Exchange Rate Update: Vietnamese Dong Dips Against the US Dollar in Early May

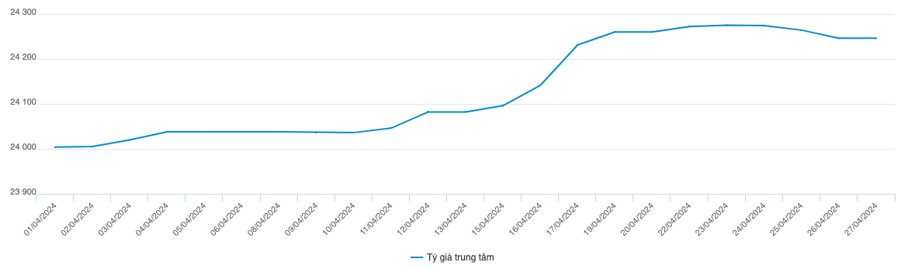

On May 2, the exchange rate for the US dollar in the unofficial market witnessed a rise of 125 Vietnamese dongs (VND) for the buying rate and 130 VND for the selling rate, settling at 25,665 – 25,770 VND per USD. This follows a week of decline in the unofficial market exchange rate (April 22-26).

Meanwhile, the State Bank of Vietnam (SBV) announced an adjustment to the central exchange rate, lowering it by 4 VND compared to April 26. As such, 1 USD is now valued at 24,242 VND. The SBV also maintained the buying rate for immediate delivery at 23,400 VND/USD, while the selling rate remained unchanged at 25,450 VND/USD from the previous week’s holiday.

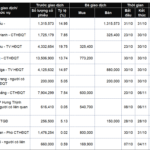

Commercial banks’ USD exchange rates remained relatively stable for the buying rate and declined by 4-5 VND for the selling rate.

Vietcombank’s exchange rates on May 2 saw a slight decrease of 4 VND for both buying and selling, setting the rates at 25,084 – 25,454 VND/USD.

In contrast, Vietinbank reported a substantial increase of 80 VND for the buying rate compared to April 26, while the selling rate was adjusted down by 4 VND, resulting in a trading range of 25,140 – 25,454 VND/USD.

As of 10:30 AM on May 2, the unofficial market USD rate surged further by 125 VND for the buying rate and 135 VND for the selling rate compared to the closing price on April 26, reaching 25,665 – 25,770 VND/USD.

The previous week (April 22-26), the central exchange rate underwent adjustments by the SBV, with increases in the first two sessions followed by a decline. On April 26, the central exchange rate was fixed at 24,246 VND/USD, representing an 18 VND drop from April 19.

The interbank exchange rate experienced a decline during the week of April 22-26. At the end of the April 26 session, the interbank exchange rate closed at 25,334 VND/USD, marking a decrease of 116 VND compared to April 19.

The unofficial market exchange rate also witnessed a decline in the week from April 22-26. On April 26, the unofficial exchange rate fell by 150 VND for the buying rate and 130 VND for the selling rate compared to April 19, trading at 25,530 VND/USD and 25,630 VND/USD, respectively.

According to the Vietnam Interbank Market Research Association (VIRA), during the week of April 22-26, VND interbank interest rates exhibited a rising trend across all tenors. On April 26, VND interbank interest rates traded around the following levels: overnight 4.78% (+0.82 basis points); 1 week 4.82% (+0.68 basis points); 2 weeks 4.92% (+0.56 basis points); 1 month 4.95% (+0.37 basis points).

USD interbank interest rates fluctuated between small increases and decreases across all tenors throughout the week. On April 26, USD interbank interest rates closed at: overnight 5.24% (-0.01 basis points); 1 week 5.31% (-0.02 basis points); 2 weeks 5.38% (-0.02 basis points); and 1 month 5.40% (-0.01 basis points).

In the open market during the week of April 22-26, the State Bank of Vietnam conducted a government bond offering through a 14-day secured lending scheme. The auction amount was 122,000 billion VND, with an interest rate of 4% for the initial session and 4.25% in subsequent sessions. A total of 117,805.1 billion VND was successfully auctioned, while 32,865.1 billion VND matured during the week.

The State Bank of Vietnam also auctioned State Bank bills with a 28-day maturity, bidding for interest rates in all sessions. At the end of the week, a total of 11,400 billion VND was successfully auctioned, with interest rates increasing from 3.73% per annum to a peak of 3.75% before settling at 3.5%. A total of 26,500 billion VND matured during the week.

As a result, the State Bank of Vietnam injected 100,040 billion VND into the market through open market operations in the last week of April. The volume of State Bank bills in circulation declined to 51,350 billion VND, while the volume in circulation on the secured lending channel stood at 117,805.1 billion VND.

In the early hours of May 2 (Vietnam time), the USD Index fell by 0.64% to 105.6 points following the Federal Reserve’s “dovish message” during its May policy meeting and the Bank of Japan’s intervention to support the JPY by selling 35.06 billion USD (approximately 5.5 trillion JPY).

The Fed announced that it would maintain the benchmark interest rate at its highest level in two decades, at 5.25% to 5.5%, due to renewed inflationary pressures in the economy. The positive news is that the Fed has downplayed the possibility of further interest rate hikes in the second half of the year and stated that the current rate level is sufficient to control inflation, although it will take more time to achieve this goal.