND1,344 billion) and trading securities revenue climbed 37% (VND38 billion).

VietinBank set aside over VND8,049 billion for credit risk provisions in the first quarter, a 20% increase year-over-year. As a result, the bank’s pre-tax profit only rose slightly by 4%, to over VND6,210 billion.

In the annual general meeting document for 2024, set to be organized on April 27, VietinBank did not set a specific profit plan, only stating that it would follow the approval of competent authorities.

|

CTG’s Q1/2024 business results. Unit: Billion VND

Source: VietstockFinance

|

As of the end of the first quarter, the bank’s total assets had risen slightly by 2% since the beginning of the year, to nearly VND2.08 million billion. Loans to customers increased by 3% to over VND1.51 million billion, while customer deposits were up 1% to VND1.43 million billion.

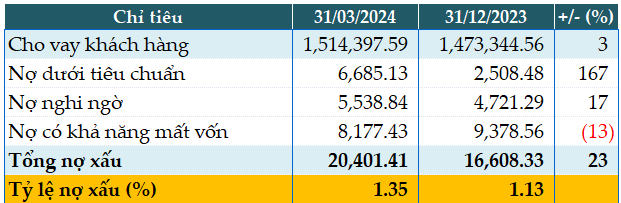

VietinBank’s loan quality has somewhat declined, as the total bad debt as of March 31, 2024 was recorded at VND20,401 billion, an increase of 23% compared to the beginning of the year. Notably, substandard debt (group 3) is 2.7 times higher than at the beginning of the year. The ratio of bad debt to outstanding loans rose from 1.13% at the beginning of the year to 1.35%.

|

CTG’s loan quality as of March 31, 2024. Unit: Billion VND

Source: VietstockFinance

|