RECORD-BREAKING PROFIT PLAN, 5% DIVIDEND

At the meeting, the enterprise’s leadership assessed that 2024 will continue to be a year of challenges for business operation and production, when macroeconomic conditions, such as exchange rates, interest rates, and credit, are expected to continue to fluctuate unpredictably, thereby adversely affecting the expansion of business operations and production. Inflation and interest rates in major export markets of Vietnam, such as the USA and EU, are still high, so consumer demand and purchase orders from these markets have not clearly recovered.

Meanwhile, the domestic market is also just entering a recovery phase after two difficult years in 2022 and 2023.

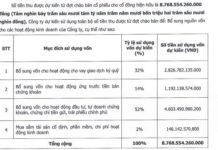

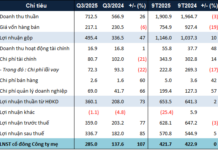

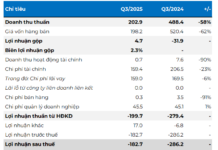

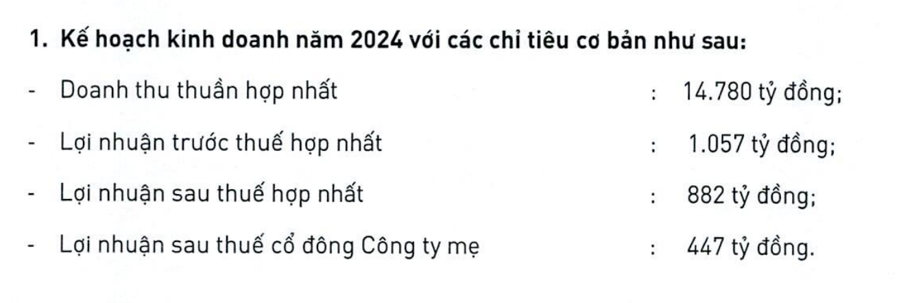

Therefore, the business plan of each company, as well as that of the consolidated plan for 2024, was built with a scenario of certain caution: consolidated revenue of VND 14,780 billion, an increase of 12%, and consolidated profit growing at a corresponding rate of 10%, reaching VND 882 billion. This is the company’s record high profit in history.

In a more positive scenario, it is expected that both the export market and the domestic market will experience stronger recoveries in the second half of 2024 and could bring higher-than-expected growth to PAN’s business segments.

Ms. Nguyen Thi Tra My – Member of the Board of Directors and General Director, shared: “In exactly two weeks, I will have completed six years as General Director of PAN Group. Six years ago, PAN’s shareholders numbered less than 1,500; now, that number has increased more than 11 times. Revenue and profit have increased 3.3 times and more than 4 times, respectively, during the same period. This is thanks to the efforts of nearly 11,000 PAN Group staff. We believe that we will overcome difficulties. Difficulties are our companions, and solidarity will help us overcome them and assert our mark.”

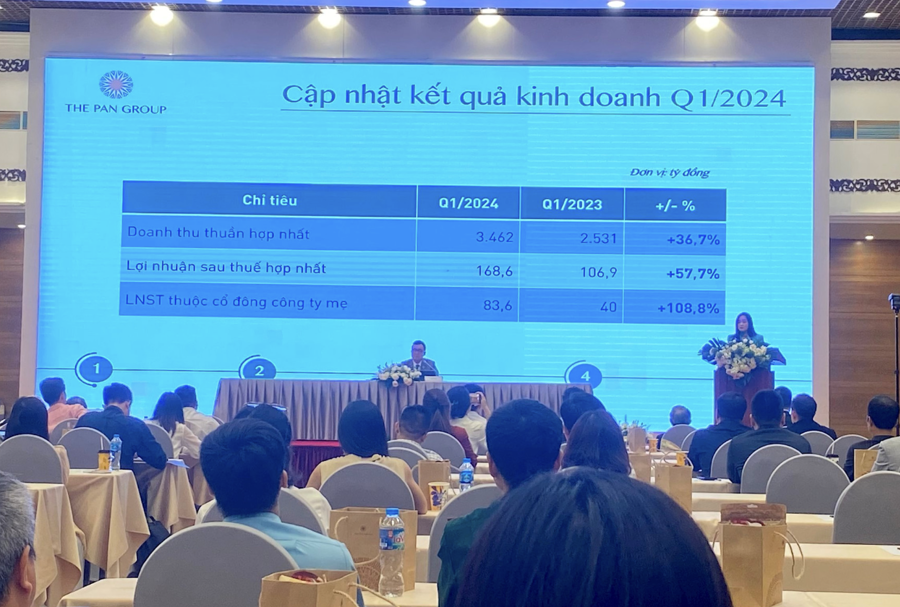

Revealing the business results for the first quarter, according to Ms. My, consolidated revenue reached VND 3,462 billion, an increase of 36.7%, consolidated post-tax profit of VND 168.6 billion, an increase of 57.7%; post-tax profit for shareholders of the parent company was 83.6 billion, an increase of 108.8%. This year, PAN plans to pay a 5% cash dividend.

“This is not yet a high dividend, but it is the group’s effort to ensure profits for shareholders. The goal is to maintain the cash dividend policy and increase the rate year by year,” said Ms. My.

ASSESSING CREDIT RISK MUST LOOK AT BUSINESS RESULTS

At the general meeting, the company’s leadership also responded to many questions from shareholders. One shareholder asked: In the near future, will PAN focus on which segment, as PAN owns many subsidiaries and operates in many fields?

PAN’s Chairman, Mr. Nguyen Duy Hung, emphasized: PAN will not abandon any segment, and will continue to focus on three main segments: agriculture, seafood, and packaged food.

The group determined that these are the three most important goals for building up, seizing opportunities, making agri-food a spearhead industry, and reaching out to the international market. The group has also done everything to support the business divisions, and does not interfere with the member companies. Each member company has its own strategy to suit its industry.

“Last year, we talked about cash flow, profits, dividend stress, but this year, there are dividends that may even be higher, but we are starting at 5% and stabilizing at 5%,” said Mr. Hung.

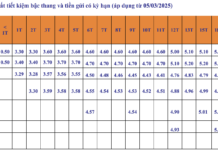

Shareholders expressed concerns about borrowing costs, of which short-term interest rates are relatively high. Does the management have any plans for the composition of the company’s interest expenses? Ms. Nguyen Thi Tra My said that the group has recently worked with an international bank on financial matters and is confident that it will soon reap the benefits.

Emphasizing further, Mr. Hung said that assessing risk in credit must look at business results. A high financial credit rating, such as PAN’s, still ensures that profits and cash flow cover everything; that is how to measure financial health. When looking at loans, one must look at the output of the loans and the effectiveness of the investment. PAN’s sustainable development system, good risk control, and financial and credit situation are all sound.

The General Director also mentioned credit opportunities through other channels, such as green development and sustainable development. When the credit structure and the interest rates are changed, the efficiency will increase a lot.

Regarding business segments, specifically the shrimp segment, Mr. Ho Quoc Luc – Chairman of the Board of Directors of Sao Ta (Code FMC) said that the Vietnamese shrimp industry in the US is facing many difficulties, including anti-dumping and anti-subsidy lawsuits. The US is a major shrimp import market for Vietnam, but for FMC, Japan is the largest market, with a consumption rate of over 45%.

The US economic downturn has affected demand; in addition, the Vietnamese shrimp industry is also facing difficulties due to anti-dumping and anti-subsidy lawsuits. In particular, in the anti-dumping case, the tax is currently 0%, while in the anti-subsidy case, it is 2.84%, and the final tax rate may be announced in August or September.

Companies wishing to export to the US need to account for a contingent expense of about 7-8%. If, in August or September, the Vietnamese shrimp industry is not taxed, that amount will be included in the profit. This is not a big enough issue to worry about, because PAN is concentrated in Japan. In the US, Sao Ta will focus on products that are not affected by these two lawsuits. Therefore, this is not a major issue for PAN. During the time waiting for the final tax, other businesses may limit their exports to the US due to risk aversion.

Regarding the confectionery segment, the leaders of Bibica shared that the US market is not the main export market for confectionery products. Japan and South Korea are the main markets. For the confectionery industry, the proportion of exports increased sharply in 2023. The whole world continues to consume confectionery.

Our biggest advantage is that we have a domestic market of 100 million people. Bibica has a large enough scale to overcome quality barriers and has competitive advantages. Therefore, there is still a lot of potential for exports in the future.

HOW WILL CAMBODIA’S CANAL PROJECT AFFECT US?

Given the recent concern that the Mekong Delta is facing a water shortage and is confronted with saltwater intrusion, and Cambodia is building a canal that will reduce water flow by 50%, how will the company respond?

According to Ms. Tran Kim Lien, Chairwoman of the Board of Directors and General Director of the Vietnam Seed Group (Vinaseed), Vietnam is currently one of the countries most affected by climate change, especially the Mekong Delta, which is experiencing droughts, saltwater intrusion, and more.

We cannot fight climate change, so businesses have had to find more sustainable solutions in order to adapt. The company’s policy is to find climate change adaptation and mitigation solutions.

In PAN’s business areas, the most immediate impact on rice production is drought, yield, and price due to political conflicts, etc. We have proactively developed a business strategy, quickly switching to a business model that uses crops adapted to climate change, and have developed varieties suitable for saltwater intrusion. We have a variety of seeds that can adapt to flooding, drought, and salinity. The company focuses on research and anticipates changes in order to develop product structures that can adapt to nature.

In such difficult circumstances, challenges are opportunities for agricultural producers. PAN always takes a long-term view in order to develop products that can adapt to climate change.

Regarding food prices, Vietnam produces 24 million tons of rice, exports 30%, and the remaining 60% is for domestic consumption by 100 million people, so domestic prices are always higher than world prices. The domestic retail price of ST25 is