Illustration

SHB Delivers Record Profit in Q1/2024

Disclosing at the Annual General Meeting of Shareholders in 2024, General Director Ngo Thu Ha declared that pre-tax profit in the first quarter of 2024 reached a value of over 4,017 billion VND, equivalent to 35% of the yearly plan. This is the highest Q1 profit in SHB‘s history, succeeding the consolidated pre-tax profit of approximately 3,020 billion VND in Q1/2023.

HDBank Earns Almost 1,300 Billion Per Month

Speaking at the Annual General Meeting of Shareholders in 2024 held this morning, Pham Quoc Thanh, General Director of HDBank, stated that in the first quarter of 2024, HDBank obtained over 4,000 billion VND in profit, aligning with the set schedule, establishing confidence among shareholders. Hence, on average, the bank’s monthly profit exceeds 1,330 billion VND.

Previously, HDBank posted a consolidated pre-tax profit of 2,743 billion VND in Q1/2023.

Eximbank Profits Over 1,000 Billion in the First 4 Months

At the Annual General Meeting of Shareholders held this morning, Acting General Director of Eximbank, Nguyen Hoang Hai, announced that the bank secured a profit of 661 billion VND in Q1/2024, reaching 1,009 billion VND by the end of April.

VPBank’s Consolidated Profit Nears 4,200 Billion, Up 64% Compared to Q1/2023

In the first quarter of 2024, VPBank posted a consolidated pre-tax profit of nearly 4.2 trillion VND, registering an increase of about 66% against the previous quarter and 64% year-on-year. At the parent bank, the first quarter’s pre-tax profit reached over 4.9 trillion VND, almost doubling the figure in Q4/2023, with total operating income growing by 15% and net interest income by 25% compared to the same period last year.

ACB Earns 4,900 Billion in Q1, Slightly Lower than Q1/2023

By the end of March 2024, the consolidated pre-tax profit of ACB totaled 4.9 trillion VND, achieving 22% of the yearly plan. The quarterly profit decreased marginally compared to the corresponding period last year due to unusual income in Q1/2023 and an increase in loan loss provisions. Currently, ACB’s non-performing loan ratio stands at 1.45%. Excluding the debt group under CIC, ACB’s NPL ratio would be only 1.3%.

According to the report, ACB’s credit reached 506 trillion VND, while mobilization hit nearly 493 trillion VND. In comparison to the beginning of the year, credit and mobilization growth rates were 3.8% and 2.1%, respectively, exceeding the industry’s growth.

OCB’s Pre-Tax Profit Exceeds 1,200 Billion, Gaining 23%

Closing the first quarter of 2024, OCB reported a pre-tax profit of 1,214 billion VND, up 23% year-on-year.

Compared to the end of 2023, total assets remained steady at nearly 237 trillion VND, and its mobilizing reached over 163,400 billion VND.

OCB ensures that key risk management indicators such as capital adequacy ratio (CAR), short-term fund ratio to medium- and long-term loans, and loan-to-deposit ratio (LDR) are maintained at safe levels. The NPL ratio is controlled under 3%, complying with all regulations set forth by the State Bank of Vietnam. Liquidity remains stable with sufficient liquidity buffer.

MSB: Pre-Tax Profit at 1,530 Billion VND

MSB recently announced its Q1 business results, with pre-tax profit reaching 1,530 billion VND. This shows a slight increase compared to Q1/2023 and represents 22.5% of the yearly target.

MSB’s total operating income in the first quarter surpassed 3,100 billion VND, climbing almost 9% year-on-year. Net interest income remains a growth pillar, reaching close to 2,400 billion VND, a 9.6% increase. Non-interest income to total income retained an effective proportion of over 24%.

In Q1, credit growth reached 5.6%. As of the end of the first quarter, MSB’s total assets neared 279,000 billion VND.

On another front, customer deposits rose by 4.1% compared to the end of 2023, with the total non-term deposits of the bank reaching nearly 40,300 billion VND, expanding by 14.64%. As a result, the CASA to total deposit ratio reached 29.21%, an increase of almost 3 percentage points compared to 31/12/2023.

Q1, ABBank Earns 178 Billion VND

An Binh Commercial Joint Stock Bank (ABBank) unveiled its first quarter business results of 2024, highlighting a pre-tax profit of 178 billion VND.

As of March 31, 2024, ABBank recorded a total mobilization of 127,382 billion VND, along with a total outstanding loan balance of 125,108 billion VND, reflecting a respective growth of 8.29% and 10.06% over the same period last year.

BVBank Earns 69 Billion in Q1

Vietnam Bank for Small and Medium Enterprises (BVBank – stock code: BVB) has just disclosed its Q1/2024 business outcomes. Accordingly, thanks to substantial growth in core business revenue, BVBank fulfilled 35% of its annual profit plan in the first three months, posting a pre-tax profit of 69 billion VND.

TPBank: Pre-Tax Profit Reaches Over 1,800 Billion VND

Techcombank: Pre-Tax Profit at 7,802 Billion VND, Up 38.7%.

MB: Pre-Tax Profit Nears 5,800 Billion VND, Down 11%.

LPBank: Pre-Tax Profit Approaches 2,900 Billion VND, Surging 84%.

BacABank: Pre-Tax Profit at 339 Billion VND, Up 1%.

PGBank: Pre-Tax Profit at 116 Billion VND, Down 24%.

VIB: Pre-Tax Profit Exceeds 2,500 Billion VND.

SeABank: Pre-Tax Profit Over 1,500 Billion, Up 41%.

BaoVietBank Earned 8 Billion VND, Higher Than 2023’s 7 Billion VND.

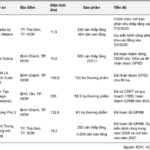

So far, 18 banks have publicized their Q1/2024 business results. Techcombank currently leads the banking industry with a pre-tax profit of 7,802 billion VND, a growth of 39% compared to the same period last year. MB ranks second with a profit of 5,795 billion VND, a decrease of 11%. In the same period last year, MB recorded a higher profit than Techcombank. Coming in third is ACB with a pre-tax profit of 4,900 billion VND. HDBank and SHB had comparable profits, both exceeding 4,000 billion VND.