(Image for illustration)

Surge in Banks Offering Higher Interest Rates on Savings

The wave of decreasing interest rates across the board has begun to turn the corner as several banks have adjusted upwards their savings interest rates. According to our survey, there are currently 16 banks offering higher savings interest rates, including: HDBank, MSB, Eximbank, NCB, Bac A Bank, GPBank, OceanBank, BVBank, PVComBank, CBBank, BIDV, TPBank, VPBank, KienLong Bank, VietinBank, ACB. This is also the first time in the past year that the number of banks raising interest rates has been so significant.

Among them, VPBank and KienLong Bank have both made two adjustments to increase savings interest rates over several terms.

OceanBank has implemented the highest interest rate increase across all terms, with an average increase ranging from 0.1% to 0.9% per annum. Following this adjustment, the market has started to witness interest rates above 6% per annum, as OceanBank raised interest rates in the 36-month term to 6.1% per annum.

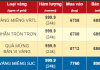

VietinBank is currently the only bank in the Big 4 group to raise its savings interest rates. However, the bank has only increased interest rates for customers with deposits exceeding 300 million dong. For terms of 1-11 months, the average increase is 0.2 percentage points. The savings interest rate for terms between 1-2 months has risen to 1.9% per annum, for terms between 3 and 6 months it is 2.2% per annum. The savings interest rate for terms between 6 and 11 months is 3.2% per annum. Notably, interest rates for terms of 24-36 months have returned to the 5% per annum mark.

Prior to March 3, 2024, the market only saw a wave of decreasing interest rates among banks. It was not until the latter half of March that four banks were recorded to have increased interest rates over various terms. According to the survey, 25 banks lowered interest rates during March, outnumbering banks that raised interest rates.

Have Interest Rates Hit Bottom?

According to information provided by the State Bank of Vietnam, based on interest rate reports from commercial banks as of March 31, 2024, the average deposit interest rate for new transactions is 3.02% per annum, a decrease of 0.5% compared to the end of 2023. The average lending interest rate for new transactions is 6.5% per annum, a decrease of 0.6% per annum compared to the end of 2023.

However, in April, with the surge of banks raising savings interest rates, experts believe that interest rates have reached their bottom and begun to rise. Several bank executives have also forecasted a moderate increase in savings interest rates.

Previously, Mr. Luu Trung Thai, Chairman of the Board of Management of MB Bank stated: “We believe that it is unlikely that lending interest rates will continue to remain as they have been in the first months of the year. It is likely that interest rates will either stay stable or rise from now until the end of the year”.

At the 2024 Annual General Meeting of Shareholders (AGM), Mr. Tran Hung Huy, Chairman of the Board of Management of ACB Bank also suggested that interest rate increases from now until the end of the year will be marginal, though there is a possibility of interest rates rising slightly each quarter.

Meanwhile, several research firms share similar opinions regarding the future movement of savings interest rates.

Specifically, Dragon Capital Management Limited forecasts that savings interest rates will likely increase by 30-50 basis points in the coming months. The firm suggests that this can be seen as a mid-cycle interest rate adjustment during a period of decreasing interest rates to relieve exchange rate pressures.

The analyst team at KB Securities Vietnam (KBSV) also predicts that savings interest rates have likely bottomed out and may edge up slightly for the remainder of the year.

According to experts, low savings interest rates, coupled with the rise of gold prices, USD prices, and the gradual recovery of the real estate market, have prompted people to shift their investments to these channels. De facto, credit growth recorded in the first quarter of 2024 was only 0.26%, marking the lowest growth in many years. This is the reason why several banks have increased their savings interest rates to attract funds.

Experts predict that while interest rates may see a slight increase, the average interest rate is expected to remain low.