Market liquidity increased slightly compared to the previous trading session, with matching order volume on VN-Index reaching nearly 657 million shares, equivalent to a value of over VND 15,000 billion; HNX-Index reached over 55 million shares, equivalent to a value of over VND 1,000 billion.

VN-Index opened the afternoon session with a seesawing trend, but selling pressure gradually increased, causing the index to decline below the reference point, but buying power reappeared at the end of the session, helping VN-Index rebound slightly. In terms of impact, TCB, VCB, HVN, and MSN were the stocks with the most positive impact on VN-Index, with an increase of over 3.3 points. In contrast, GVR, FPT, and LPB were the stocks with the most negative impact, reducing the index by more than 1 point.

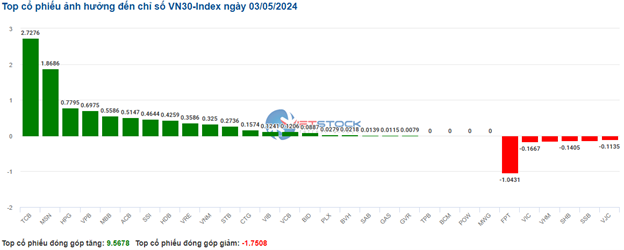

| Top 10 stocks influencing the VN-Index on May 3, 2024 |

The HNX-Index also had a similar trend, with the index positively impacted by stocks such as VCS (3.67%), CEO (1.68%), NET (6.67%), HHC (9.15%), and more.

|

Source: VietstockFinance

|

The transportation and warehousing sector experienced the strongest recovery with an increase of 1.96%, mainly driven by stocks such as HVN (+6.94%) and VJC (+2.02%). This was followed by the construction materials sector and the household goods manufacturing sector with increases of 1.08% and 1%, respectively. On the other hand, the other finance sector recorded the largest decline in the market with -1.05%, primarily due to stocks such as IPA (-1.43%), OGC (-0.34%), and TVC (-1.12%).

In terms of foreign trading, foreign investors net bought more than VND 504 billion on the HOSE exchange, focusing on stocks such as MWG (546 billion), PDR (82 billion), VCB (47 billion), and MSN (45 billion). On the HNX exchange, foreign investors made similar trades, net buying more than VND 29 billion, with a focus on IDC (24 billion) and CEO (5 billion).

| Foreign net buy-sell transactions |

Morning session: VN-Index rises on low liquidity

At the end of the morning session, all three exchanges were up, with VN-Index gaining 7.03 points. Green dominated the market, with 418 stocks increasing and 248 stocks decreasing in the morning session.

The excitement took over the stock market in the morning session. The construction materials group was the main driver with an increase of 2.16%. HPG rose 2.29% during today’s session, contributing to the overall index increase on the HOSE exchange. Other steel stocks also moved positively. HSG gained 1.77%, NKG gained 1.54%.

In addition, other stocks in the group also increased well such as VGS (+2.42%), VCS (+3.83%), VHL (+4.55%), GKM (+2%),…

TCB, HPG, VCB, MSN, BID were the stocks that contributed the most to the index’s growth. However, FPT continued to lose points towards the end of the session, pulling VN-Index down 0.25 points.

Today’s increase also had considerable contributions from the securities and food and beverage groups. Stocks in these two groups were awash with green during the session. VNM, MSN, SAB gained points. In the securities group, many stocks such as SSI, VND, VCI, HCM, SHS, VIX, FTS, MBS, BSI, CTS, … were mostly tinted with positive green during the morning session.

Although the index points jumped significantly, liquidity was quite sluggish during the morning session. Trading value across the market reached only over VND 6 trillion, significantly lower than the recent average.

10:40 AM: Moments of consolidation and continued acceleration

The overall market trend continued to diverge as buying and selling forces in the market were quite balanced, but the uptrend was still being maintained. As of 10:40 AM, the VN-Index had gained more than 6 points, trading around 1,222 points. The HNX-Index rose 1.23 points, trading around 228 points.

The breadth of the VN30 index basket was mostly covered in a positive shade of green. Of which, TCB, MSN, HPG, and VPB contributed 2.73 points, 1.87 points, 0.78 points, and 0.69 points to the VN30-Index, respectively. Meanwhile, FPT, VIC, VHM, and SHB were stocks that were still under selling pressure and took away more than 1 point from the overall index.

Source: VietstockFinance

|

Leading the current rally was the banking group, with currently more than 60% of stocks covered in green. Specifically, some notable stocks such as SSI increased 1.3%, VND decreased 1.48%, VCI decreased 1.4%, and HCM decreased 2.09%… Only TVS and VFS remained in red, but the decrease was less than 1%.

In addition, the banking group also experienced a good increase with a wider breadth towards buying. Notably, TCB increased 2.56%, BID increased 0.61%, CTG increased 0.62%, VPB increased 0.82%, and ACB increased 0.74%…

The retail stock group showed a contrasting trend with a rather negative red shade. Currently, this group is under significant selling pressure as investors are trading quite concentrated in three large