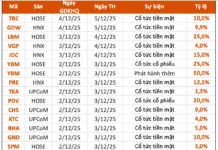

Q1/2024: Becamex IDC Reports a Slight Revenue Increase and a Significant Cost Reduction

In Q1/2024, Becamex IDC recorded a modest 3% increase in net revenue to nearly VND 812 billion. Notably, the cost of goods sold experienced a significant 38% reduction, with the bulk of the decrease stemming from the cost of real estate business operations, which amounted to over VND 86 billion, and the cost of providing services and goods, which decreased by 52% and 42% to VND 78 billion, respectively.

BCM’s Cost of Goods Sold Declines Significantly in the Period

Source: BCM

After deducting the cost of goods sold, the company’s gross profit reached over VND 574 billion, representing an increase of 41%. As a result, the gross profit margin rose substantially from 51% in the same period last year to 71%, marking the company’s highest level since its listing on HOSE in 2020.

BCM’s Gross Profit Margin from Q1/2020 – Q4/2023

In contrast, financial revenue declined sharply by 95% to approximately VND 3 billion. Total expenses for the period exceeded VND 513 billion, reflecting a 19% increase, including interest expenses of over VND 164 billion, which decreased by 14%.

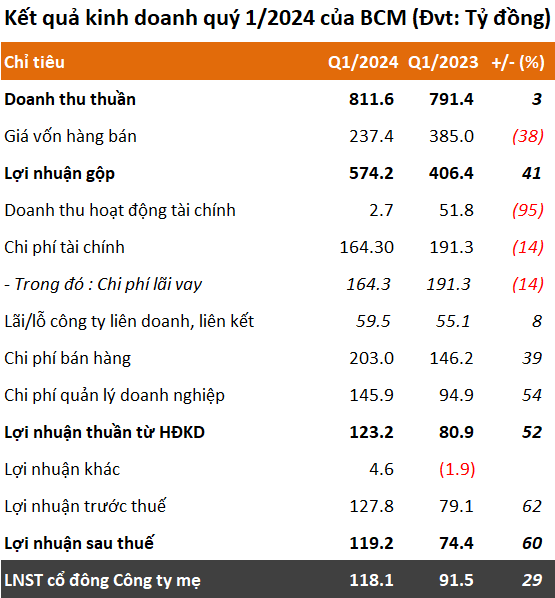

Becamex IDC Maintains Net Profit Growth

As a result, Becamex IDC’s net profit remained at over VND 118 billion, indicating a 29% increase compared to the same period last year.

Source: VietstockFinance

Outstanding Bonds Remain High

As of the end of March, Becamex IDC’s total assets stood at VND 54,069 billion, showing a slight 1% increase since the beginning of the year. A large proportion of the company’s assets, amounting to VND 20,348 billion or 38%, are composed of inventories, representing a 3% increase from the beginning of the period. The company also holds cash and cash equivalents of nearly VND 2,480 billion, an 86% increase, with VND 2,459 billion in bank deposits.

In addition, long-term work-in-process costs reached over VND 2,294 billion, reflecting a 1% decrease since the start of the period. The bulk of these costs is concentrated in the Hòa Lợi project (over VND 1,404 billion), the TDC Plaza project (over VND 521 billion), and the Unitown project – Phase 2 (VND 369 billion).

The company’s total liabilities as of March 31, 2024, amounted to almost VND 34,543 billion, indicating a marginal 1% increase. Of this amount, the combined total of short-term and long-term debt exceeded VND 21,000 billion, showing a 7% increase and accounting for 61% of total liabilities. The majority of this debt, approximately VND 12,000 billion, is in the form of bonds, representing a financial burden for the company as these bonds approach maturity in the coming years.