Net Income in Q1 of Previous Years for GVR

Source: GVR’s Q1 2024 Financial Statements

|

|

GVR’s Core Business Performance in Q1 2024

Unit: Billion VND

Source: VietstockFinance

|

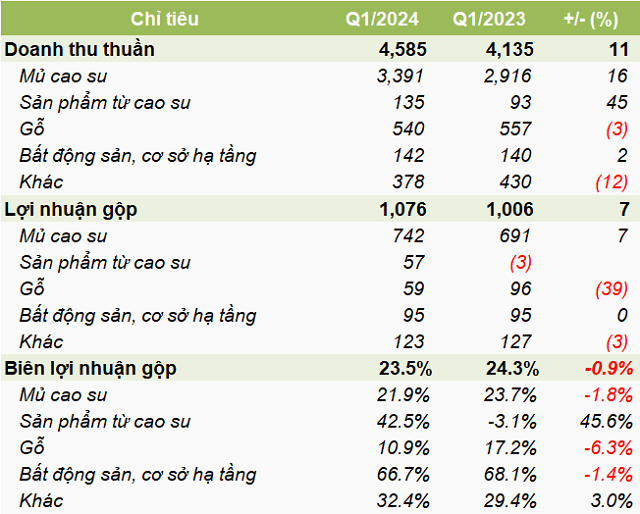

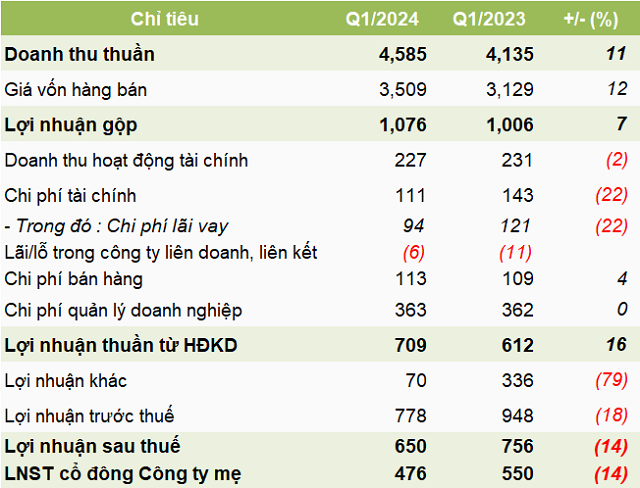

In Q1/2024, GVR’s net revenue reached over 4.585 billion VND, an 11% increase year-over-year, primarily driven by a 16% growth in its core rubber production and trading activities, which generated 3.391 billion VND. Moreover, the production and trading of rubber-based products increased by 45%, amounting to 135 billion VND.

However, the gross profit margin narrowed by 0.9 percentage points, impacted by the decline in gross profit margins for both rubber and timber, which are key segments for the company, decreasing by 1.8 percentage points and 6.3 percentage points, respectively. Consequently, GVR’s gross profit rose by only 7% to 1.076 billion VND.

Financial activities showed improved performance, with interest income reaching nearly 116 billion VND, a 31% increase. During the period, financial expenses fell by 22% due to reduced interest expenses and exchange rate differences.

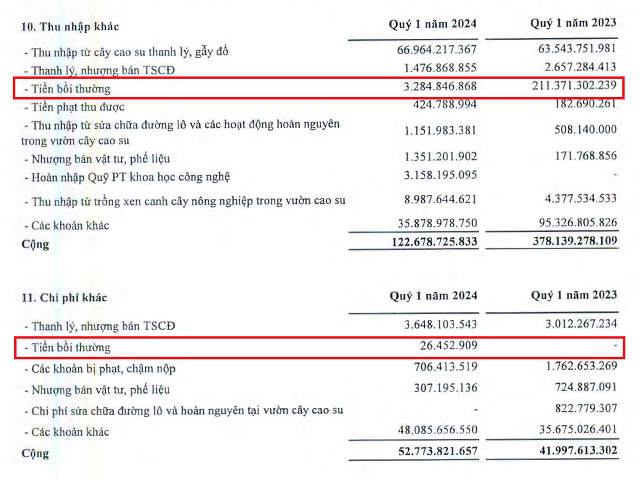

Nevertheless, a significant decrease in income from land compensation and return of land to local authorities led to other income falling to around 70 billion VND, representing a 79% decline. This was the primary reason for the 14% drop in GVR’s net income, which amounted to approximately 476 billion VND.

|

GVR’s Q1 2024 Business Performance

Unit: Billion VND

Source: VietstockFinance

|

As of March 31, 2024, GVR’s total assets exceeded 76.913 billion VND, showing a slight decrease compared to the beginning of the year. Long-term assets accounted for over 53.938 billion VND (70%), mainly comprising fixed assets of rubber plantations and construction-in-progress costs for new rubber plantations.

Short-term financial investments also represented a significant portion of GVR’s asset structure, totaling over 11.744 billion VND, primarily in the form of time deposits.

The company’s capital structure revealed total borrowings of over 5.928 billion VND, predominantly long-term loans. Compared to the beginning of the year, borrowings decreased by 10%. Additionally, the company had approximately 8.964 billion VND in unearned revenue, mostly from infrastructure and residential area rentals.