Note: HSG fiscal year runs from Oct 01 to Sep 31

HSG‘s Q2 FY2023-2024 Financial Results

Unit: VND

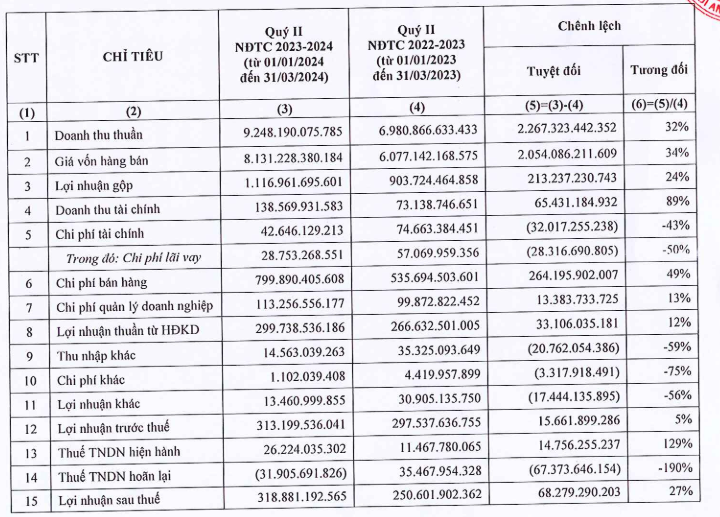

In Q2, HSG continued to record a positive business picture: Revenue of nearly 9,250 billion VND and net profit of nearly 320 billion VND, an increase of 32% and 27% respectively compared to the same period last year.

The recovery in consumption volume, along with the strong contribution from financial activities, was the main reason for Hoa Sen’s significant profit in Q2.

During the period, financial revenue increased by 89% to nearly 140 billion VND, while financial expenses decreased by 43% to nearly 40 billion VND.

The drawback was that the profit margin declined compared to the same period, along with an increase in selling expenses and business management expenses. In the first 3 months of the year, sales expenses increased by 49% to 800 billion VND, while business management expenses increased by 13% to over 110 billion VND.

Achieved 84% of Positive Scenario Profit Plan

In the first 6 months of the 2023-2024 fiscal year, the galvanized steel giant recorded a net revenue of over 18,300 billion VND, an increase of 23% compared to the same period; net profit of over 420 billion VND, while in the same period there was a heavy loss of 420 billion VND.

With the above results, HSG have exceeded the profit after tax plan of negative scenario (400 billion VND) and achieved 84% of the profit plan in positive scenario (500 billion VND).

In fact, this positive result was forecasted at the annual meeting held in late March 2024. However, Mr. Le Phuoc Vu – Chairman of HSG – is still cautious about the 2024 outlook because the trends are uncertain, not following any rule.

“We should not be subjective, we should be more defensive,” Mr. Vu shared at that time.

In the immediate future, HSG is taking advantage of the low HRC prices to increase its inventory. “Currently, HSG is negotiating orders with quality equivalent to the price of 530 USD/ton,” Mr. Vu shared. At the end of March 2024, the galvanized steel giant owned nearly 12,000 billion VND of inventory, much higher than the 8,000 billion VND at the beginning of 2024.

However, the current low HRC price could be threatened when Hoa Phat and Formosa file a lawsuit against anti-dumping of HRC steel from China. Currently, HSG and the big players in the galvanized steel industry are protesting this lawsuit.