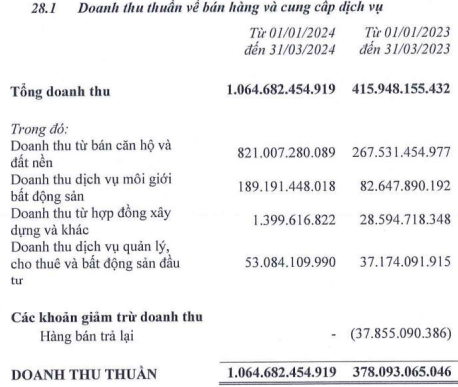

Specifically, DXG‘s net revenue reached nearly 1.1 trillion VND in the first quarter of 2024, 2.8 times higher than the same period last year. In particular, the apartment/land transfer and real estate brokerage services became highlights with revenue reaching over 821 billion VND and 189 billion VND, respectively, 3 times and 2.3 times higher than the first quarter of the previous year.

|

Revenue structure of DXG in Q1

Source: DXG

|

At the 2024 Annual General Meeting of Shareholders, Chairman of the Board of Directors of DXG – Mr. Luong Tri Thin shared that DXG‘s transaction volume in the first quarter of 2024 improved compared to the fourth quarter of 2023. During the period, the Company completed and handed over all products of the Opal Skyline project. As for the service segment, the first quarter recorded positive figures and is expected to continue to flourish in the remaining quarters of 2024.

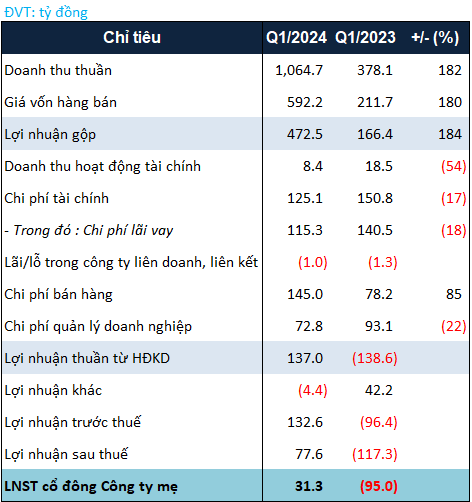

Not only increasing revenue, DXG also significantly reduced expenses, with financial and management expenses decreasing by 17% and 22% respectively, to 125 billion VND and 73 billion VND. Notably, selling expenses increased sharply by 85%, reaching 145 billion VND.

Thanks to the above positive factors, DXG recorded a net profit of over 31 billion VND in the first quarter of 2024, compared to a loss of over 95 billion VND in the same period last year. Despite turning a loss into a profit, DXG‘s profit only reached nearly 14% of the 226 billion VND target set for 2024.

|

Q1/2024 business results of DXG

Source: VietstockFinance

|

As of March 31, 2024, DXG‘s total assets increased by 3% compared to the beginning of the year, to nearly 30 trillion VND. The two items accounting for the largest proportion are short-term receivables and inventories, which remained almost unchanged at over 11.4 trillion VND and 14 trillion VND, respectively. However, it is noteworthy that the Company’s cash holdings amounted to approximately 1.5 trillion VND, 4 times higher than at the end of the previous year.

Meanwhile, total liabilities decreased by 3% to nearly 14.2 trillion VND. Total borrowings also decreased slightly by 2%, to over 5.2 trillion VND.