Hoa Phat Group To Issue Nearly 582 Million Shares For 2023 Capital Increase

Hoa Phat Group Joint Stock Company (HPG) has recently announced a resolution regarding the detailed plan to issue shares to increase charter capital from its equity in 2023.

Without distributing cash dividends in 2023, HPG proposes a plan to issue bonus shares to shareholders. This plan was approved at the 2024 Annual General Meeting of Shareholders (AGM) on April 11.

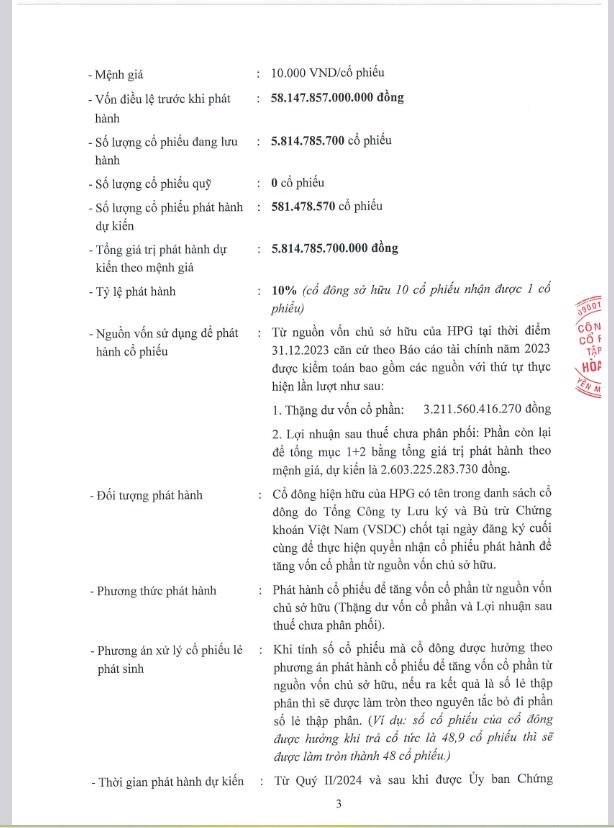

Specifically, HPG plans to issue 581.5 million shares to existing shareholders at a ratio of 10%, meaning that shareholders owning 10 shares will receive an additional 1 share. The total issuance value at par value is over VND 5,814 billion.

After the issuance, HPG’s charter capital is expected to increase from VND 58,147.8 billion to VND 63,960 billion by the end of 2024, corresponding to approximately 6.4 billion outstanding shares.

Source: HPG

The issuance capital comes from share premium (over VND 3,211 billion) and retained earnings after tax (over VND 2,603 billion).

The expected implementation time is in the second quarter of 2024 and after approval from the State Securities Commission. In addition, Hoa Phat Group will also issue a 10% dividend.

The recent AGM also approved the 2024 business plan with the group’s total revenue reaching VND 140,000 billion and after-tax profit of VND 10,000 billion. With this target, Hoa Phat’s revenue and after-tax profit will increase by 17% and 46%, respectively, compared to the 2023 results.

Regarding the profit distribution plan, VND 6,800 billion of post-tax profit in 2023 is expected to be allocated to funds of VND 408 billion. The remaining profit after allocation is VND 6,392 billion.

The Board of Directors expects that the revenue in 2024 will increase compared to 2023, mainly due to production output with the expectations of the return of real estate developers after the Land Law 2024 is issued. However, the challenge is rising raw material prices, disproportionate selling prices, and high financial costs due to the expectation of continued high interest rates.

In 2024, Hoa Phat plans to allocate a maximum of 5% of actual profit for the reward and welfare fund and a maximum of 5% of after-tax profit exceeding the plan to reward the Group’s Management Board and the Management Boards of the member companies.