Commercial banks must publicly disclose interest rates for loans and deposits. |

The State Bank is seeking comments from organizations and individuals on two draft documents related to the application of interest rates to deposits in VND and USD.

Specifically, the draft Circular will replace Circular No. 07/2014/TT-NHNN regulating interest rates for VND deposits of organizations and individuals at credit institutions and the draft Circular will replace Circular No. 06/2014/TT-NHNN regulating maximum interest rates for deposits in USD of organizations and individuals at credit institutions.

Accordingly, for VND deposits, credit institutions shall apply deposit interest rates not exceeding the maximum interest rate for non-term deposits, deposits with a term of less than 1 month, deposits with a term of from 1 month to less than 6 months by the Governor. shall decide on a period and for each type of credit institution.

The interest rate on VND deposits with a term of 6 months or more shall be applied by credit institutions on the basis of market supply and demand for capital.

For deposits in USD, credit institutions shall apply deposit interest rates not exceeding the maximum interest rate decided by the Governor from time to time.

In both of these draft circulars, the State Bank clearly states that the maximum interest rate for VND and USD deposits includes all forms of promotional expenses, applied to the method of paying interest at the end of the term and other methods of paying interest converted according to the method of paying interest at the end of the term.

Credit institutions shall publicly list interest rates on VND and USD deposits at legal transaction locations within the credit institution’s network of operations and post them on the credit institution’s website (if any).

It is strictly forbidden for credit institutions to, when receiving deposits, carry out promotions in any form (in cash, interest, and other forms) that are not in accordance with the provisions of law.

According to the State Bank, the drafting of the circular to replace the two above circulars aims to comply with the provisions of the Law on Credit Institutions 2024, which has been approved by the National Assembly and will take effect from July 1.

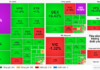

Currently, the interest rate applied to USD deposits is 0%; the maximum deposit interest rate for non-term deposits and deposits with a term of less than 1 month is 0.5%/year; the maximum deposit from 1 month to less than 6 months is 4.75%/year, specifically for People’s Credit Funds and Microfinance Organizations, the maximum interest rate is 5.25%/year.

|

– On January 18, 2024, the Law on Credit Institutions was approved by the National Assembly and became effective from July 1, 2024 (the Law on Credit Institutions 2024), including: + Clause 27 of Article 4 states: Receiving deposits is an activity of receiving money from an organization or individual in the form of non-term deposits, fixed-term deposits, savings deposits, issuing deposit certificates and other forms of deposit receipt in accordance with the principle of full repayment of principal and interest as agreed for the depositing organization or individual (hereinafter referred to as the depositor). + Point b of Clause 2 of Article 114; point b of Clause 2 of Article 119; point b of Clause 2 of Article 124, point b of Clause 1 of Article 125; Clause 1 of Article 131 stipulates that the issuance of bonds is part of the other business activities of credit institutions. – In Clause 2 of Article 1 of Circular No. 06/2014/TT-NHNN dated March 17, 2014 of the Governor of the State Bank of Vietnam regulating the maximum interest rate for deposits in US dollars of organizations and individuals at credit institutions (Circular No. 06/2014/TT-NHNN) stipulates: Deposits include forms of non-term deposits, demand deposits, savings deposits, time deposits, certificates of deposit, promissory notes, bills, bonds and other forms of receipt of deposits of organizations (except credit institutions), individuals as prescribed in Clause 13 of Article 4 of the Law on Credit Institutions. Thus, on the basis of reviewing the related regulations in Circular No. 06/2014/TT-NHNN and to comply with the regulations in the Law on Credit Institutions 2024 mentioned above, the SBV needs to issue a Circular replacing Circular 06/2014/TT-NHNN. |