Banking, by nature, involves the business of “money.” Banks collect funds from depositors and lend them to entities within the economy, earning a “profit” on the difference between lending and deposit interest rates. Loans are not like stocks or real estate in terms of liquidity and repayment security.

The inherent risk associated with banking operations necessitates diversification of loans across different industries. It allows banks to spread out and minimize the risk of capital loss if any industry suffers a downturn.

In particular, analyzing the debt structure by industry provides insights into the sectors driving economic growth. This helps banks develop effective business strategies.

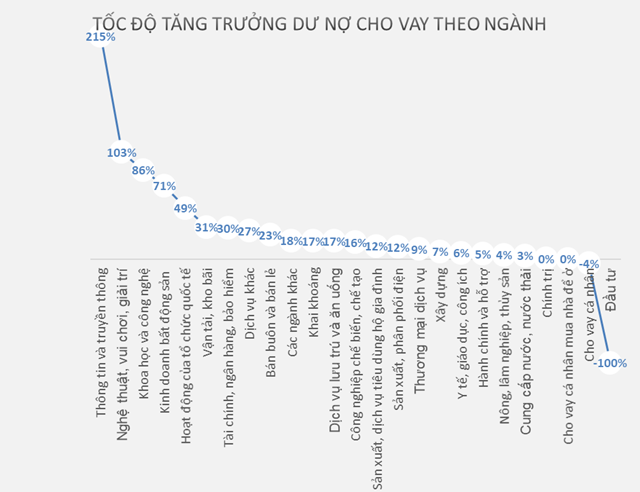

Source: Audited financial statements of banks in 2023

|

According to the published loan balance by industry of 28 banks as of December 31, 2023, approximately 11.6 trillion VND in outstanding loans were allocated to key business sectors, an 18% increase from the beginning of the year. Banks concentrated the most credit capital on wholesale and retail trade, with 2.49 trillion VND, accounting for 21.5% of the total and a 23% increase year-over-year.

BIDV was the bank that lent the most to the wholesale and retail sector, with a balance of over 553.748 billion VND, a 20% increase; the proportion rose from 30.42% to 31.15%. VietinBank (CTG) ranked second in lending to this sector, with a loan balance of over 550.695 billion VND, a 26% increase from the beginning of the period; accounting for 37.4% of CTG‘s industry structure.

|

According to VietstockFinance data, in 2023, listed companies in the wholesale and retail sector achieved revenue of 905,307 billion VND, an increase of over 10% compared to 2022; net profit reached 10,712 billion VND, an increase of 43%. |

Loans to the wholesale and retail sector increased 3.8 times year-over-year, to 46,004 billion VND; HDB was the bank that significantly increased lending to this sector, accounting for 13.4% of the total. NCB followed with a loan balance of 3,492 billion VND, 3.3 times higher than the beginning of the year, and a 6.3% share.

The sector providing household services, producing material products, and personal services (household consumption) accounted for the second-largest share of outstanding loans, at 12.9%, or 1.5 trillion VND.

Source: Consolidated from audited financial statements of banks in 2023

|

In terms of growth rate, the information and communication sector saw its bank loan balance increase 3.2 times year-over-year, from 7,579 billion VND to 23,878 billion VND. However, the sector’s share remained very small, at less than 1%.

|

The 2023 business results of listed companies in the information and communication sector recorded revenue of over 1 trillion VND, an increase of over 9% compared to 2022; net profit was 21,509 billion VND, an increase of over 18%. |

With outstanding loans doubling year-over-year, the arts, entertainment, and recreation sector was the second-highest priority for bank lending, rising from 25,296 billion VND to 51,397 billion VND; it also had a low share of less than 1%.

Despite ongoing challenges in real estate legal clearances, credit growth in this sector exceeded the overall economic growth (13.71% in 2023) with a 71% increase, from 361,377 billion VND to 617,273 billion VND, accounting for over 5% of the loan balance by industry.

For the construction sector, total outstanding loans from banks increased by only 7% year-over-year, to 768,384 billion VND, with a share of nearly 7%.

Which sectors are expected to drive credit growth in 2024?

According to SSI Securities Corporation (SSI), credit growth in 2024 is projected to recover to 14%. This is partly driven by lower lending rates. Growth potential may come from corporate sectors such as infrastructure construction; manufacturing and foreign direct investment (FDI) enterprises; and priority sectors (such as agriculture, export, high technology, SMEs, and supporting industries). Additionally, real estate developers may need to refinance maturing bond issuances in 2024 with a total value of approximately 200 trillion VND (equivalent to 20% of outstanding credit to real estate developers in 2023).

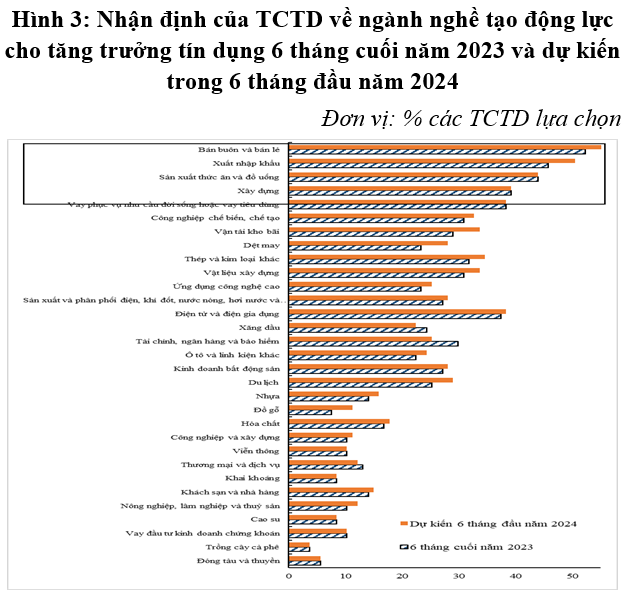

According to a survey conducted by the State Bank of Vietnam (SBV), credit institutions (CIs) forecast that credit demand will continue to improve gradually in the first half of 2024 compared to the second half of 2023 across most sectors. Factors negatively affecting credit demand include unfavorable developments in the real estate and stock markets, economic growth, and declining consumer confidence.

The SBV also indicated that CIs are concerned about a further increase in overall credit risk in the first half of 2024 (reaching 11.9%, higher than the 10.9% in the second half of 2023). However, for the entire year of 2024, overall credit risk is projected to increase at a slower pace than in 2023 (reaching 7.81%, lower than the 15.6% in 2023). Credit risk in some sectors, such as agricultural, forestry, and fishery development lending and investment lending in the logistics services industry, is projected to decrease. The two sectors with the highest potential credit risk remain real estate investment and stock lending.

Most CIs expect to continue easing credit standards in the first half and all of 2024 for some priority sectors, namely manufacturing, investment lending in the logistics services industry, and home loans for residential purposes.

Source: SBV

|

Economic sectors identified as the main drivers of credit growth in 2024 include wholesale and retail trade, export, food and beverage manufacturing, and construction.