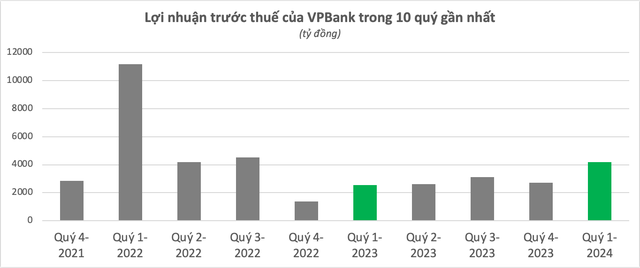

VPBank Consolidated Net Income Nears VND4.2 Trillion, Up 64% YoY

In the first quarter of 2024, VPBank recorded a consolidated pre-tax profit of approximately VND4.2 trillion, a rise of nearly 66% compared to the previous quarter and 64% year-on-year. Notably, the parent bank’s pre-tax profit for Q1 reached over VND4.9 trillion, nearly doubling compared to Q4/2023, with total operating income increasing by 15% and net interest income surging by 25% year-on-year.

Combining the parent bank’s profit with VPBankS and OPES, VPBank earned nearly VND5.2 trillion, roughly double the amount in the final quarter of 2023.

By the end of Q1, VPBank’s consolidated credit increased by 2.1% compared to the beginning of the year – higher than the industry average (1.3%), and rose by nearly 22% year-on-year, reaching approximately VND613 trillion.

Customer deposits and securities of the consolidated bank grew by 2.4% compared to the end of 2023 and by more than 21% year-on-year.

OCB Pre-Tax Income Exceeds VND1.2 Trillion, Up 23%

Following Q1/2024, OCB recorded pre-tax profit of VND1,214 billion, an increase of 23% year-on-year.

In the first 3 months of the year, OCB’s total revenue reached VND2,287 billion, up 9.4% compared to the same period in 2023, with net interest income and foreign exchange operations contributing significantly to the growth.

Net interest income in the quarter amounted to VND1,901 billion, an increase of 8.6% year-on-year and accounting for 83.12% of total revenue.

Non-interest income also grew significantly, increasing by 13.8% to VND386 billion. Notably, net interest income from foreign exchange trading reached VND118 billion, 2.4 times higher year-on-year, due to the bank’s ability to capitalize on the significant fluctuations in exchange rates during the first months of the year.

As of March 31, 2024, OCB’s Tier 1 market loans increased by 3.5% compared to the end of 2023, reaching VND153,199 billion. Total assets remained stable at nearly VND237 trillion. Tier 1 market deposits amounted to over VND163,400 billion.

Risk management-related indicators such as the capital adequacy ratio (CAR), the short-term capital to medium- and long-term loan ratio, and the loan-to-deposit ratio (LDR), were maintained at safe levels by OCB. The non-performing loan ratio was controlled below 3%, meeting all regulations set by the State Bank of Vietnam (SBV). Liquidity indicators were stable with sufficient liquidity buffers.

BVBank Earns VND69 Billion in Profit in Q1

Bac Viet Bank (BVBank – stock code: BVB) recently announced its business results for Q1/2024. Accordingly, thanks to strong growth in revenue from core business operations, BVBank completed 35% of its annual profit plan in the first 3 months of the year, recording a pre-tax profit of VND69 billion.

By the end of the first 3 months of the year, BVBank’s total assets reached nearly VND84,000 billion, an increase of 7% compared to the same period in 2023.

As of March 31, 2024, the bank’s total outstanding loans reached nearly VND66,500 billion, an increase of 10% year-on-year. Among these, the main growth driver was lending to individuals and economic organizations, with outstanding loans reaching over VND57,000 billion, a 6.7% increase year-on-year.

Outstanding loans to corporations declined slightly by 1.2%, with the decline occurring in January and a rapid rebound in the last 2 months of the quarter.

On the liquidity side, total deposits grew by 6.4% compared to Q1/2023.

MSB: Pre-Tax Profit Reaches VND1,530 Billion

MSB recently announced its Q1 business results, with a pre-tax profit of VND1,530 billion, a slight increase compared to the same period in 2023 and equivalent to 22.5% of the annual plan.

MSB’s total operating income in Q1 reached over VND3,100 billion, an increase of almost 9% compared to the same period in 2023. Net interest income remained the growth pillar, reaching nearly VND2,400 billion, up 9.6%. Non-interest income accounted for an effective proportion of over 24% of total income.

Credit growth in Q1 reached 5.6%. MSB’s total assets reached nearly VND279,000 billion by the end of the first 3 months.

On the other hand, customer deposits increased by 4.1% compared to the end of 2023. Of which, the bank’s total non-term deposits reached nearly VND40,300 billion, an increase of 14.64%, bringing the CASA/Total Deposits ratio to 29.21%, an increase of almost 3 percentage points compared to December 31, 2023.

Amidst the growth in total assets and total revenue, the bank maintained a net interest margin (NIM) of 3.87%. The bank’s operating costs were better controlled, leading to a decrease in the cost-to-income ratio (CIR) to 33.6% from 39.26% at the end of 2023.

As of March 31, 2024, the loan-to-deposit ratio (LDR) stood at 71.9% and the ratio of short-term capital used for medium- and long-term loans (MTLT) was at 28.78%. The consolidated CAR was 12.15% at the end of Q1, significantly higher than the minimum requirement of 8% set by the State Bank of Vietnam.

ACB Earns VND4.9 Trillion in Q1, Slightly Lower than the Same Period in 2023

By the end of March 2024, ACB’s consolidated pre-tax profit reached VND4.9 trillion, fulfilling 22% of the annual plan. Quarterly profit declined slightly compared to the same period due to an extraordinary income in the same period of 2023 and an increase in loan loss provisions. ACB’s current non-performing loan ratio stands at 1.45%. Excluding the CIC group, ACB’s non-performing loan ratio is only 1.3%.

According to the report, ACB’s credit reached VND506 trillion, and deposits reached nearly VND493 trillion. Compared to the beginning of the year, credit and deposit growth were 3.8% and 2.1%, respectively, higher than the industry’s growth rate. Notably, the CASA ratio recorded an impressive growth of 23.7%. Furthermore, strong growth was seen in core business operations, with interest income and service income increasing ACB’s total income to nearly VND8.2 trillion, a growth of 3.1%. ACB’s ROE stood at 23.4%, maintaining the bank’s leading position in terms of efficiency.

ABBank Earns VND178 Billion in Q1

An Binh Commercial Joint Stock Bank (ABBank) has just announced its business results for the first quarter of 2024, reporting a pre-tax profit of VND178 billion for Q1/2024.

Specifically, as of March 31, 2024, ABBank recorded total deposits of VND127,382 billion and total outstanding loans of VND125,108 billion, representing increases of 8.29%