The market’s afternoon session was relatively positive despite a significant drop in trading volume. The HoSE saw a 27% decrease in trading volume compared to the morning, but stocks reversed course across the board. The VN-Index closed at its daily high, up 0.57%.

The low liquidity had a positive impact on stock prices, indicating light selling pressure. At the close of the morning session, the VN-Index had a negative market breadth with 194 gainers and 241 decliners. By the end of the session, the situation had completely reversed with 268 gainers and 194 decliners.

The HoSE traded only about VND 5,299 billion in the afternoon, a 27% decrease from the morning session. The VN30 basket fell by 28%, reaching only VND 2,279 billion. However, 25 out of 30 stocks in this blue-chip basket rose in price compared to the morning session, with only VPB, STB, and TPB declining.

Leading the VN-Index was FPT with an overall gain of 3.33%, although it did not rise further in the afternoon, maintaining its gains from the morning. The index was also supported by VHM, the third-largest capitalized stock on the market. VHM closed the morning session down 0.74%, but recovered strongly in the afternoon, gaining 1.61% and rising above its reference price by 0.86%. Other pillars also had a positive impact, such as VIC, which recovered 1.34% from its morning closing price, narrowing its decline to 0.11% below its reference price. GVR rose 2% and returned to its reference price. BID, CTG, HPG, and VCB also recovered, although not all of them surpassed their reference prices.

The VN30-Index ended the morning session slightly higher, closing up 0.54%. The index representing the blue-chip group rose first and led the other groups. The Midcap closed the session up 0.46%, and the Smallcap gained 0.4%. The overall market breadth on the HoSE remained tilted toward decliners for most of the afternoon session, reaching equilibrium around 2:15 PM. This reflects the gradual and cautious increase in prices from buyers as they noticed that selling pressure was not increasing.

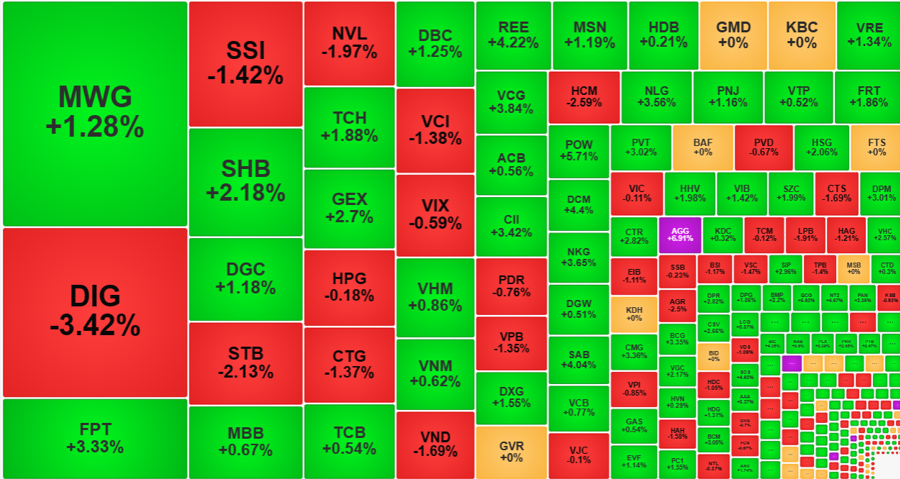

Although the recovery process was gradual, the final result was positive. Not only did the market breadth improve, but the overall price level also rose. At the close of the morning session, the HoSE had only 78 stocks rising by more than 1%, which increased to 135 stocks at the close. The number of stocks declining by more than 1% decreased from 86 in the morning to 72, and their trading volume accounted for approximately 25% of the total trading volume on the floor. Many stocks still faced considerable pressure and high liquidity, such as DIG, which fell 3.42% with a trading volume of VND 920.3 billion; SSI, which declined 1.42% with a trading volume of VND 423.2 billion; NVL, which lost 1.97% with a trading volume of VND 228.9 billion; and CTG, which dropped 1.37% with a trading volume of VND 205.1 billion. However, even these stocks experienced significant recoveries: DIG rose 2.48% from its lowest point of the day; SSI rebounded 1.17%; NVL recovered 1.7%; and CTG gained 1.1%.

The advancing stocks were naturally more active, not only in terms of volume but also in liquidity, accounting for almost 47% of the total trading volume on the floor. There was a surge in trading volume in MWG today, with foreign investors accounting for more than 25% of the stock’s total liquidity and a net buy value of VND 241.9 billion. Tomorrow, the ETF will sell over 48 million MWG shares, and the stock price is at a 7-month high, rising 1.28% today with a trading volume of VND 1,219.8 billion, equivalent to approximately 22 million shares. FPT gained 3.33%, SHB rose 2.18%, DGC increased 1.18%, TCH jumped 1.88%, GEX climbed 2.7%, and DBC advanced 1.25%, all with trading volumes above VND 200 billion.

Despite the overall low liquidity in the market, capital flow was still concentrated in a number of stocks. Caution prevailed, as evidenced by the consistently low liquidity levels. Last week before the holiday, the total trading value on the two listed exchanges was around VND 15,782 billion per session, but today it was only VND 13,525 billion.