The analytic firm Canalys published its latest report on the Q1 2024 smartphone market in China, and Apple had a dismal showing as the only one of the top five brands vying for supremacy in Asia’s largest market to lose share.

Huawei returned to the top spot after 13 quarters with a 17% share of the market. The homegrown vendor shipped 11.7 million smartphones thanks to its popular Mate and nova series, while OPPO moved up to second place with a strong performance from its Reno 11 series, shipping 10.9 million units. HONOR, vivo, and Apple, on the other hand, all saw their shipments decline during the quarter, ranking third, fourth, and fifth respectively.

Huawei Pura 70 smartphone is a hot seller in China. (Image: SCMP)

HONOR shipped 10.6 million units for a 16% market share, up 9% year-over-year, while vivo shipped 10.3 million units for a 15% share, down 9% year-over-year. Apple had the biggest decline among the top five, falling from the top spot to fifth place, shipping 10 million units for a 15% share that is down 25% year-over-year.

Huawei’s shipments increased by 70% compared to a year ago, when the company was still restructuring its smartphone business following US sanctions. Huawei’s 5G Mate 60 Pro features a domestically produced 7-nanometer processor designed specifically for the home market, demonstrating the kind of advanced semiconductor manufacturing capabilities that US sanctions were designed to thwart.

Huawei has since released its new Pura flagship smartphone series and is busy developing its own operating system, HarmonyOS, since it can no longer use Google’s Android and Google Mobile Services. The continued expansion of the HarmonyOS ecosystem has broken the Android-iOS duopoly in mainland China.

However, it’s not all sunshine and rainbows for the Chinese quartet that ranked above Apple this quarter.

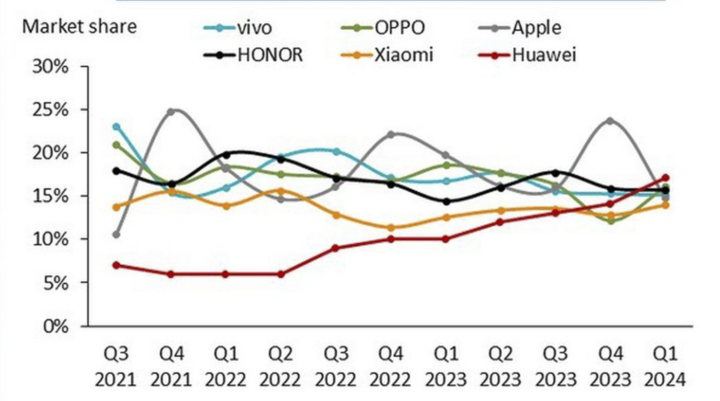

The market share of the top six smartphone vendors in China from Q3 2021 to present.

Looking at the past two quarters alone, it’s clear that while Huawei and OPPO are charging ahead, Apple has been “declining,” nearly falling out of the top five and only narrowly beating out Xiaomi. There’s a pattern that has repeated itself over the past few years: Apple always has a “boom” in the fourth quarter of the year, then gradually loses ground in the following three quarters.

This has to do with Apple’s product and sales strategy, as its flagship product, the main iPhone series (excluding the iPhone SE), is always unveiled and released in September-October of each year. Every time a new iPhone is released, it has a great product effect in the billion-dollar market, far surpassing its rivals. Every time Apple reaches the “peak,” no other brand comes close.

In contrast, the Chinese domestic brands’ product strategies allow them to maintain a stable market share throughout the year. In contrast to Apple’s “sine wave” pattern, HONOR, OPPO, and even Xiaomi have relatively flat charts. Perhaps Tim Cook and Apple executives could afford to relax, if not for one major dark horse: Huawei.

The rivalry between Apple and Huawei will likely take more time to resolve, but by this point, the Cupertino company’s problem should be clear: attracting new users to its product ecosystem – and getting existing users to upgrade more often.

It’s no surprise that the rate of iPhone upgrades has slowed in recent years. There are multiple reasons for this: phone prices have gone up, the economy is uncertain, and the world is still trying to recover from the COVID-19 pandemic. More than anything, Apple is giving its customers fewer reasons to upgrade.

Let’s face it: Apple’s flagship product hasn’t changed much since the iPhone 12 was released in 2020. And before that, there weren’t any major upgrades since 2017. Meanwhile, users in the low- to mid-range segment have a flood of appealing options to choose from. The question is, will Apple be willing to revolutionize its product line and focus on lower-priced phones to capture market share?