The State Bank of Vietnam has just updated the data on customer deposits in the credit institution system by the end of January 2024. Accordingly, deposits of both corporate and individual customers decreased sharply in the first month of the year.

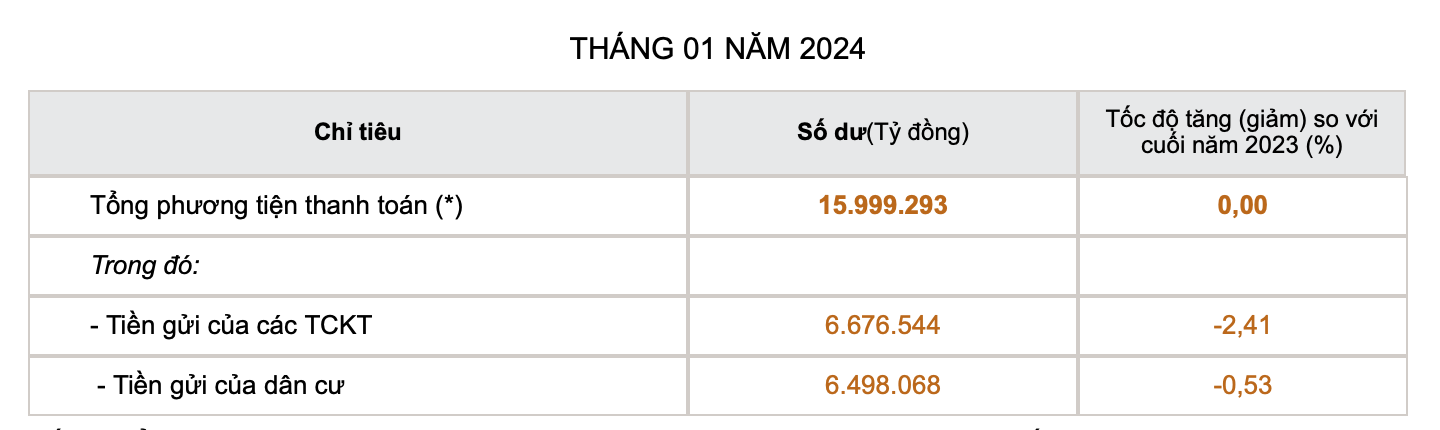

Specifically, the deposits of economic organizations at the end of January 2024 were over 6.67 million billion VND, a decrease of more than 165 trillion VND compared to the end of 2023, equivalent to a decrease of 2.41%. Previously, the deposits of this group of customers had increased sharply by more than 457 trillion VND in December 2023 to a record of over 6.84 million billion VND.

Meanwhile, household deposits also decreased by more than 34.6 trillion VND in January 2024 to nearly 6.5 million billion VND. Notably, this is the first month that household deposits have turned down after 25 consecutive months of positive growth.

Total customer deposits in the banking system at the end of January reached over 13.17 million billion VND, a decrease of nearly 200 trillion VND compared to the end of 2023.

In fact, it is not uncommon for deposits of economic organizations to decline sharply in the first months of the year. For example, in January 2023, deposits of economic organizations decreased by nearly 250 trillion VND, and in January 2022, they decreased by more than 68 trillion VND. The reason for the decline is often due to seasonal factors when the end of the fiscal year is also the occasion of Tet, businesses need a large amount of cash to pay salaries and bonuses to employees.

Meanwhile, the sharp decrease in household deposits in the first month of 2024 may be due to the record low mobilization interest rates at this time. According to the statistics in the market from January to March 2024, banks’ deposit interest rates have fallen below 5%/year for a term of 12 months, and many places only mobilize at an interest rate of 4.5%/year. From the beginning of April 2024, mobilization interest rates have just started to show signs of increasing again, with statistics showing that 16 banks have adjusted up, with some increasing by up to 0.9 percentage points.