Sacombank Is Ready for Sustainable Growth After Restructuring.

Sacombank’s Approach to Bad Debts Plays a Critical Role in Restructuring

Recently, Moody’s upgraded the bank’s credit rating in multiple categories, thanks to a significant reduction in non-performing assets, leading to improved balance sheet quality, profitability, funding and liquidity.

The restoration of Moody’s credit rating to pre-merger levels is one of the key indicators in assessing Sacombank’s restructuring roadmap. It is worth recalling that in 2016, the rating agency downgraded the bank in the context of its merger with Phuong Nam Bank and the commencement of its restructuring plan.

That was a challenging phase for Sacombank despite the significant growth in scale after the merger. Business operations continued to expand, but the need to set aside provisions for bad debts following the merger impacted profitability, with several key safety indicators falling below regulatory standards, and the bank’s reputation and brand were also affected, heavily impacting partners, customers and employees.

After developing and receiving SBV approval for the Self-Restructuring Plan, Sacombank established a Steering Committee for Debt Resolution to oversee individual cases, ensuring that the resolution of bad debts was transparent, fair and in the best interests of both the bank and its customers.

The second group of solutions entailed restructuring the operating model, segregating and improving management – operations – supervision in line with Circular 13, while applying advanced governance practices and international standards to the risk management system.

In addition to governance, the third group of solutions focused on reinvigorating business operations, restructuring capital and lending activities in a more prudent manner to generate financial resources to gradually resolve outstanding issues; the bank also promoted comprehensive digital transformation, enhanced professional management, and continuously innovated products and services.

In practice, these three groups of solutions have delivered positive results. The proportion of non-performing assets to total assets continued to decline sharply, reaching 3% at the end of 2023, from 28.1% in 2016 when the plan was launched.

In the past year alone, the bank recovered and resolved nearly VND 8,000 billion, including VND 4,500 billion in loans under the restructuring plan. Sacombank also fully set aside provisions in accordance with regulations, with the total provision balance reaching VND 25,099 billion, including a 100% provision for the entire portfolio of bad debts sold to VAMC.

Assessing Sacombank’s bad debt resolution process, Prof. Dr. Nguyen Huu Huan, Head of the Department of Financial Markets, Ho Chi Minh City University of Economics, believes that the resilient performance reflects the bank’s management’s unwavering determination, especially considering that the previous restructuring plan did not factor in the challenges in the market over the past several years (such as Covid-19, geopolitical tensions or the rise in bad debts across the market).

At the same time, Sacombank’s case study demonstrates how the approach to bad debts plays a crucial role in the restructuring of banks. Besides management changes, resolving bad debts has a major impact on the bank’s business operations and its financial statements.

The Sacombank case also provides clearer direction for resolving weak banks through mergers. In reality, consolidation has never been easy because not only do bad debts increase sharply, but also the merger integrates governance and operations. “The question is how to bring a good bank together with a bad bank to create a good bank? The integration factor is crucial,” emphasized Dr. Huan.

Concentrating Resources, Recovering Position

From a bank stock investment perspective, Sacombank is considered a “rising star” when it comes to business growth potential after the completion of its restructuring plan.

Sacombank Focuses Resources on Recovering Position.

Earlier, SSI Securities’ research team commented that if Sacombank continues to maintain its rate of resolving bad debts and positive business performance, its rebound will be impressive.

With a similar assessment, Dr. Huan believes that the reduction of Sacombank’s non-performing loan ratio from a high level to a low level, potentially even below 3%, while the industry average is above 3%, is a remarkable achievement. “If bad debts are managed effectively, Sacombank could usher in a new era where its shareholders will reap the benefits from the bank’s profits,” said Dr. Huan.

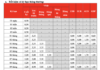

Sacombank’s consolidated pre-tax profit in 2023 reached VND 9,595 billion, up 51.4% and surpassing the target by 101%. Profitability indicators such as ROA and ROE were 1.22% and 18.30%, respectively, significantly higher than in 2022 (0.31% and 4.47%).

This demonstrates that Sacombank’s core business operations continue to show significant improvements, despite the rising non-performing loan ratio across the industry and the subdued demand in both international and domestic markets. The increase in profit also indicates that the bank is nearing the end of its bad debt resolution process, while strengthening the bank’s financial structure.

Sacombank’s retained earnings after setting aside funds at the end of 2023 amounted to VND 18,387 billion, close to its charter capital. The issue of dividend distribution is therefore a major concern for the bank’s shareholders at each AGM, considering the growing retained earnings figure. The funds for dividend distribution are available, and the remaining question is when to distribute the dividends. The bank’s senior leaders have repeatedly stated that Sacombank has submitted the necessary procedures to SBV and that dividends will be distributed to shareholders as soon as approval is granted.

According to Dr. Huan, the dividend distribution policy generally depends on the individual company, but even if no dividends are distributed, the shareholders’ value is not lost, as it remains in the stock and increases in value over time. In Sacombank’s case, even if the bank intends to pay dividends, it can only do so when approved by SBV. “If the bank resolves its non-performing loans and sets aside full provisions, then the retained earnings are the shareholders’ profit. The key is patience; loyal shareholders who stay invested will reap greater rewards in the long run,” Dr. Huan concluded.

The bank continues to focus on capacity building with increasingly ambitious goals. The bank recently announced the completion and implementation of Basel III at the end of last year. The implementation project for International Financial Reporting Standard 9 (IFRS 9) is still on track. Upon completion, Sacombank will join the group of pioneering banks to adopt the accounting standard that enables banks to better classify, evaluate assets and mitigate risks.

Sacombank is also keeping pace with digital transformation, an area where the bank has consistently invested resources across its entire system during the seven years of restructuring. The comprehensive digital transformation solutions have also borne “sweet fruit,” with the bank ranking among the top banks in terms of digital transformation, pioneering the launch of many modern, multi-functional products that are highly rated for their user experience and security. Most recently, the bank introduced a new-generation customer service center that uses artificial intelligence (AI), along with an advanced ATM system called STM that allows customers to use voice and touch to conduct transactions. “Digital transformation is not simply about new technology projects but also about changing mindsets, transforming business models and processes and enhancing digital skills and capabilities in the organization,” emphasized Ms. Nguyen Duc Thach Diem, Sacombank’s General Director.

Customers Experience the STM Machine.

Moving Towards Sustainable Growth

An interesting point to note is that, beyond the short-term goal of completing the restructuring plan by 2025 and regaining its leading position in retail banking, Sacombank has also set a long