The General Department of Taxation stated that in the past, in parallel with the deployment of electronic tax applications, to contribute to the integration of the database, serving the tax administration as well as general state management, the tax sector has promoted and deployed the application of e-invoices.

This is one of the important management information that needs to be standardized, updated with international practices to better serve the exploitation and use of information.

With the modern information technology platform, the electronic invoice system keeps track of all data of buyers and sellers. E-invoice data has also been integrated with the data systems of tax authorities in particular and other state management agencies in general.

“In cases where buyers and sellers have violations related to invoices for deducting input value-added tax, reducing the value-added tax payable, increasing the refundable value-added tax, legalizing purchased smuggled goods, creating fictitious costs arising, reducing taxable income leading to a reduction in corporate income tax payable… will be detected and handled in accordance with regulations”.

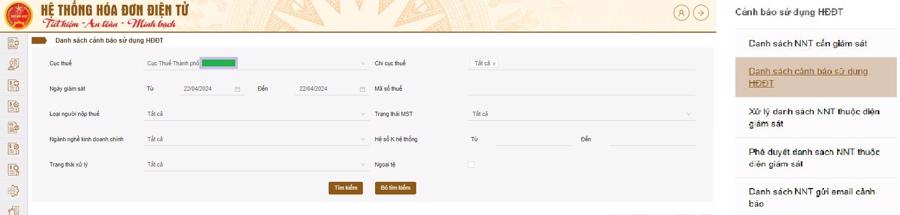

In order to increasingly increase the transparency of tax management processes, strengthen the electronization of risk management and audit measures in the use of e-invoices through analysis, synthesis of purchase/sale data on invoices, thereby warning a list of taxpayers subject to audit, the General Department of Taxation researched, developed, and deployed an upgrade of the “e-invoice usage warning function on the e-invoice management application” version 3.1.0, meeting tax administration requirements, preventing violations in the use of electronic invoices.

The General Department of Taxation said that the “e-invoice usage warning function on the e-invoice management application” applies to taxpayers who are organizations, businesses, and business households, and individuals doing business who have registered to use electronic invoices.

Accordingly, from April 15, 2024, the application will automatically send daily notifications to taxpayers who are sellers on the e-invoice usage warning list and who have invoices arising on the warning day.

“It is expected from May 15, 2024, the application will automatically send daily notifications to taxpayers who are buyers on e-invoices arising on the day of the seller receiving the warning”, the General Department of Taxation stated.

According to the General Department of Taxation, in the past, when using paper invoices, many taxpayers intentionally failed to comply with the law and violated invoices, but it was not until tax audits that the violations were detected, and the detection of violations was still difficult, and manual.

Since the tax sector has deployed the electronic invoice system so far, the General Department of Taxation said that through tax management procedures, the tax authority has analyzed, compared, and assessed each electronic invoice that taxpayers send to the data system electronic invoices.

Therefore, it is easy to detect illegal use of invoices as well as illegal use of invoices and promptly handle violations, ensuring that the seriousness of the law is enforced, creating a healthy and fair business environment.

According to figures from the General Department of Taxation, since the deployment to the end of the first quarter of 2024, the number of electronic invoices received and processed by the tax authority is estimated to reach 7.12 billion invoices, of which 2 billion invoices have codes and more than 5.12 billion invoices do not have codes.

Regarding the results of the deployment of electronic invoices initiated from cash registers, by the end of the first quarter of 2024, 50,303 business establishments had registered to use electronic invoices initiated from cash registers, the number of electronic invoices initiated from cash registers was more than 252.8 million invoices.

From May 15, 2023, the General Department of Taxation deployed an application to analyze risks according to a set of criteria indicators, identifying taxpayers with signs of risk in invoice management and use.

By the end of 2023, the tax authority had switched the form of invoice use from uncoded to coded for 618 enterprises, putting 4,800 enterprises on the list of enterprises to be inspected for invoice management and use.

The tax administration said that with the increasingly wide scope of management, the increasing number of taxpayers managed, while economic activities are increasingly diverse and complex, the problems of exploiting loopholes in regulations on the establishment of enterprises, buying and selling illegal invoices, even openly selling them on the Internet, falsifying records, documents for tax declaration and settlement, or even not declaring and paying taxes… have become increasingly sophisticated and unpredictable.

Therefore, the tax sector will continue to promote digital transformation, upgrade information technology applications to support tax management in the direction from manual to automatic, the tax sector hopes to contribute to building a healthy, transparent, and equal business environment.

In the coming time, the tax sector will continue to synchronously implement tax management solutions. In which, it will focus on promoting digital transformation such as: applying big data analysis and artificial intelligence (AI) to serve tax administration, invoice management, contributing to controlling, quickly detecting taxpayers with invoice violations.

At the same time, promote digital transformation in state management of e-commerce activities, business activities on digital platforms, cross-border business; continue to complete the construction of a database serving the implementation of tax assistance programs; researching and providing automatic information such as: artificial intelligence, chatbot…