Steel Manufacturing Company (SMC) Prepares for Cautious Year with Focus on Risk Management and Profitability

In his opening remarks at the annual shareholders’ meeting, Chief Executive Officer Dang Huy Hiep emphasized the persistence of “risk, uncertainty, and caution” in 2024, projecting a global economic growth slowdown of approximately 2.4%. Hiep assessed the steel industry as facing a gradual recovery, primarily towards the latter half of 2024, due to challenges in the real estate market and pressure from steel imports.

In light of these factors, SMC has adopted a prudent outlook for 2024, centering on streamlining operations, cost reductions, and enhanced risk management.

The company has set a revenue target of 13,500 billion VND and a post-tax profit of 80 billion VND, with a projected total consumption output of 900,000 tons. Long steel production is estimated around 350,000 tons, followed by 550,000 tons of flat steel. “Long steel production is slightly higher than the previous year due to some signs of recovery in the real estate sector, albeit slow,” Hiep added.

Earnings exceeding 200 billion VND from the sale of NKG shares

At the meeting, the CEO disclosed that SMC recorded a net profit of 183 billion VND in the first quarter of 2024, largely driven by a 215 billion VND gain from the sale of NKG shares.

Hiep acknowledged ongoing challenges in business operations. During Q1/2024, SMC‘s steel trading segment faced difficulties due to the real estate market slowdown, prompting the company to adjust its business strategy.

“Previously, SMC‘s strength lay in construction projects, but we have now shifted to the civilian sector. This segment has not been very profitable. We are primarily focused on maintaining market share and customer relationships,” he stated. “Our steel pipe and galvanized steel production segments recorded losses and are undergoing downsizing.”

The processing segment has been the most stable for SMC. “Production is comparable to last year, with nearly 80,000 tons, contributing 8 billion VND in profit during Q1/2024. While profitability remains low, it has improved compared to the past,” Hiep said.

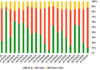

In Q1/2024, the steel processing segment contributed 65% to SMC‘s total revenue, while construction steel trading and steel manufacturing contributed 10% and 25%, respectively.

Photo: Vuong Dong

|

Looking ahead to Q2, management revealed that additional profits are expected from the sale of the company’s office building in Dien Bien Phu. “This transaction is projected to be completed in Q2/2024, with a sale price of 170 billion VND. After deducting expenses, SMC anticipates a profit of approximately 100 billion VND from this property,” said Nguyen Ngoc Y Nhi, Vice Chairman of the Board and Deputy General Director of SMC.

Another positive development is the expected profitability of SMC‘s Phu My factory, which specializes in manufacturing washing machine and refrigerator casings for Samsung, starting from April 2024.

Hiep noted that SMC is the exclusive domestic supplier for Samsung, marking a breakthrough into the global supply chain. The factory is scheduled to produce 2 million units this year and enter its profit-generating phase from April 2024 onwards. Additionally, SMC is actively seeking new customers for this facility.

Determination to fully resolve receivables with Novaland this year

Besides the company’s business performance, shareholders raised concerns regarding provisions and settlement of bad debts, particularly those related to Novaland.

At the end of Q1/2024, SMC‘s non-performing loans remained at approximately 1,300 billion VND, of which 98% were short-term, and the company had already set aside provisions of over 570 billion VND. The majority of these loans are owed by real estate companies linked to Novaland.

According to Vice Chairman Y Nhi, SMC did not need to make additional provisions for receivables in the first quarter. However, if the debt is not resolved, SMC will be required to set aside an additional 90 billion VND in provisions in Q2 and nearly 300 billion VND in total for 2024. “These provisions will impact profitability, which is why SMC is actively working with Novaland and other partners,” she stated.

Y Nhi emphasized that SMC is determined to resolve the issue this year, possibly before June 30th. “Debt settlement options include cash collection, share swaps, and asset transfers to offset receivables. SMC is open to any feasible solution. The goal is to address this matter within the year to avoid further provisions,” Y Nhi said.

Regarding the 105 billion VND debt owed by HBC, Y Nhi disclosed that SMC has signed a formal agreement to convert the debt into equity. For the 105 billion VND, SMC will receive over 10 million HBC shares at a conversion price of 10,000 VND per share.

Private placement of 73 million shares

In addition to debt resolution, SMC aims to raise an additional 730 billion VND through a private placement of 73 million shares at a price of 10,000 VND per share. The privately placed shares will be subject to a one-year lock-up period and will only be offered to a maximum of 20 investors.

Along with this plan, the company has decided to eliminate five business lines to facilitate increased foreign investor ownership in the upcoming issuance.

Y Nhi further explained: “Under the current business lines, foreign investor ownership in SMC is capped at 25%, and the upcoming issuance could potentially raise foreign ownership above that level. Therefore, the company seeks to eliminate certain business lines with lower foreign ownership restrictions.”