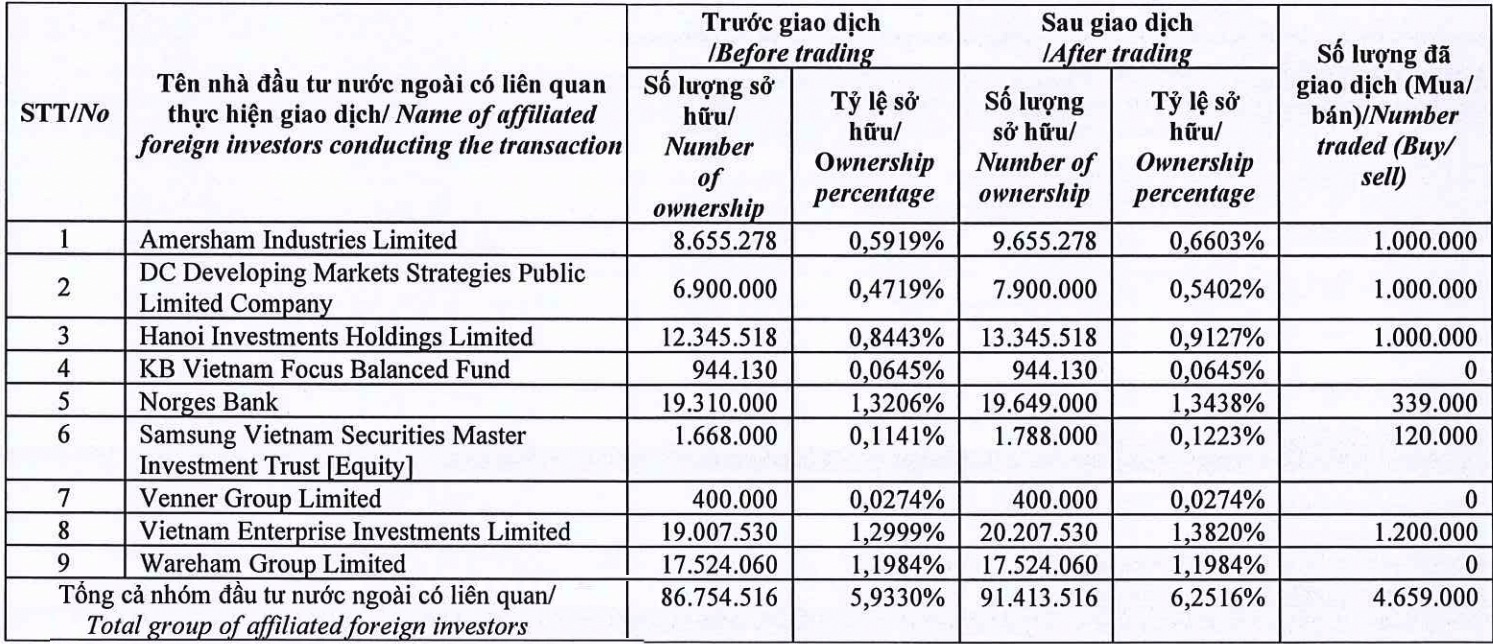

In its latest announcement, the Dragon Capital fund group reported the completion of its share purchase in Mobile World Investment Corporation (MWG).

Specifically, 6 member funds including Amersham Industries Limited, DC Developing Markets Staregies Public Limited Company, Hanoi Investments Holdings Limited, Norges Bank, Samsung Vietnam Securities Master Investment Trust, Vitnam Enterprise Investments Limited have simultaneously purchased between 120,000 and 1.2 million MWG shares. The total number of purchased shares is nearly 4.7 million.

After the transaction, the Dragon Capital group increased its ownership in MWG to 6.25% of capital, equivalent to 91.4 million shares. The transaction was completed on April 23.

Provisionally calculated based on the closing price, the fund group has spent approximately VND 258 billion to complete the above transaction.

Dragon Capital’s purchase comes after MWG was recently removed from the VN Diamond index basket in the April restructuring. According to forecasts, 3 ETF funds that reference the “diamond” index, DCVFM VNDiamond ETF, MAFM VNDIAMOND ETF, and ETF BVFVN DIAMOND, which are holding approximately 50 million MWG shares, will need to sell all of their shares.

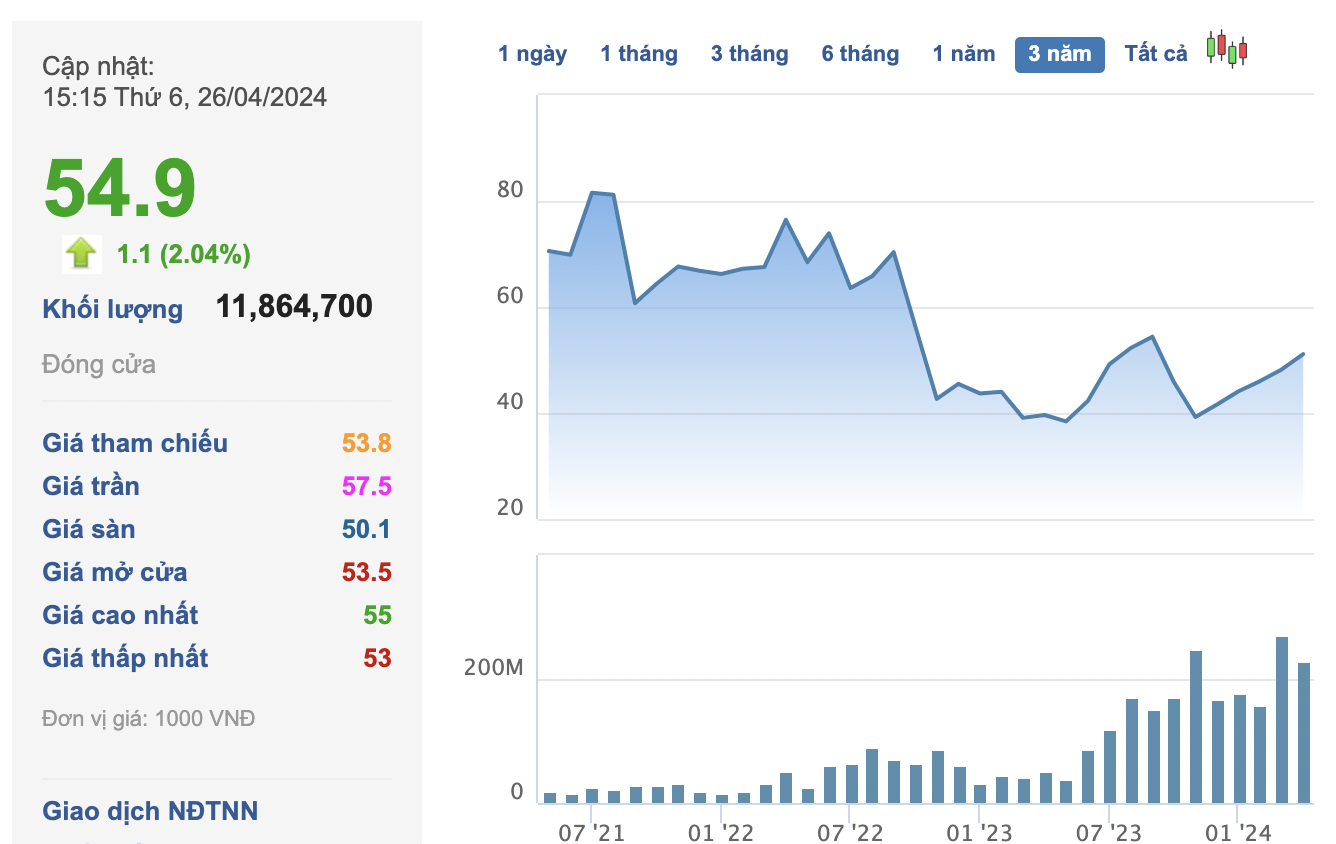

Despite the negative news, MWG shares have performed well in the market. The stock price increased significantly last week before the holiday, reaching VND 54,900 per share, approaching the peak reached in September 2023. Since the beginning of 2024, the MWG stock price has increased by 28%.

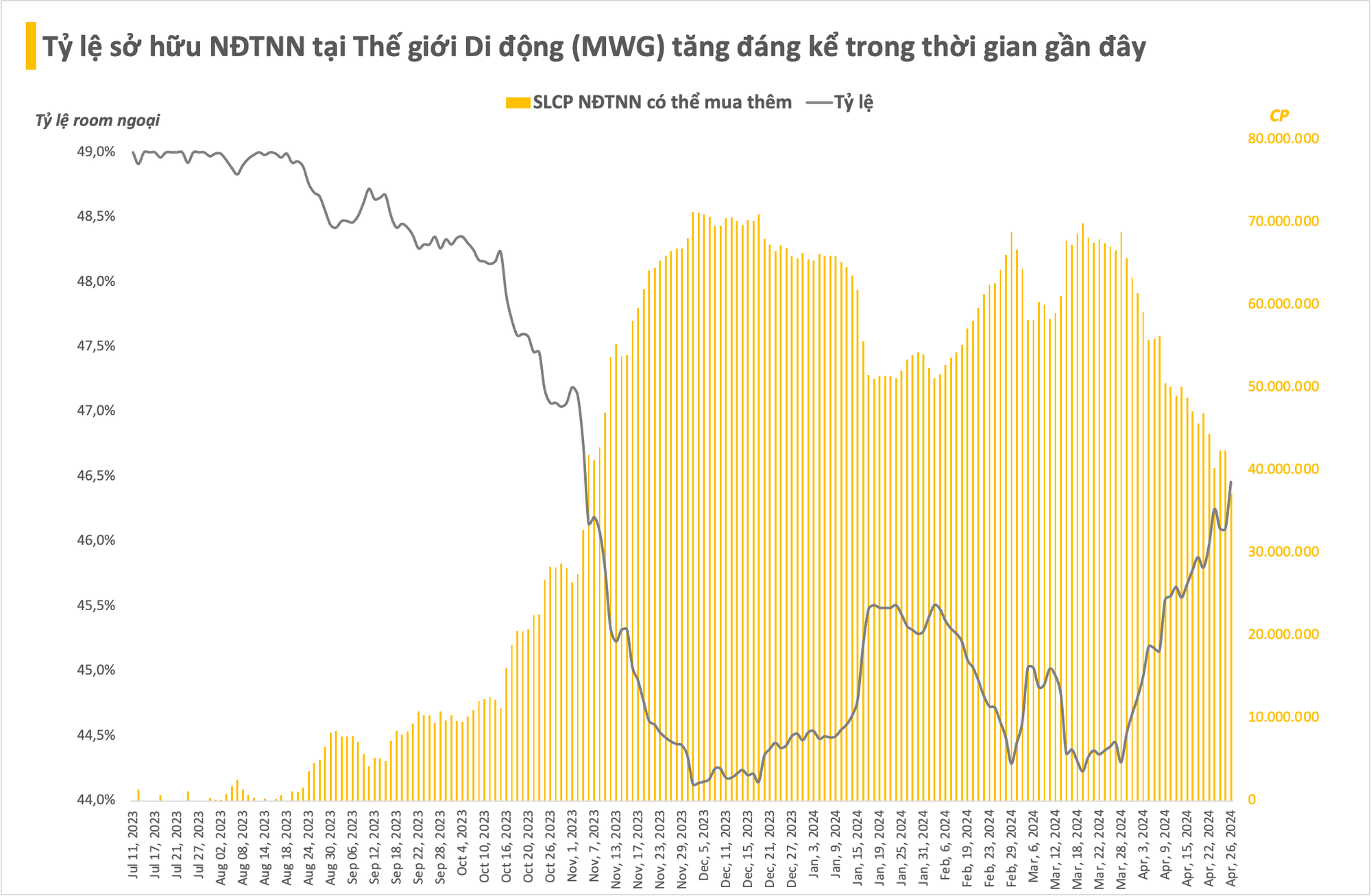

Furthermore, the ownership ratio of foreign investors in MWG has also increased significantly in the past month. After a long period of continuous selling in late 2023, foreign investors are actively returning and investing in shares of the retail giant. Foreign room as of the end of April 26 is approximately 46.5%, the highest since November 2023, corresponding to the number of shares that foreign investors can buy of over 37 million units.

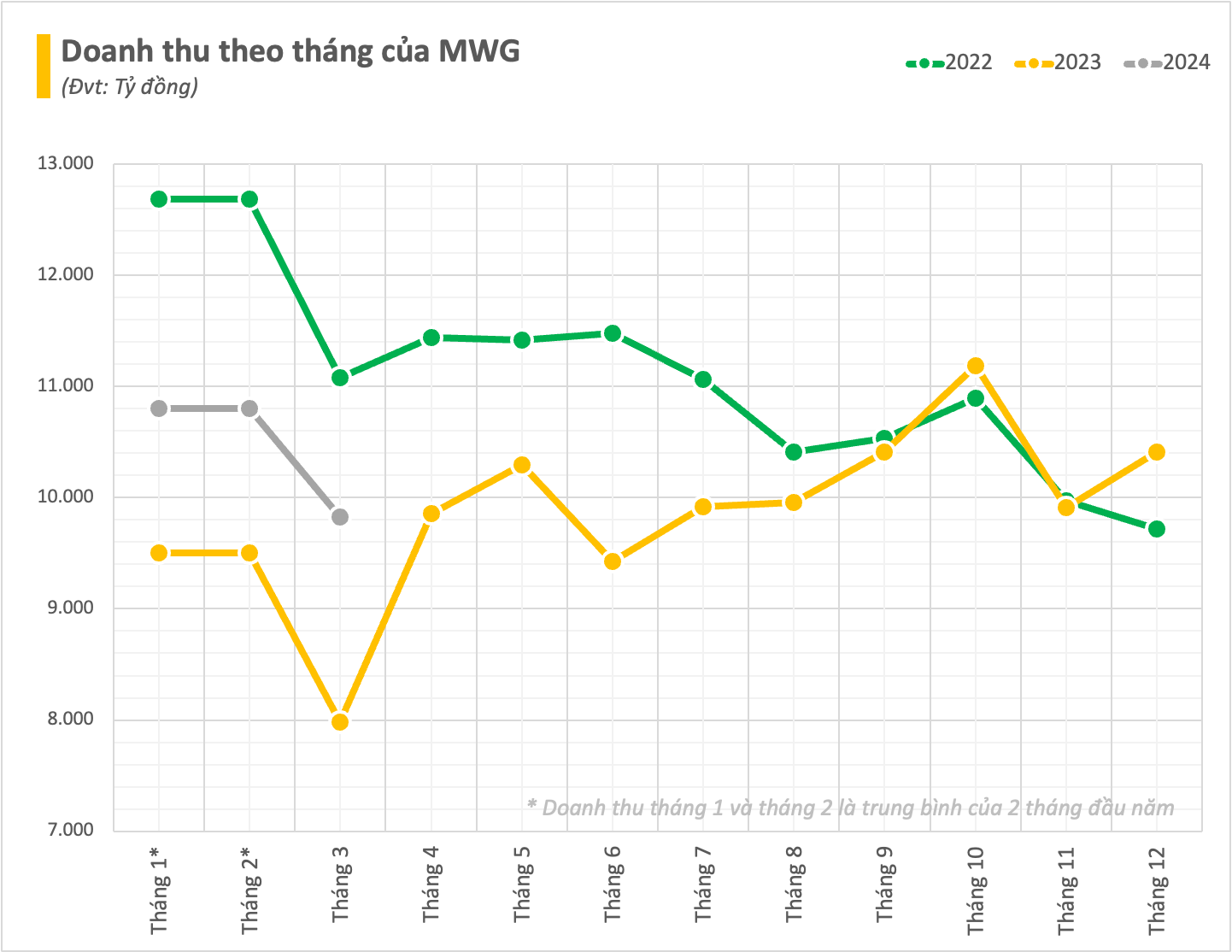

Relatedly, MWG has announced its business results for the first 3 months of the year, with accumulated revenue reaching VND 31,441 billion, an increase of 16.5% over the same period last year. Thus, the company has completed 25% of its revenue plan for the year.

In March 2024 alone, MWG’s revenue reached VND 9,828 billion, an increase of 23% over the same period last year.

In the first 3 months of the year, revenue from the Thế Giới Di Động and Topzone chains recorded revenue of VND 6,791 billion, and the Điện Máy Xanh chain reached VND 14,526 billion. The total revenue of these chains reached VND 21,300 billion, an increase of approximately 7% over the same period. For Bách Hóa Xanh, March’s revenue recorded VND 9,149 billion, and accumulated revenue for the first 3 months of the year increased by 44% over the same period. Average revenue reached VND 1.8 billion/store/month and still maintained the breakeven point after all expenses corresponding to the current operating reality.

After deducting expenses, MWG’s net profit reached VND 902 billion, 43 times higher than the same period in 2023 and the highest level in 6 quarters since Q3/2022.