VietABank Reports Solid Q1 2024 Financial Performance

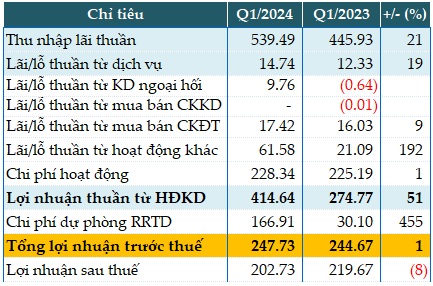

In the first quarter of 2024, VietABank recorded a net interest income of over VND 539 billion, a 21% increase compared to the same period last year.

Non-interest income also saw growth, with service fees increasing by 19%, income from trading securities rising by 9%, other operating income tripling, and foreign exchange trading generating a profit compared to a loss in the same period last year.

Meanwhile, operating expenses only rose by 1% to over VND 228 billion. As a result, net operating profit increased by 51% to almost VND 415 billion.

However, the bank set aside nearly VND 167 billion for risk provisions, 5.6 times higher than the same period last year, resulting in a pre-tax profit of nearly VND 248 billion, a 1% increase.

Compared to the pre-tax profit target of VND 1,058 billion set for the entire year, VietABank achieved 23% of its goal after the first quarter.

|

VAB’s Q1 2024 Business Results. Unit: Billion VND

Source: VietstockFinance

|

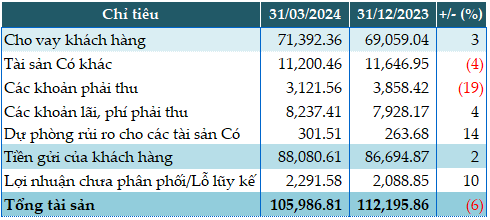

The bank’s total assets as of the end of Q1 decreased by 6% compared to the beginning of the year, to VND 105,986 billion. Of which, cash decreased by 16% (to VND 305 billion), deposits at other commercial banks decreased by 44% (to VND 10,443 billion), loans to customers increased slightly by 3% (VND 71,392 billion)…

On the funding side, deposits from other commercial banks decreased by 55% (to VND 6,299 billion), customer deposits increased by 2% (VND 88,080 billion), issuance of debt securities increased by 72% (VND 835 billion)…

|

VAB’s Key Financial Indicators as of March 31, 2024. Unit: Billion VND

Source: VietstockFinance

|

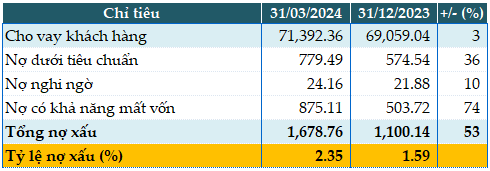

VietABank’s total bad debt as of March 31, 2024 was nearly VND 1,679 billion, an increase of 53% compared to the beginning of the year. The most significant increase was in potential loss loans (+74%). As a result, the ratio of bad debt to outstanding loans increased from 1.59% at the beginning of the year to 2.35%.

|

VAB’s Loan Quality as of March 31, 2024. Unit: Billion VND

Source: VietstockFinance

|