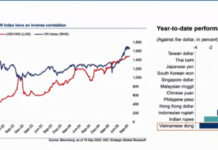

Following a rapid decline, the VN-Index has gradually recovered, easing some of the tension among investors. However, the continuous decrease in liquidity suggests that the cash flow remains cautious.

Sharing at the “Grasping the cash flow of May” program recently organized by FIDT, Mr. Nguyen Thanh Nguyen Vu – Founder of TVN & Partners suggested that there are some indications that the market has bottomed out.

Specifically, the bottoming-out session corresponds with a session in which the market corrects sharply, and liquidity spikes. Moreover, extremely low market breadth or the transition from low to high market breadth within the session, and fast transaction speed indicate that the selling pressure has been well absorbed. Another bottoming-out signal is a sharp decline or a strong recovery of the VN-Index from a low price point within the session.

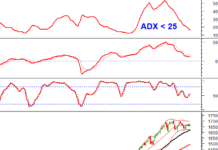

From a technical perspective, Mr. Vu also provided two ways to distinguish between low liquidity due to supply shortage or weak demand. If the low liquidity is caused by weak selling pressure, a session with explosive volume and a strong price increase should follow the supply shortage session. Conversely, if the low liquidity is caused by weak demand, it usually ends with a climax correction – which often occurs before extreme psychological indicators.

According to the expert, the market does not have enough signs to indicate a bottom because the correction period has not been long enough, and large cash flows have not yet entered the market. The market is expected to stabilize from mid-May, but the sideways movement may continue until June before entering a new uptrend. However, this is an appropriate time for investors to gradually accumulate stocks at reasonable valuation levels as the VN-Index is still in an uptrend and is expected to reach 1,380 points by the end of the third quarter of this year.

Regarding the market reversal signal from the bottom, the expert believes that the market needs to have a widespread buying force reaching about 41%, a buying ratio exceeding 52%, and a strong trading speed of 3.5 million shares/minute. Typically, the recovery confirmation session will occur approximately 2-3 sessions after the bottoming-out session.

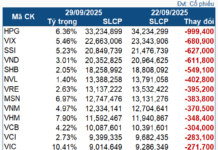

In a context of market turmoil, it is important to pay attention to stocks that have a strong cash flow, absorb sufficient selling pressure, or maintain their prices. After several such sessions, a reliable price area for testing supply and demand will be formed. Notably, investors should pay attention to the stocks that individual investors have been selling heavily since April 16, with high volume, and that have been simultaneously bought by institutional investors.

Also providing his perspective on the market, Mr. Huynh Hoang Phuong – Director of FIDT Analysis suggested that after the correction, the P/E and P/B valuations at the VN-Index range of 1,160-1,180 are relatively attractive for this year and could potentially attract cash flows from value investors who are currently on the sidelines.

With the expectation of an approximately 18% growth in the profits of listed companies in 2024, the forward P/E of 11.8 is an attractive level to open new positions for the entire year.

After the panic subsides, the market will definitely experience recoveries, and fundamentally sound stocks with good growth in 2024 or with individual stories will continue to recover and grow subsequently, with less dependence on the general index.

“It is unlikely that the market will experience a V-shaped recovery. Instead, it will need to accumulate to create a new foundation that can withstand short-term risks such as a gradual decline in exchange rates. Therefore, the VN-Index will move sideways in May, with strong differentiation among stocks.”

In the medium and long term, factors such as economic growth, profit growth of listed companies, interest rate environment, and the potential upgrade story continue to be positive supporting factors for the market.