2023: Achieving Goals of Maintaining Secure Operations and Efficient Business Performance

The Vietnamese economy and banking sector faced numerous challenges in 2023, yet Vietbank maintained impressive growth. The bank’s accomplishments are reflected in its business results, which were reported with positive numbers during the General Meeting of Shareholders.

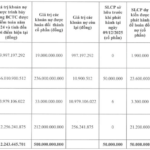

Vietbank’s total assets reached VND 138,258 billion, exceeding the plan by 111%. Of this, total outstanding loans constituted 58% of the bank’s total assets.

The structure of the asset portfolio continued to be adjusted to increase the proportion of income-generating assets, which consistently remained above 95%.

Total outstanding loans reached VND 80,754 billion, a 19.6% increase compared to 2022, meeting the assigned target and exceeding the average credit growth of the entire banking system.

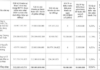

Risk warning and assessment processes were enhanced, while closely monitoring and managing the purpose of borrowed funds and controlling asset quality remained among Vietbank’s top priorities. As a result, Vietbank’s credit quality has consistently remained at a good level, with the non-performing loan ratio on December 31, 2023, standing at only 1.79%, which is lower than the industry average recorded by the banking system in Q4 2023 based on NHNN Circular 11.

Capital mobilization reached VND 101,547 billion, a 25.2% increase compared to 2022, exceeding the set plan. Vietbank diversified its capital mobilization sources, ensuring stability and liquidity, contributing to improving capital costs at reasonable levels, and supporting sustainable credit growth.

Vietbank’s consolidated pre-tax profit in 2023, after audit, reached VND 812 billion, fulfilling 84.6% of the plan set by the Board of Directors and reflecting a 23.8% growth compared to 2022. As shared by Vietbank’s management, the bank proactively cut its profits and interest rates in order to support and share difficulties with the market and customers in general during 2023.

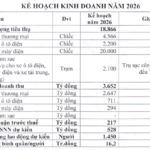

2024: Establishing Practical and Prudent Business Plans

In 2024, Vietbank aims to achieve a pre-tax profit of VND 1,050 billion, a 29% increase compared to the previous year; total assets of VND 150,000 billion; mobilized funds from customers (including financial instruments) of VND 116,000 billion; and loans to customers of VND 95,000 billion. The bank also aims to expand its market share, increase the scale of its total assets in both quality and quantity, and control bad debts below or equal to 2.5% as stipulated by NHNN (NHNN’s provision is 3%).

Compared to the targets set at the 2023 Annual General Meeting of Shareholders, the growth targets for 2024 are realistic and prudent. Vietbank’s business plan for 2024 sets a goal of increasing pre-tax profit by a minimum of 17% (according to the base plan) and a maximum of 29% (according to the ambitious plan), which is only 63% of the growth target set in 2023 at 46%. Additionally, the indicators for total assets and customer deposits also aim for lower growth rates compared to the figures approved at the previous General Meeting. The growth target for total assets has been reduced from 12% to 8%, while the growth target for mobilized funds in 2023, which was 17%, has been reduced to 14% in the 2024 plan. Setting realistic and prudent business targets helps to accurately reflect the state of business operations, management, and ensuring a balance between the interests of customers and the profitability of the organization.

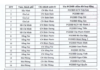

In addition to the business plan indicators approved by the General Assembly, the Board of Directors also reported on Vietbank’s operating regulations, which included amendments and additions to the organizational structure of the executive apparatus; and regulations on organization, governance, and control. With the approval of the resolutions on internal regulations and provisions by the Assembly of Shareholders, Vietbank has fulfilled the regulations on governance, organization, and operation, meeting the new provisions of the Law on Credit Institutions just 3 months after the Law was issued (01/2024). The timely adjustment of these new regulations is a step forward in laying the foundation for stability in Vietbank’s operations and management. At the same time, it also provides the bank with ample time to familiarize itself with and adapt to the changes before the Law takes effect on July 1, 2024.

Earlier in 2023, Vietbank was also one of the first banks to have its restructuring plan approved by the State Bank for the 2021-2025 period. This is a positive signal in the bank’s operations and compliance with the State Bank’s regulations.

According to the NHNN’s Official Dispatch on the Restructuring Plan for the Period 2021-2025, the NHNN did not impose any additional requirements and instructed Vietbank to actively implement the plan and regularly report the results to the NHNN. Due to its proactive and positive approach in controlling bad debts, Vietbank’s NPL ratio has always been kept at a low level compared to the NHNN’s regulations (<3%). Notably, in 2023, Vietbank recorded a bad debt ratio of only 1.79%, a 0.68% decrease compared to the 2022 results and lower than the industry average of 1.93% in Q4 2023. Continuously