According to Michael Kokalari, CFA, Director of Macroeconomic Analysis and Market Research at VinaCapital, the USD/VND exchange rate has increased by 4.5% since the beginning of the year due to several factors. One factor is the unexpected surge of the US dollar, which has appreciated by almost 5% against the DXY Index. Due to higher inflation and economic growth in the US, the Federal Reserve may reduce interest rate cuts in 2024, which strengthens the value of the US dollar.

In addition, the significant increase in gold prices also impacts the USD/VND exchange rate. The 16% increase this year (30% since the end of 2022) has motivated Vietnamese investors to buy gold, resulting in an increased demand for USD.

With various depreciation pressures on the Vietnamese dong and the likelihood of inflation reaching 4-5% by the end of the year, Michael Kokalari predicts that bank deposit interest rates in Vietnam will increase by 50 – 100 basis points by year-end. This measure aims to prevent the depreciation of the VND.

The VinaCapital expert believes that interest rates do not need to increase by more than 100 basis points to support the VND against the USD. Vietnam’s trade surplus rose from 6% of GDP in 2023 to 8% of GDP in the first quarter of 2024. Additionally, there has been a significant increase in FDI inflows, approximately 5% of GDP in the first quarter. Vietnamese policymakers seek a balance between stabilizing the VND and supporting economic growth, suggesting interest rates will be high enough to support the currency without hindering GDP growth.

In recent years (especially in 2022), the State Bank of Vietnam has demonstrated its willingness to sacrifice economic growth to maintain a stable USD/VND exchange rate. This stability encourages foreign direct investment, supporting Vietnam’s long-term economic growth. “We don’t expect the SBV to officially hike its policy rate to defend the VND as it did in 2022, but rather continue its focus on the interbank rate it has pursued in recent weeks,” said Michael Kokalari.

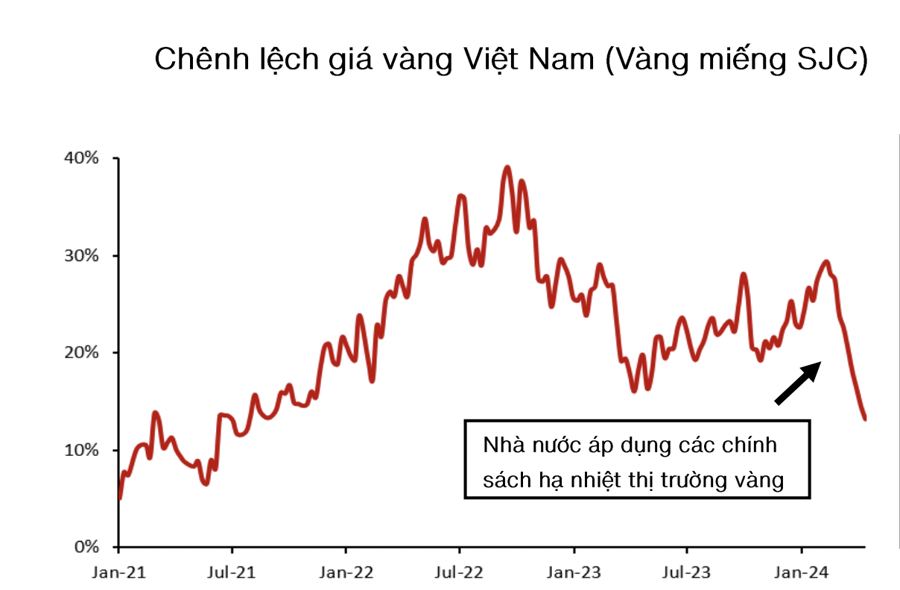

Regarding the gold market, the sharp increase in domestic gold prices has led to gold smuggling from Vietnam to Cambodia. The substantial inflow of informal gold imports effectively drains the country’s USD, reflected in errors and omissions in Vietnam’s balance of payments. The State Bank of Vietnam recently announced that it would auction gold from Vietnam’s foreign exchange reserves, indicating that there could be a resumption of official gold imports for the first time in 11 years. These announcements, among other less impactful measures, have helped reduce the gap between domestic SJC gold prices to around 15%.

Smuggling will continue as long as domestic gold prices in Vietnam remain significantly higher than global prices, which indirectly takes USD out of the Vietnamese economy.

According to Michael Kokalari, higher interest rates make bank deposits more attractive than stock market investments. Higher lending rates also increase borrowing costs for businesses, reducing corporate profits. As a result, higher interest rates usually negatively impact the stock market.

However, the current depreciation pressure on the VND is largely due to the strength of the US economy, which is bolstering Vietnam’s exports and GDP growth. Therefore, Michael Kokalari is not overly concerned that a 100-basis-point increase in deposit interest rates in Vietnam will significantly impact the economy, earnings growth, or the stock market this year. VinaCapital still expects earnings growth of around 20% in 2024.