Commercial banks must transparently disclose lending and mobilization interest rates.

|

The State Bank is seeking feedback from organizations and individuals on two draft circulars on applying interest rates to VND and USD deposits.

Specifically, the draft circular will replace Circular No. 07/2014/TT-NHNN regulating interest rates on VND deposits by organizations and individuals at credit institutions and draft circular will replace Circular No. 06/2014/TT-NHNN regulating the maximum interest rate on deposits in USD by organizations and individuals at credit institutions.

Accordingly, for VND deposits, credit institutions shall apply deposit interest rates not exceeding the maximum interest rate for non-term deposits, deposits with terms of less than 1 month, deposits with terms of 1 month to less than 6 months as decided by the Governor in each period and for each type of credit institution.

Deposit interest rates in VND with terms of 6 months or more shall be applied by credit institutions based on market supply and demand for capital.

For deposits in USD, credit institutions shall apply deposit interest rates not exceeding the maximum interest rate set by the Governor in each period.

In both of these draft circulars, the State Bank specifies that the maximum interest rate for deposits in VND and USD includes all forms of promotional expenses, applicable to the method of paying interest at the end of the term and other methods of paying interest are converted according to the method of paying interest at the end of the term.

Credit institutions shall publicly list interest rates on VND and USD deposits at legal transaction locations within the credit institution’s operational network and post them on the credit institution’s website (if any).

It is strictly forbidden for credit institutions, when receiving deposits, to offer promotions in any form (in cash, interest rates, or other forms) that are not in accordance with legal regulations.

According to the State Bank, the drafting of circulars to replace the two above circulars is to comply with the provisions of the Law on Credit Institutions 2024, which has been passed by the National Assembly and will take effect from July 1.

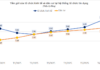

Currently, the interest rate on USD deposits is 0%; the maximum deposit interest rate for non-term deposits and deposits with terms of less than 1 month is 0.5%/year; the maximum deposit for terms of 1 month to less than 6 months is 4.75%/year, and for People’s Credit Funds and Microfinance Organizations, the maximum interest rate is 5.25%/year.

|

– On January 18, 2024, the Law on Credit Institutions was passed by the National Assembly and took effect on July 1, 2024 (Law on Credit Institutions 2024), in which: + Clause 27, Article 4 stipulates that: Receiving deposits is the act of receiving money from organizations and individuals in the form of non-term deposits, term deposits, saving deposits, issuing deposit certificates, and other forms of receiving deposits according to the following principles: fully refunding the principal and interest as agreed to the organization or individual depositing money (hereinafter referred to as the depositor). + At Point b, Clause 2, Article 114; Point b, Clause 2, Article 119; Point b, Clause 2, Article 124, Point b, Clause 1, Article 125; Clause 1, Article 131 stipulates that bond issuance activities belong to other business activities of credit institutions. – Clause 2, Article 1 of Circular No. 06/2014/TT-NHNN dated March 17, 2014, of the Governor of the State Bank of Vietnam regulating the maximum interest rate on US dollar deposits by organizations and individuals at credit institutions (Circular No. 06/2014/TT-NHNN) stipulates: Deposits include forms of non-term deposits, term deposits, saving deposits, deposit certificates, promissory notes, credit notes, bonds, and other forms of receiving deposits from organizations (except credit institutions), individuals as prescribed in Clause 13, Article 4 of the Law on Credit Institutions. Thus, on the basis of reviewing the relevant regulations in Circular No. 06/2014/TT-NHNN and to comply with the regulations in the Law on Credit Institutions 2024 mentioned above, the SBV needs to issue a circular to replace Circular 06/2014/TT-NHNN. |