SERVICES

Businesses with existing loans with SHB will receive an unsecured overdraft facility from the bank of up to 85% of their total capital requirements, with a maximum of VND 300 million, with a 12-month term. In addition, SHB also provides businesses with fast and convenient payment and receipt services under its SHBPRO package, which includes digital banking services, beautiful account number services, and payment services.

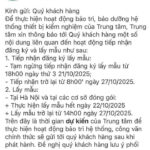

Customers who register for the SHBPRO package and maintain a certain account balance over a specified period will receive gifts worth up to VND 6,500,000, be exempt from all transaction fees on the mobile app, and receive a VIP beautiful account number worth up to VND 25 million, among other benefits. Notably, from now until July 22, 2024, the first 1,000 customers to open an unsecured overdraft facility and successfully register for the SHBPRO product package will receive VND 100,000 into their accounts.

SHB provides overdraft facilities of up to VND 300 million to support customers in expanding their businesses

|

Furthermore, customers with demand for consumer and business production loans will also receive preferential interest rates from SHB that are lower than market rates and additional interest when making online savings deposits (interest rates are updated periodically).

A representative of SHB stated that small businesses and business households are customer groups that the bank places a focus on developing. The Vietnam Chamber of Commerce and Industry (VCCI) has recorded that there are approximately 5 million business households and small businesses nationwide. These are potential customers with many specific characteristics such as high stability, a dynamic approach to attracting customers, and especially given that e-commerce is currently growing very rapidly.

“We provide tailored financial solutions packages that do not require collateral and simplify procedures, expedite processing, and provide capital to business households quickly. SHB also provides practical payment features to help customers accelerate their businesses and closely follow business objectives. This is one of SHB’s steps in the strategy to develop the retail segment in the coming years,” emphasized the representative.

Prior to this, from mid-March, SHB reduced lending interest rates for individual customers. Short-term loans have interest rates from 6.39%/year, and medium- and long-term loans have interest rates from 5.79%/year, with a credit package of VND 23,000 billion, focusing on demand for capital for production, business purchases, payments, and consumption in support of daily life. Currently, SHB has successfully disbursed more than VND 7,000 billion to approximately 4,000 customers.

Based on the motto “customer centricity,” SHB actively introduces to the market a variety of promotional programs, preferential interest rate packages, and exemptions for many types of transaction fees to support customers. The bank is confident that the financial solutions packages will help provide additional motivation for customers, in addition to supporting capital to increase their competitive advantage, and promote growth in 2024. SHB will always be the bank that works hand in hand with people and businesses for sustainable growth, helping them expand their reach.

To register to receive financial solutions packages, customers can contact the 24/7 Customer Service Center: *6688 or SHB’s branches and transaction offices nationwide