The retail group reported positive business growth in the last quarter, but on the stock market, share prices have not always reflected the potential for rising profits, with the exception of a few stocks.

RECORD HIGH REVENUES AND PROFITS REPORTED

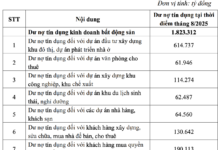

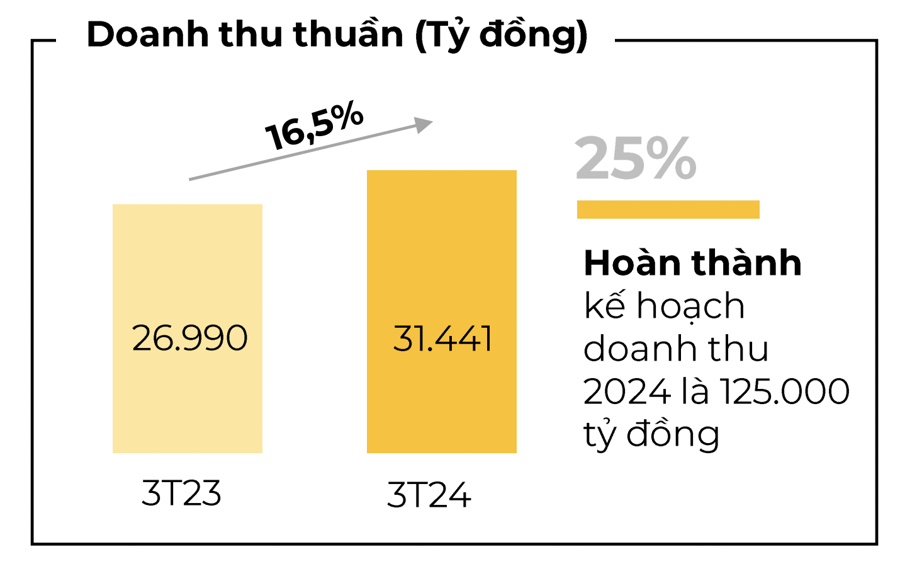

Mobile World Investment Corporation (MWG) has reported its Q1/2024 financial statement, showing net revenue of 31,486 billion VND, an increase of over 16% compared to the same period last year, and fulfilling 25% of the planned revenue for the whole year. After deducting expenses, MWG’s net profit was 902 billion VND, 43 times higher than the same period in 2023 and the highest it has been in the last 6 quarters since Q3/2022.

The main growth driver was the electronics sector, with a double-digit increase in revenue, most notably air conditioners, which saw a 50% increase compared to the same period last year. The gross profit margin for both the Mobile World and Dien May Xanh chains have shown positive improvement in Q1/2024 due to the electronics sector contributing more to the total revenue, while this is a product group with a stable profit margin.

Bach Hoa Xanh reported revenue of over 9,100 billion VND in Q1, a 44% increase compared to the same period last year. Average revenue reached 1.8 billion VND/store/month, with revenue growth driven by both fresh food and FMCG sectors. The average number of transactions reached approximately 500 bills/store/day, a 40% increase, and the average value/bill increased slightly compared to the same period last year.

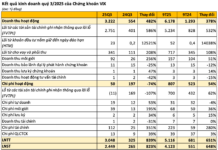

Similarly, FPT has continued its double-digit growth in Q1/2024, with revenue of over 14,000 billion VND and a net profit of close to 1.8 trillion VND. This was also the highest quarterly profit in FPT’s operating history.

The growth in Q1 was mainly due to the technology sector, including domestic IT services and international IT services, which reached 8,472 billion VND and 1,155 billion VND respectively, representing a 24% and 28% increase compared to the same period last year.

Although it did not achieve record growth, Digital World Corporation (DGW) also reported strong growth compared to the same period last year. In Q1/2024, DGW recorded net revenue of 4,985 billion VND, an increase of 26% over the same period. After deducting the cost of goods sold, DGW’s gross profit was over 388 billion VND, a 49% increase.

All sectors recorded growth, with consumer goods increasing by 53%, office equipment by 48%, mobile phones by 29% contributing 49% to total revenue, home appliances increasing by 27%, and laptops & tablets increasing by 4% contributing 23% to total revenue. DGW’s net profit in Q1/2024 was over 93 billion VND, an increase of 16%, and it fulfilled 19% of the annual plan.

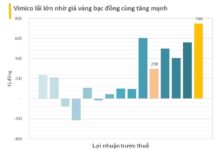

In the first quarter of this year, Phu Nhuan Jewelry Joint Stock Company (PNJ) also reported a 66% and 12% increase in 24k gold and retail jewelry revenue respectively compared to the same period last year, resulting in net revenue of 12,594 billion VND, an increase of nearly 29% compared to the same period last year and surpassing the record for the whole of 2022.

ARE STOCKS STILL APPEALING?

Looking at the outlook for the retail industry, according to Viet Dragon Securities (VDSC), the retail industry’s sales in 2024 will be more positive than the lackluster results of 2023, based on the economic recovery. Consumer confidence and purchasing power will recover in 2024, due to the impact of both expansionary fiscal and monetary policies implemented in 2023-2024 and the impetus from the global economic recovery.

For grocery retailing: Sales will be driven by a profitable expansion strategy and a shift in shopping habits from traditional to modern channels. Vietnamese consumers’ grocery shopping habits have been reshaped during the 2019-2021 period due to the Covid-19 pandemic. Consumers have gradually adapted to shopping through online and modern retail channels.

In addition, modern grocery retailers are restructuring their store operating models to capture this trend in the 2021-2023 period. Grocery retailers have found efficient operating models for their retail chains in 2023, and will now enter a period of profitable expansion from 2024 onwards.

WCM, BHX, Saigon Co.op, Kingfood mart, and Emart are expected to open new stores in 2024, most of which will be located in Ho Chi Minh City. Based on the increasing urbanization trend that is keeping pace with growing economic activities, footfall at modern grocery retail stores is forecasted to be higher in the next 12 months, leading to higher average monthly revenue per store compared to the same period in 2024.

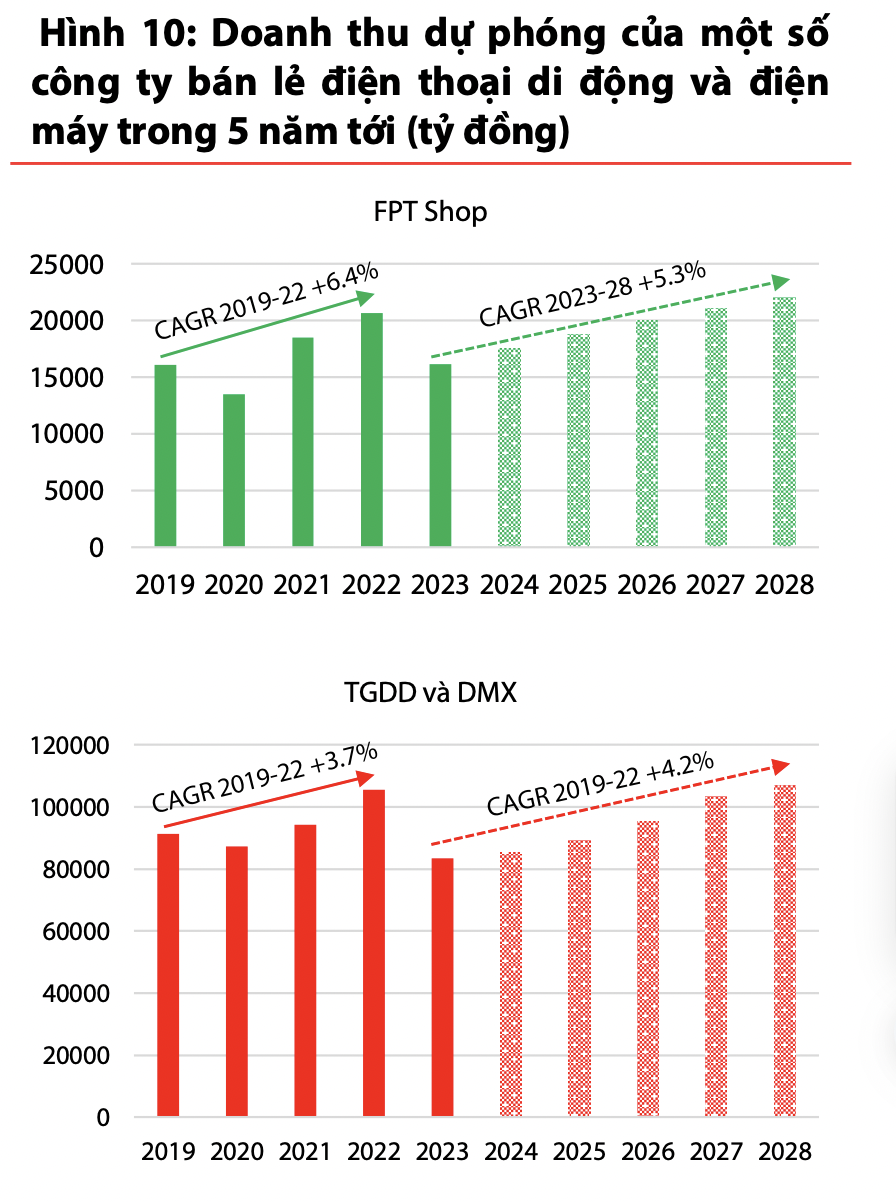

For ICT/CE retailing: single-digit sales growth in 2024 due to market saturation in the medium term, supported mainly by the premiumization trend.

In 2024, Vietnam’s consumption of ICT/CE products will recover compared to the same period last year after experiencing a sharp decline in 2023. Despite benefiting from a low base in 2023, VDSC expects sales growth to be in the single digits due to market saturation.

In the last 5 years, several new retailers have emerged in the ICT market such as CellphoneS, Shopdunk, HHaMobile, and Didongviet. These retailers have applied more flexible marketing and pricing strategies targeting younger generations of consumers, aged 18-40. Additionally, the trend of consuming through online channels like Lazada, Shoppee, and TiktokShop, as well as the “flagship stores” of brands like Apple, Samsung, and Xiaomi, is spreading rapidly.

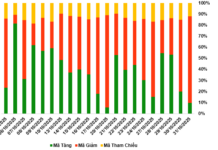

Regarding share prices, the share prices of retail stocks have been improving since November 2023 on the back of positive revenue growth expectations in 2024. According to VDSC, MWG is the stock with the most potential for price growth.