Mobile World Investment Corporation (stock code: MWG) has just announced its business results for the first quarter of 2024, recording revenue of VND 31,441 billion, an increase of 7% compared to the first quarter of the previous year, completing 25% of the year’s plan.

In the revenue structure, the Mobile World and Dien May Xanh chains brought in VND 21,300 billion (accounting for 67.7%), an increase of 7% compared to the same period last year. The main growth driver was the electronics sector, in which the air conditioner product line grew by nearly 50% compared to the same period last year.

Online revenue of these systems reached about VND 3,500 billion, accounting for 16% of the revenue of the 2 chains.

Revenue of the Bach Hoa Xanh chain increased sharply by 44% to VND 9,100 billion. The growth drivers came from 2 industry groups: fresh food and FMCG.

Regarding the network, this retail group currently owns 1,071 The Gioi Di Dong stores (including TopZone), 2,184 Dien May Xanh stores, 1,696 Bach Hoa Xanh stores, 526 An Khang pharmacies, 64 AVAKids stores and 55 Erablue stores (overseas)

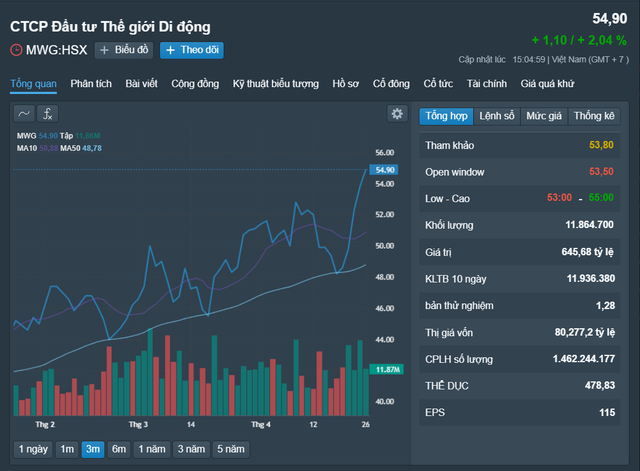

On the market, MWG shares are currently priced at VND 54,900 per share. Compared to the beginning of April, this stock has decreased by nearly 11%, but compared to the beginning of the year, it has still increased by more than 12%.

MWG stock price movement in the last 3 months Source: Fireant

A major competitor of The Gioi Di Dong is FPT Digital Retail Joint Stock Company (FPT Retail, stock code: FRT) also reported positive business results after the first 3 months of the year.

Specifically, FPT Retail recorded revenue of VND 9,042 billion, an increase of 17% compared to the previous year and completed 24% of the annual plan.

FPT Retail’s profit after tax was 29 times higher than the first quarter of the previous year, reaching VND 60 billion. This result is mainly due to the process of carrying out the product structure shift, the gross profit margin of the FPT Shop chain – a chain of retail stores for mobile phones, tablets… increased by 3% compared to the first quarter of 2023. Besides, the Long Chau store chain continued to expand its pharmacy system, maintaining a revenue growth rate of 68% compared to the same period.

Furthermore, FPT Retail said that accessing a source of low-interest loans helped reduce the company’s financial expenses by 50%.

FRT shares on the market are currently at VND 161,000 per share, an increase of nearly 51% compared to the beginning of the year, a record high since its listing.

-

FPT Retail successfully organizes its 2024 Annual General Meeting of Shareholders

At the recent General Meeting of Shareholders, FPT Retail said that it will close some poorly performing FPT Shop stores in order to focus on improving business efficiency.

At the same time, it will continue to expand the Long Chau chain with 400 new pharmacies, bringing the total number to about 1,900 stores by the end of 2024. In addition, FPT Retail aims to open 100 new vaccine centers in 2024.

Also operating in the technology sector but in the distribution segment, Digiworld Corporation (stock code: DGW) announced its business results for the first quarter of 2024, recording net revenue of nearly VND 5,000 billion, an increase of 20.5% compared to the same period last year.

Digiworld’s business segments grew significantly compared to the same period, such as mobile phones increased by 29% and office equipment increased by 48%. The laptop and tablet segment increased slightly by 4%,

However, financial revenue from bank deposit and lending interest, exchange rate differences, and receivables discounts… decreased by 35%, down to about VND 24 billion.

In addition, selling and administrative expenses in the quarter increased by nearly VND 100 billion (mainly due to advertising, promotion, and sales support expenses) and VND 9 billion compared to the same period last year (personnel expenses).

However, Digiworld’s after-tax profit still increased strongly compared to the same period, at 16.4%, reaching VND 93.2 billion. Currently, DGW shares are priced at VND 59,000 per share. Since the beginning of 2024 to the present, this stock has increased by nearly 13%.