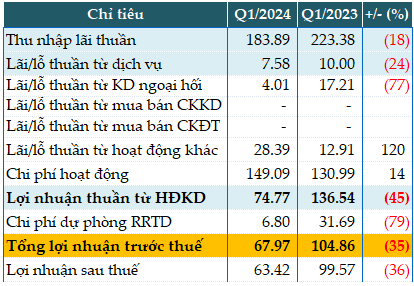

In the first quarter, SGB‘s main income declined by 18% year-on-year to nearly VND184 billion of interest income.

Other sources of income also declined, such as service revenue (-24%) and foreign exchange trading revenue (-77%).

Income from other activities was SGB‘s only source of growth, reaching over VND28 billion, 2.3 times higher than the same period last year.

During the quarter, the bank increased its operating expenses by 14% to VND149 billion. As a result, net profit from business operations decreased by 45% to nearly VND75 billion. Although SGB reduced its credit risk provision expenses by 79% to nearly VND7 billion, the bank’s pre-tax profit was only VND68 billion, a 35% decrease year-on-year.

Compared to the plan of VND368 billion in pre-tax profit for 2024, SGB has only achieved over 18% after the first quarter.

|

SGB‘s business results in the first quarter of 2024. Unit: Billion VND

Source: VietstockFinance

|

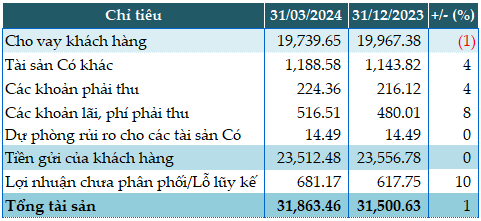

As of the end of the first quarter, the bank’s total assets increased slightly by 1% compared to the beginning of the year to VND31,863 billion. Of which, deposits at the SBV decreased sharply by 82% (to VND674 billion), deposits at other commercial banks increased by 31% (VND5,088 billion), loans to customers decreased by 1% (to VND19,739 billion)…

On the business capital sources, deposits from other commercial banks increased by 17% (VND3,555 billion), customer deposits remained unchanged at VND23,512 billion…

|

Some financial indicators of SGB as of March 31, 2024. Unit: Billion VND

Source: VietstockFinance

|

SGB‘s total bad debt as of March 31, 2024 was over VND469 billion, an increase of 16% compared to the beginning of the year. In which, doubtful debt increased the most by 80%. As a result, the ratio of bad debt to outstanding loans increased from 2.03% at the beginning of the year to 2.38%.

|

SGB‘s loan quality as of March 31, 2024. Unit: Billion VND

Source: VietstockFinance

|