As of 9:30 a.m., there were 5 shareholders representing over 7.3 million shares, accounting for 5.003% of the total number of voting shares attending the meeting.

With an attendance rate of less than 50% of the total number of voting shares, the 1st 2024 Annual General Meeting of Shareholders of SBS was unsuccessfully held.

The 1st 2024 Annual General Meeting of Shareholders of SBS was unsuccessfully held

|

The content of the AGM included the report on the 2023 business activities, the business orientation of the Board of Directors and the Executive Board for 2024; the report of the Supervisory Board; the presentation on the company’s personnel; the presentation on the additional issuance of shares.

In 2024, SBS aims to achieve net revenue of around VND 120 – 140 billion. Profit from operating activities is expected to reach VND 8-10 billion. The company has not yet paid dividends or distributed funds for 2024.

In terms of personnel, Ms. Le Thi Mai Loan has submitted her resignation as a member of the Board of Directors of SBS since October 2023. The company will submit to shareholders the approval of Ms. Loan’s resignation and nominate additional personnel.

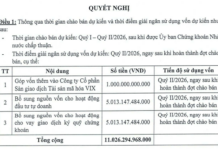

The company also submitted to the shareholders a plan to offer 30 million private shares at a price not less than VND 10,000 per share.

This offering plan is adjusted from the plan to offer a maximum of VND 500 billion at the Extraordinary General Meeting of Shareholders in 2022 and the Annual General Meeting of Shareholders in 2023, which was expected to be implemented from 2023 to 2025. Due to various objective factors and the failure to find suitable investors, the Board of Directors of SBS has not yet implemented the plan to offer a maximum of VND 500 billion in private shares.

In 2023, SBS‘s operating revenue reached over VND 146.1 billion, up 6% year-on-year. Financial revenue reached over VND 8.6 billion, which is the revenue from dividends and bank deposits.

The company reported a net profit of nearly VND 540 million, improving over the loss of VND 70.6 billion in the previous year.

In the first quarter of 2024, the company reported a loss of nearly VND 38 billion due to management expenses of over VND 31.5 billion and interest expenses of over VND 9.3 billion, while the profit from the main business activities was nearly breakeven.

Operating revenue in the first quarter reached nearly VND 33 billion, coming from securities brokerage (VND 13 billion) and other activities (VND 18.3 billion).

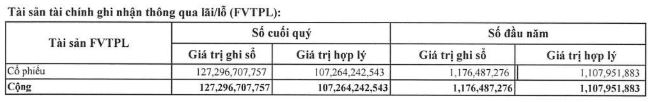

The operating expenses were mostly losses on financial assets recorded through profit/loss (FVTPL, VND 21 billion), mainly due to the decrease in the revaluation of assets and brokerage fees (nearly VND 6 billion).

|

Q1/2024 Business Results of SBS

Source: VietstockFinance

|

|

SBS’s FVTPL asset value explained in Q1/2024 financial report

Unit: Billion VND

Source: SBS

|

At the end of the first quarter, SBS‘s proprietary trading held over VND 127 billion in shares (at purchase price), and this portfolio has a temporary loss of 16%.