Profit Plan Divergence: Conservative vs. Ambitious

|

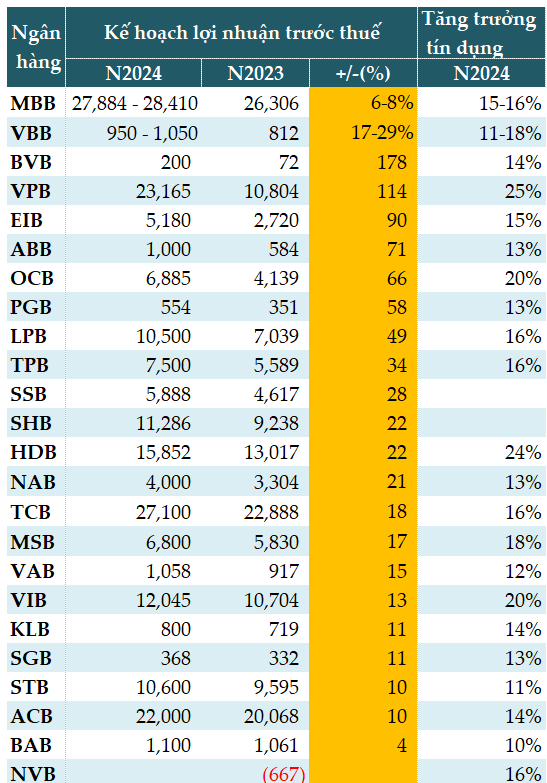

Banks’ 2024 Profit and Credit Growth Plan. Unit: billion VND

|

In the plans set out for 2024 by various banks, there is a divergence in profit targets due to different projections for credit growth set by the State Bank of Vietnam (SBV) as well as expectations for a brighter economic outlook compared to 2023.

In the cautious group, banks have set pre-tax profit growth targets for 2024 below 20%. **Bac A Bank (BAB)** believes that the economic situation remains challenging. The bank has set a target for pre-tax profit to increase by only 4% compared to the 2023 result, to VND 1,100 billion, based on the 10% credit growth rate assigned by the SBV.

In 2024, potential risks from macroeconomic factors are still present. However, **Sacombank** (STB) believes that its internal strength has accumulated, and as it nears the end of its restructuring journey, they will continue to push forward to fully conclude the restructuring process and enter a new development phase with even higher goals. Sacombank aims for 11% growth in credit balance and 10% growth in pre-tax profit to VND 10,600 billion.

ACB plans to increase credit growth in 2024 in line with the SBV’s allowance and improve the contribution of fee income to revenue. The bank will expand its customer base by enabling customers to use digital platforms and increase the number of transactions through digital channels. Based on this, the bank aims for 14% growth in credit and 10% growth in pre-tax profit to VND 22,000 billion.

Several banks maintain a brighter and more optimistic outlook and, with their inherent strengths, have boldly set profit plans that are multiples of their current performance.

BVBank (BVB) aims to achieve VND 200 billion in pre-tax profit in 2024, 2.8 times higher than the 2023 result. At the 2024 AGM, the bank’s management announced that BVBank’s pre-tax profit is estimated to reach nearly VND 70 billion in the first quarter of 2024, achieving 35% of its target.

Some banks do not set specific targets but instead will adjust based on credit growth rates at different times.

Vietbank (VBB) has set two business scenarios for 2024. In the baseline plan, the bank targets pre-tax profit of VND 950 billion, an increase of 17% compared to the 2023 result. By the end of 2024, total assets will increase by 5% compared to the beginning of the year to VND 145,000 billion. Deposits from customers (including paper assets) will increase by 8% to VND 110,000 billion. Total outstanding loans will increase by 11% to VND 90,000 billion. The bad debt ratio will be controlled below 2.5%.

In the optimistic plan, Vietbank targets pre-tax profit growth of 29% to VND 1,050 billion. Deposits from customers and credit balance will grow by 14% and 18%, respectively, to VND 118,000 billion and VND 95,000 billion.

MB’s (MBB) recent 2024 AGM approved a credit growth target of around 15-16% in 2024, with an average growth target of approximately 15% per year for the period 2024-2029, in line with the limit set by the SBV. The bad debt ratio will be controlled below 2%.

For 2024, MB targets pre-tax profit growth of 6-8% compared to the 2023 result, corresponding to a range of VND 27,884 billion – VND 28,410 billion. For the period 2024-2029, the bank plans for