On April 29, Container Shipping Corporation of Vietnam (Viconship, VSC) held its annual General Meeting of Shareholders (GMS) for 2024. As of 9:15 AM on April 29, only 85 shareholders holding 36% of the company’s voting shares had attended the meeting. Therefore, the company was unable to hold its annual GMS because the number of shares present was below the required quorum (50% of voting shares must be present at the first meeting).

According to the company’s management, Viconship will hold a second meeting within the next month.

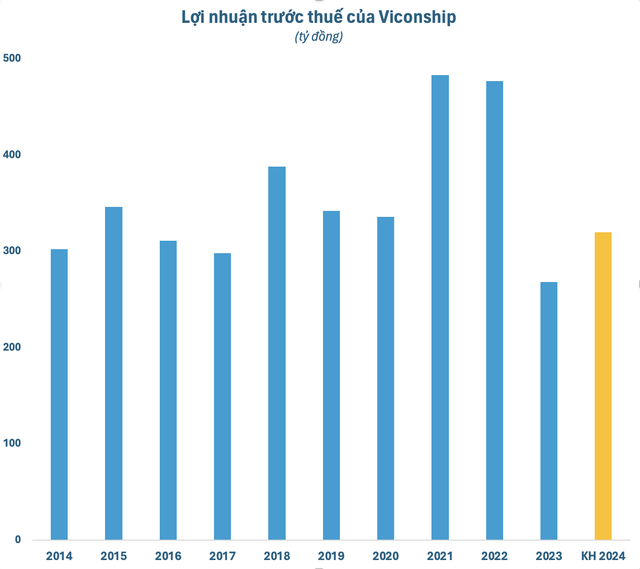

According to the meeting materials, Viconship plans to submit to its shareholders a business plan for 2024 with revenue targets of 2,450 billion VND and pre-tax profit of 320 billion VND, representing growth of 11.5% and 20.8%, respectively, compared to 2023. The dividend for 2023 is expected to be 7.5% in shares.

A company representative said that the global economy, including Vietnam’s, will face many fluctuations and challenges in 2024 due to ongoing geopolitical tensions, exchange rate movements, and interest rate increases. Logistics and ports are among the industries that will be directly affected.

In 2024, the company plans to restructure its asset portfolio, divest from non-core businesses, and focus on mergers and acquisitions (M&A) in its core areas of port operations. It will also restructure its existing loans to optimize financial costs in order to achieve the profit growth targets committed to its shareholders.

Viconship will present important details about its plans to expand through M&A. Accordingly, the company intends to acquire equity interests from members of Nam Hai Dinh Vu Port Company Limited, with the aim of increasing VSC’s ownership stake to a maximum of 100% of Nam Hai Dinh Vu Port Company Limited’s charter capital.

Viconship had previously planned to acquire an additional 44% stake in Nam Hai Dinh Vu Port, increasing its ownership to a maximum of 79% of the charter capital, thereby changing its accounting treatment from an investment in an associate to a subsidiary. The transaction was funded by proceeds of over 1,300 billion VND raised from a rights offering.

In 2023, Viconship completed the purchase of a 35% stake in Nam Hai Dinh Vu Port Company Limited (which owns Nam Hai Dinh Vu port in Hai Phong), for approximately 1,049 billion VND, equivalent to a price of nearly 75,000 VND per share. This investment is currently accounted for as an associate by Viconship.

Viconship is one of the largest and oldest port operators in Vietnam. If it acquires Nam Hai Dinh Port, Viconship could become the largest port operator in Hai Phong, with a total capacity of approximately 2.6 million TEUs and a market share of 30%. Viconship also stated that Nam Hai Dinh Vu Port has begun contributing to the company’s overall profitability.