Vĩnh Sơn – Sông Hinh (VSH): Quarterly Business Report Reveals Significant Revenue and Profit Decline

Vĩnh Sơn – Sông Hinh (VSH) recently disclosed its financial report for the first quarter of 2024, showcasing concerning business results. The report indicates a steep decline in profitability, with a 99.61% year-over-year drop in pre-tax profit, plummeting from 514 billion VND to a mere 2 billion VND.

Net profit also witnessed a significant reduction of nearly 475 billion VND, falling to 1.6 billion VND, representing a 99.66% decrease from the corresponding period last year.

According to Vĩnh Sơn – Sông Hinh’s explanation, a precipitous revenue decline contributed to the sharp profit downturn. Hydropower production was severely impacted by unfavorable hydrological conditions prevalent in Central Vietnam from late 2023 through the early months of 2024.

Water levels in reservoirs fell below projected and historical averages, adversely affecting electricity production during the first quarter of 2024. As a result, electricity production witnessed a decline of 209.79 million kWh (a 32.12% decrease). Furthermore, lower average electricity prices compared to the same period last year contributed to a 542.66 billion VND (60.82%) plunge in power generation revenue.

Financial revenue also took a 2.23 billion VND hit (a 70.13% reduction), primarily due to a shift from exchange rate gains on foreign currency loans in the first quarter of 2023 to exchange rate losses during the same period in 2024. Additionally, the company did not record any other operating revenue in this quarter.

As of March 31, 2024, the company’s total assets amounted to 9,250.3 billion VND, reflecting a 282.9 billion VND (3%) decrease since the start of the year. Fixed assets constituted 7,859.7 billion VND, accounting for 85% of total assets. Current receivables stood at 901.8 billion VND, representing 9.7% of total assets.

The primary cause of asset fluctuations was a 24.1% or 287.1 billion VND decrease in current receivables, which fell from 1,188.9 billion VND at the start of the year to 901.8 billion VND at the end of Q1.

Total short-term and long-term debt declined marginally by 1.4% (53.2 billion VND) year-over-year, reaching 3,685.9 billion VND, representing 39.8% of total capital. Short-term debt accounted for 150.5 billion VND, while long-term debt stood at 3,535.4 billion VND.

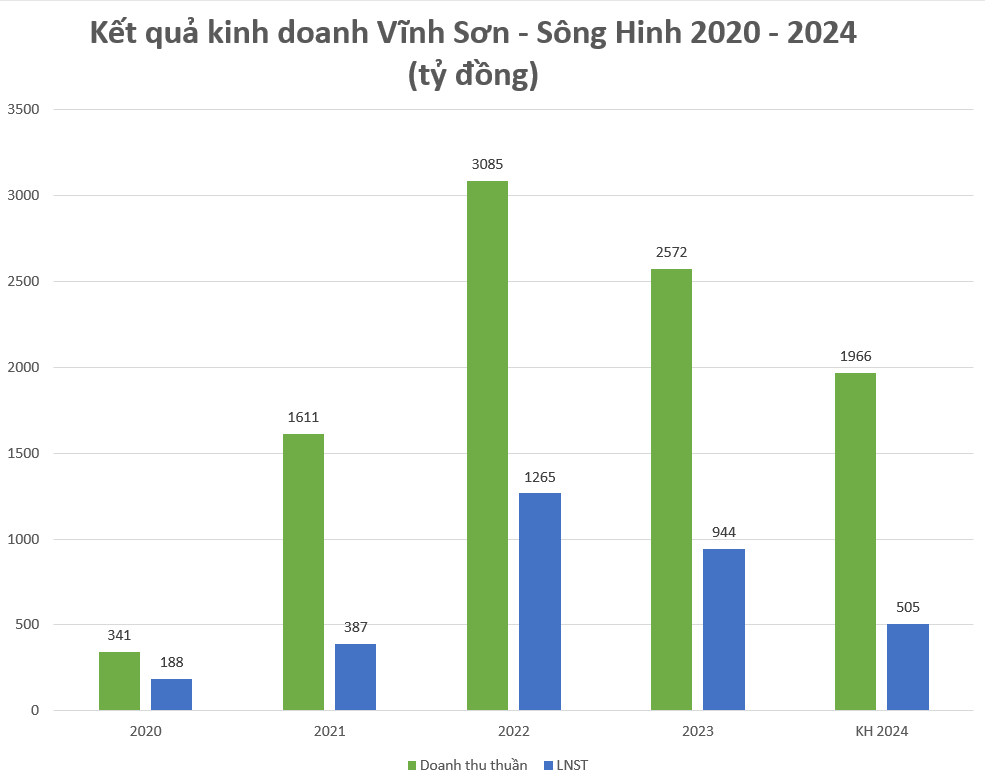

For 2024, Vĩnh Sơn – Sông Hinh has set a revenue target of 1,966 billion VND, a 24% decrease compared to the previous year. Pre-tax profit is projected to be approximately 557 billion VND, while post-tax profit is estimated at over 505 billion VND, approximately 50% of the 2023 realization. The target return on equity is 21.36%.

Graphics: PL