Quang Ngai Sugar Joint Stock Company (stock code: QNS) has just announced its Q1/2024 financial statements with revenue of VND 2,522 billion, an 18.4% increase compared to the same period last year. After deducting the cost of goods sold, the company’s gross profit reached VND 807.8 billion, up 35.6% compared to Q1/2023.

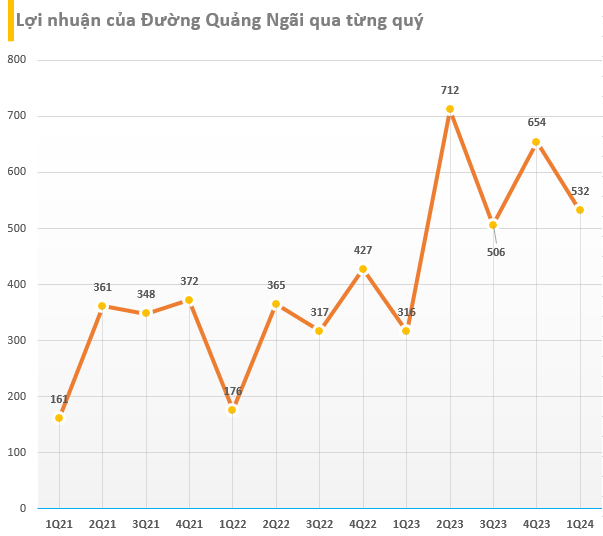

The company’s financial revenue decreased slightly from VND 71 billion to over VND 67 billion. Financial expenses, selling expenses and business management expenses all decreased. As a result, Quang Ngai Sugar earned VND 531.8 billion in net profit, an increase of 68.3% over the same period last year. EPS increased from VND 1,050 to VND 1,747.

In 2024, Quang Ngai Sugar sets a target of VND 9,000 billion in total revenue and VND 1,341 billion in after-tax profit; down 14% and 39% respectively compared to the implementation in 2023. Thus, the company has completed 28% of the revenue plan and nearly 40% of the annual profit target.

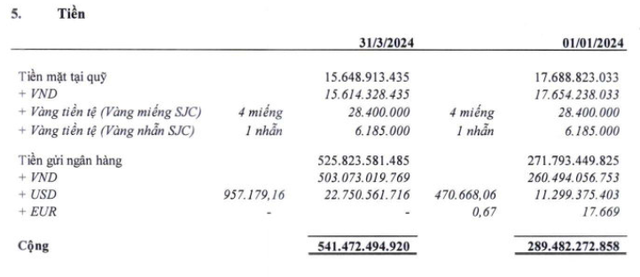

As of March 31, Quang Ngai Sugar’s total assets reached VND 13,577 billion, an increase of more than VND 1,500 billion compared to the beginning of the year. In which, cash and bank deposits account for more than half of the company’s assets, at VND 7,285 billion. In addition, the company also reports that it owns 957,000 USD in its account, 4 SJC gold bars and 1 SJC gold ring.

Inventory value increased by 94% to VND 1,861 billion. Fixed assets reached VND 3,442 billion. Quang Ngai Sugar’s equity reached VND 8,789 billion, including VND 4,920 billion of retained earnings after tax. Financial debt is at VND 3,642 billion and there is no long-term debt.