SMC Investment & Trading JSC (stock code SMC) recorded a net revenue of VND 2,230 billion in the first quarter of 2024, a decrease of 43% compared to the same period, but the profit after tax for the parent company’s shareholders was more than VND 183 billion, 8.8 times higher than the same period.

At the 2024 Annual General Meeting of Shareholders, the SMC leadership stated that most of SMC’s first-quarter profit came from the profit from the sale of NKG shares, recording VND 215 billion. The company’s trading business still faces difficulties due to the impact of the real estate market and has to adjust its business plan.

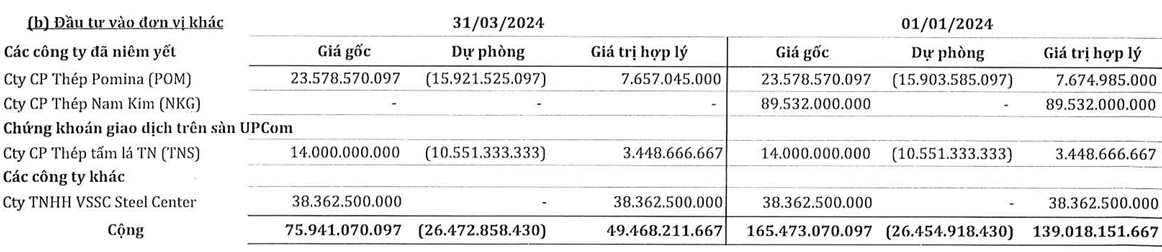

Previously, SMC had invested nearly VND 90 billion in NKG shares and sold them all during this quarter. Currently, SMC still holds shares in other steel companies such as POM and TNS.

In addition, regarding the debt of VND 105 billion from HBC, SMC signed an agreement on the conversion of debt into shares. Specifically, SMC plans to receive more than 10 million HBC shares with a conversion price of VND 10,000/share.

Tri Viet Property Management Group JSC (stock code TVC) announced its first-quarter financial statements with net revenue of more than VND 90 billion, up 398%, and gross profit of VND 63 billion, 4.6 times higher than the same period. Net income after tax reached nearly VND 159 billion, up 98%.

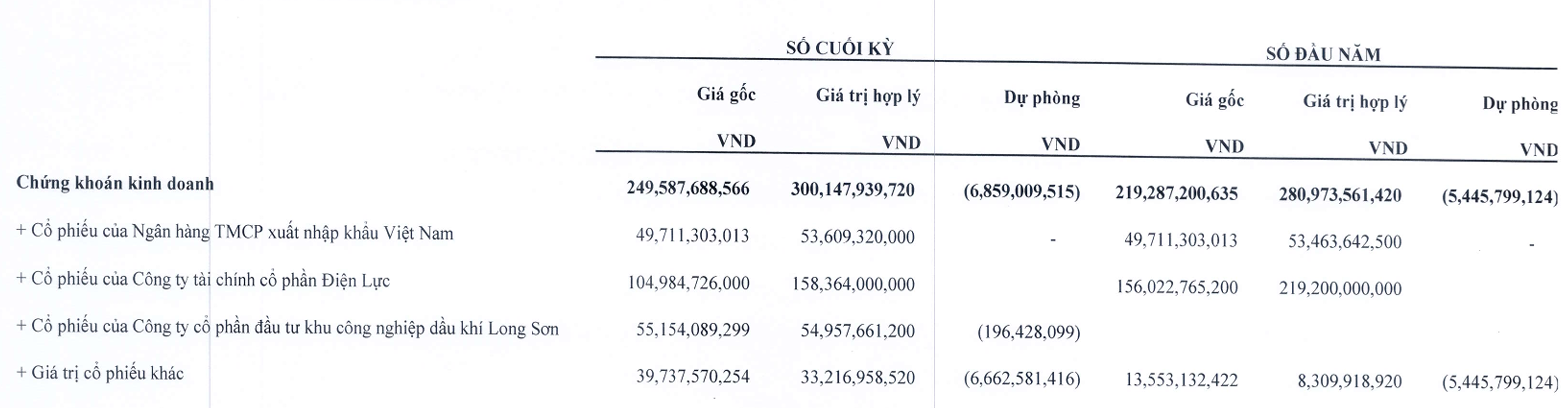

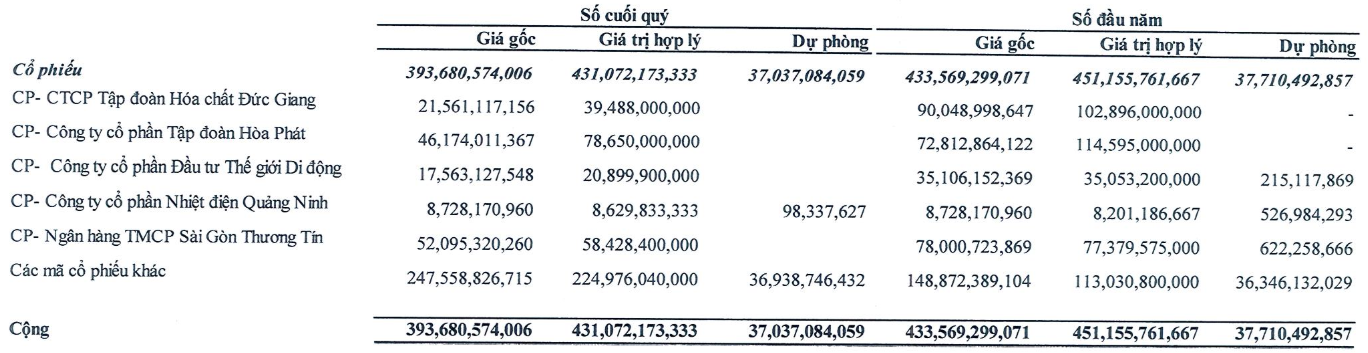

After offsetting losses from securities trading, TVC gained more than VND 60 billion from the sale and purchase of securities, and additionally, the company reversed nearly VND 54 billion in the allowance for impairment of trading securities. TVC stated that with the recovery of the stock market, the company’s stock holdings at the end of the first quarter had increased in value compared to the end of last year, resulting in the reversal of allowances for impairment of securities.

TVC currently holds shares in FPT, MWG, HPG, SSI, … Compared to the beginning of the year, TVC’s original investment in shares has decreased by nearly VND 340 billion. Notably, TVC has significantly reduced its investment in HPG and FPT, while increasing its investment in MWG and SSI.

Da Nang Investment & Development JSC (stock code NDN) reported that its first-quarter net revenue reached only VND 14.5 billion, down more than 93% compared to the same period. Gross profit also decreased by over 93% to VND 7.2 billion.

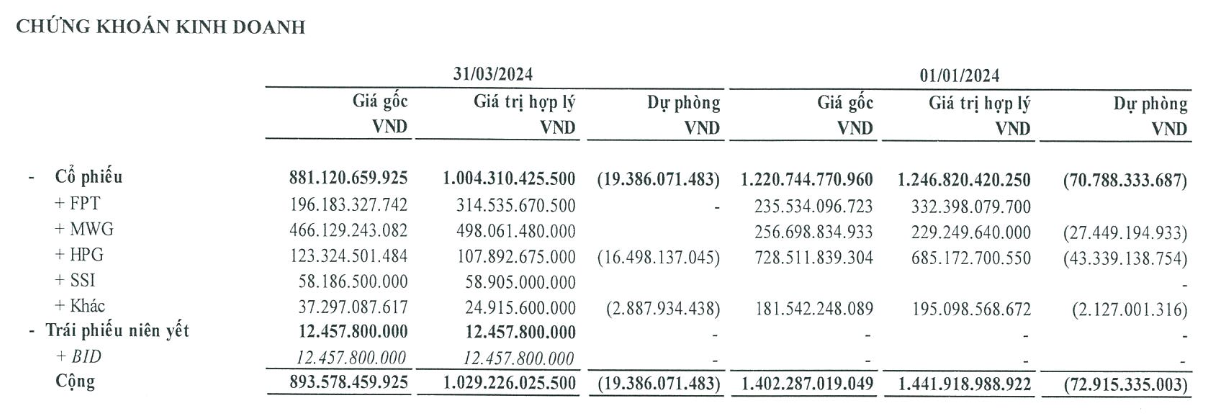

NDN’s profit after tax was VND 32.5 billion, down 69% compared to the first quarter of 2023. A large part of NDN’s first-quarter profit came from financial profit. Notably, a significant portion was the profit from investments in securities of over VND 27 billion.

NDN currently holds shares in HPG, DGC, MWG, QTP, STB, …

MHC JSC (stock code MHC) continued to operate below cost with a gross loss of over VND 271 million in the first quarter. Thanks to profit from financial activities, MHC’s profit after tax exceeded VND 6 billion, while in the same period last year, it incurred a loss of over VND 36 billion.

In the last quarter, MHC earned nearly VND 15 billion in profit from financial investments and securities, and the company made an allowance for impairment of trading securities of over VND 1.7 billion.