Mr. Michael Kokalari, CFA – Head of Macroeconomics and Market Research VinaCapital

|

The VinaCapital expert said that as of the time of this writing, the USD/VND exchange rate had increased by 4.5% compared to the beginning of the year, a level at which the State Bank of Vietnam (SBV) has previously taken specific actions to support the VND. The VND has not depreciated by more than 3.5% in any calendar year since 2015, even in years when the exchange rates of Vietnam’s regional peers depreciated by 4.1-8.5%.

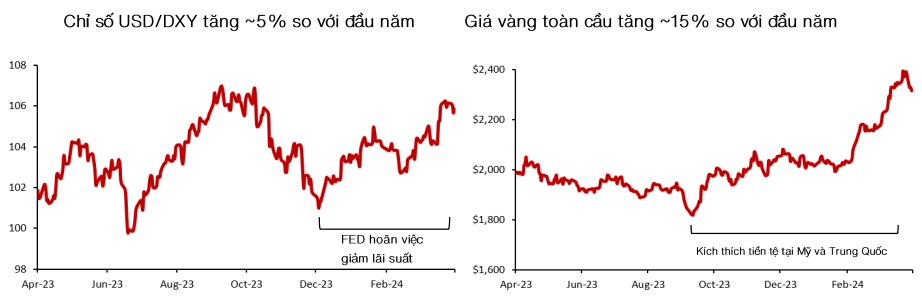

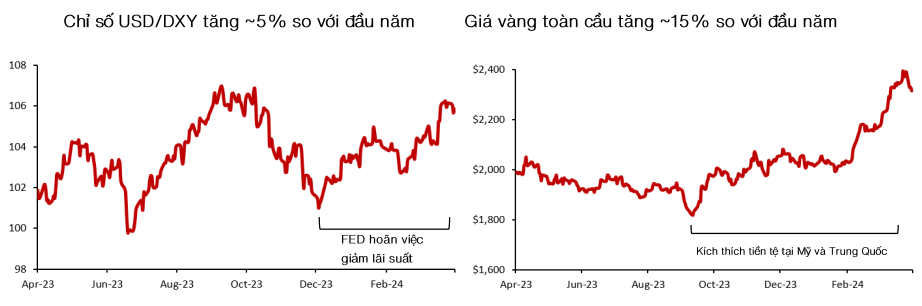

He said that the reasons for the VND depreciation in 2024 are factors including the unexpected sharp increase in the US dollar (USD) by nearly 5% compared to the beginning of the year (for the DXY index). In addition, the price of gold has increased by 16% this year (and 30% since the end of 2022), which is also putting pressure on the USD/VND exchange rate as Vietnamese investors boost their gold buying, and people’s gold buying leads to an increase in USD buying.

This is an unusual situation because higher US interest rates will support the value of the USD, but usually lead to lower gold prices by increasing the “opportunity cost” of savers holding gold instead of depositing it in the banks.

Source: VinaCapital

|

Mr. Michael Kokalari commented that with a series of devaluation pressures on the VND and the possibility of inflation in Vietnam reaching 4-5% by the end of the year (partly due to the increase in oil prices), The forecast is that bank deposit interest rates in Vietnam will increase by 50-100 basis points by the end of the year to prevent the VND from depreciating.

“We don’t think interest rates need to rise more than 100 basis points to support the USD/VND exchange rate because Vietnam’s trade surplus has increased from 6% of GDP in 2023 to 8% of GDP in the first quarter of 2024 and FDI disbursement has increased significantly by about 5% of GDP.

In addition, Vietnamese policymakers are balancing stabilizing the VND exchange rate and promoting economic growth, meaning interest rates need to be high enough to support the VND, but not so high that tight monetary policy hinders GDP growth“, he wrote.

Higher deposit rates support the recovery of the real estate market and have no major impact on the stock market

Regarding the impact, he explained that higher deposit rates make it more attractive to deposit money in banks than in the stock market. The higher mobilization interest rate also leads to higher lending rates/higher cost of capital for businesses, reducing corporate profits. Therefore, higher interest rates often negatively affect the stock market.

However, the current devaluation pressure of the VND – which is putting pressure on VND interest rates to increase – is mainly due to the strength of the US economy which is boosting Vietnam’s exports to the US from a 21% year-over-year decline in the first quarter of 2023 to a 26% increase in the first quarter of 2024; at the same time boosting Vietnam’s GDP growth.

“We are not too concerned that a 100 basis point increase in deposit rates in Vietnam will have a major impact on the economy, earnings growth (we still expect earnings growth of around 20% in 2024) and/or the stock market this year” , said the VinaCapital expert.

In addition, the upcoming interest rate hike in Vietnam is actually supporting the recovery of the real estate market by prompting potential customers to buy property early to take advantage of current low borrowing rates. Most mortgages in Vietnam are floating rate loans 15 years long, but it is currently possible to lock in low rates as low as 6% for the first two years of the loan (or 7% for the first three years), and most prospective buyers do not expect such low rates to last much longer.

Finally, he also noted that “higher for longer” US interest rates may be strengthening rather than weakening the US economy as expected. This paradox stems from the fact that savers in the US (especially “Baby Boomers”) are earning significant interest on their savings for the first time in many years, and they are spending that windfall income.

The VinaCapital expert concluded that the USD/VND exchange rate has increased by more than 4% compared to the beginning of the year, a level at which the State Bank of Vietnam often takes specific actions to strengthen the VND (the maximum depreciation of the VND in the past 8 calendar years is 3.5%). The depreciation of the Vietnamese currency was due to the unexpected sharp increase in the US dollar and due to domestic savers buying gold, even though Vietnam’s large trade surplus and FDI inflows had supported the exchange rate of the VND.